Stock Analysis

As global markets show signs of resilience, with the S&P 500 reaching new highs and sectors like manufacturing experiencing robust growth, investors continue to navigate through fluctuating economic signals. In this context, dividend stocks like ANEST IWATA can offer a blend of stability and potential income, appealing to those seeking to balance growth with more conservative investment strategies in a dynamic market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.59% | ★★★★★★ |

| Allianz (XTRA:ALV) | 5.32% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.87% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 7.27% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.19% | ★★★★★★ |

| Globeride (TSE:7990) | 3.72% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.77% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 5.90% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.18% | ★★★★★★ |

Click here to see the full list of 1967 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

ANEST IWATA (TSE:6381)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ANEST IWATA Corporation specializes in air energy and coating systems, operating across Japan, Europe, the Americas, China, and other international markets with a market capitalization of approximately ¥62.64 billion.

Operations: ANEST IWATA Corporation generates revenue primarily from its operations in Japan (¥26.33 billion), China (¥12.41 billion), Europe (¥9.38 billion), and the Americas (¥7.26 billion).

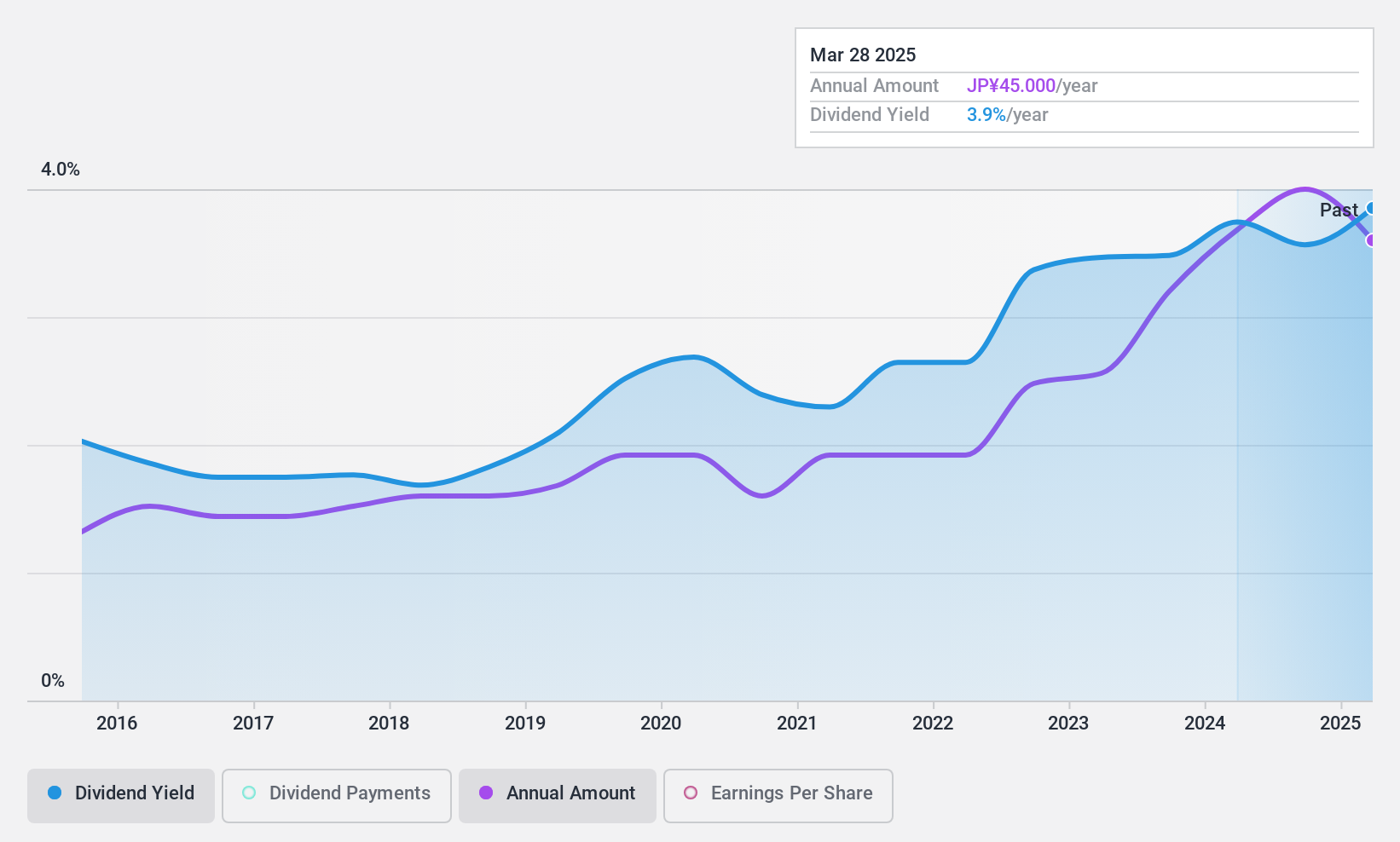

Dividend Yield: 3.1%

ANEST IWATA has increased its annual dividend to JPY 27.00 per share from JPY 22.00, with payments well-covered by both earnings and cash flows, boasting payout ratios of 40.1% and 43% respectively. Despite a history of volatility in dividend payments over the past decade, recent increases suggest a positive trend. However, its dividend yield remains modest at 3.06%, below the top quartile of Japanese market payers at 3.45%. The company's stock is currently valued at 62% below estimated fair value, indicating potential undervaluation.

