Undiscovered Gems Three Promising Stocks To Watch In February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape of accelerating inflation and high interest rates, U.S. stock indexes are climbing toward record highs, with growth stocks outpacing value shares. Despite small-cap stocks lagging behind their larger counterparts, the current market environment presents unique opportunities for discerning investors who can identify promising yet overlooked companies poised for potential growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.73% | 7.10% | 12.89% | ★★★★★★ |

| Ruentex Interior Design | NA | 21.07% | 27.94% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Ampire | NA | 1.50% | 11.39% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Taiyo KagakuLtd | 0.73% | 4.83% | -2.64% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Eclatorq Technology | 37.47% | 8.43% | 18.41% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Gem-Year IndustrialLtd (SHSE:601002)

Simply Wall St Value Rating: ★★★★★★

Overview: Gem-Year Industrial Co., Ltd. focuses on the research, development, production, and distribution of fasteners in China with a market cap of CN¥4.27 billion.

Operations: Gem-Year Industrial Co., Ltd. generates revenue primarily from the production and distribution of fasteners in China. The company's net profit margin has shown notable fluctuations, reflecting variations in cost management and pricing strategies over time.