- Get an in-depth perspective on ANEST IWATA's performance by reading our dividend report here.

- Our expertly prepared valuation report ANEST IWATA implies its share price may be lower than expected.

Japan Transcity (TSE:9310)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Japan Transcity Corporation operates in the logistics sector, providing services both domestically in Japan and internationally, with a market capitalization of ¥65.77 billion.

Operations: Japan Transcity Corporation generates its revenue primarily through logistics services across both domestic and international markets.

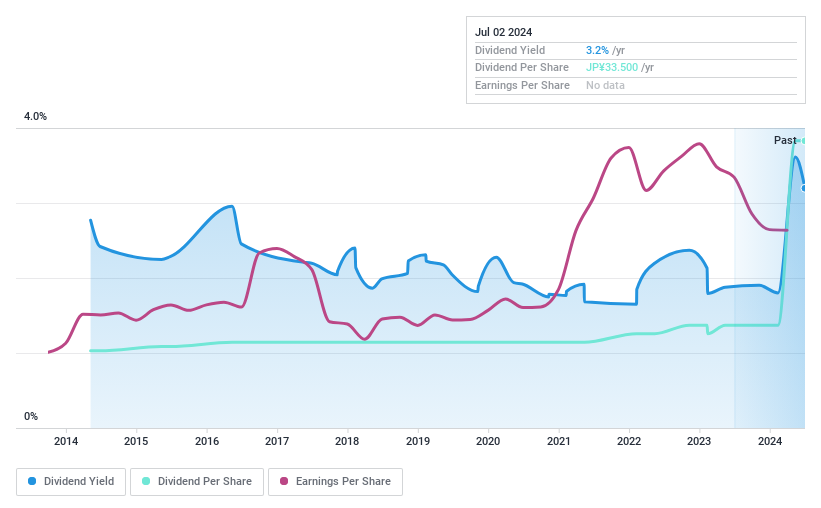

Dividend Yield: 3.2%

Japan Transcity Corporation has shown a commitment to increasing shareholder returns, evidenced by its recent dividend hike to JPY 17.00 per share for FY 2025 from JPY 7.00 in the previous year, and a robust share buyback program of up to JPY 1 billion valid through March 2025. Despite these positive steps, the company's dividends are not well supported by free cash flow and have a low yield of 3.15% compared to peers. Additionally, the stock price has been highly volatile recently, which may concern risk-averse investors.

- Delve into the full analysis dividend report here for a deeper understanding of Japan Transcity.

- Our valuation report unveils the possibility Japan Transcity's shares may be trading at a premium.

Shinkong Insurance (TWSE:2850)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shinkong Insurance Co., Ltd. operates in Taiwan, offering property insurance services to both individuals and corporations, with a market capitalization of approximately NT$30.81 billion.

Operations: Shinkong Insurance Co., Ltd. generates its revenue primarily from property insurance, totaling NT$19.20 billion.

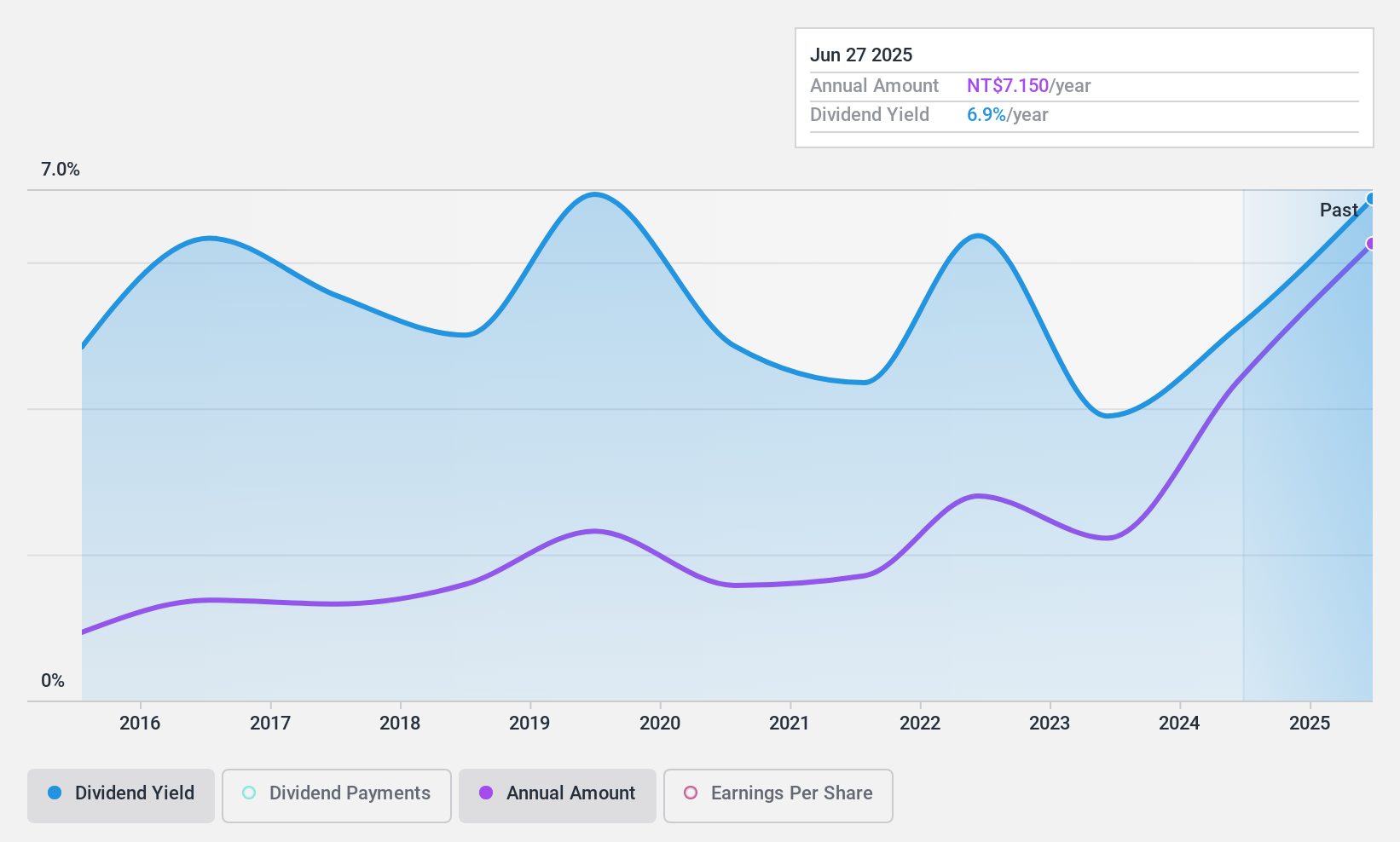

Dividend Yield: 4.8%

Shinkong Insurance has recently increased its dividend to TWD 4.99 per share, with a payment date set for July 8, 2024. Despite a volatile history, dividends are currently well-covered by both earnings and cash flows, with payout ratios at 47.2% and 49.1% respectively. The company's stock is trading below estimated fair value by 26.9%. Over the past five years, earnings have grown annually by 14.5%, supporting the sustainability of future dividends despite past inconsistencies in dividend reliability.

- Navigate through the intricacies of Shinkong Insurance with our comprehensive dividend report here.

- Our valuation report here indicates Shinkong Insurance may be undervalued.

Key Takeaways

- Delve into our full catalog of 1967 Top Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether ANEST IWATA is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6381

ANEST IWATA

Operates air energy and coating business in Japan, Europe, the America, China, and internationally.

Flawless balance sheet, good value and pays a dividend.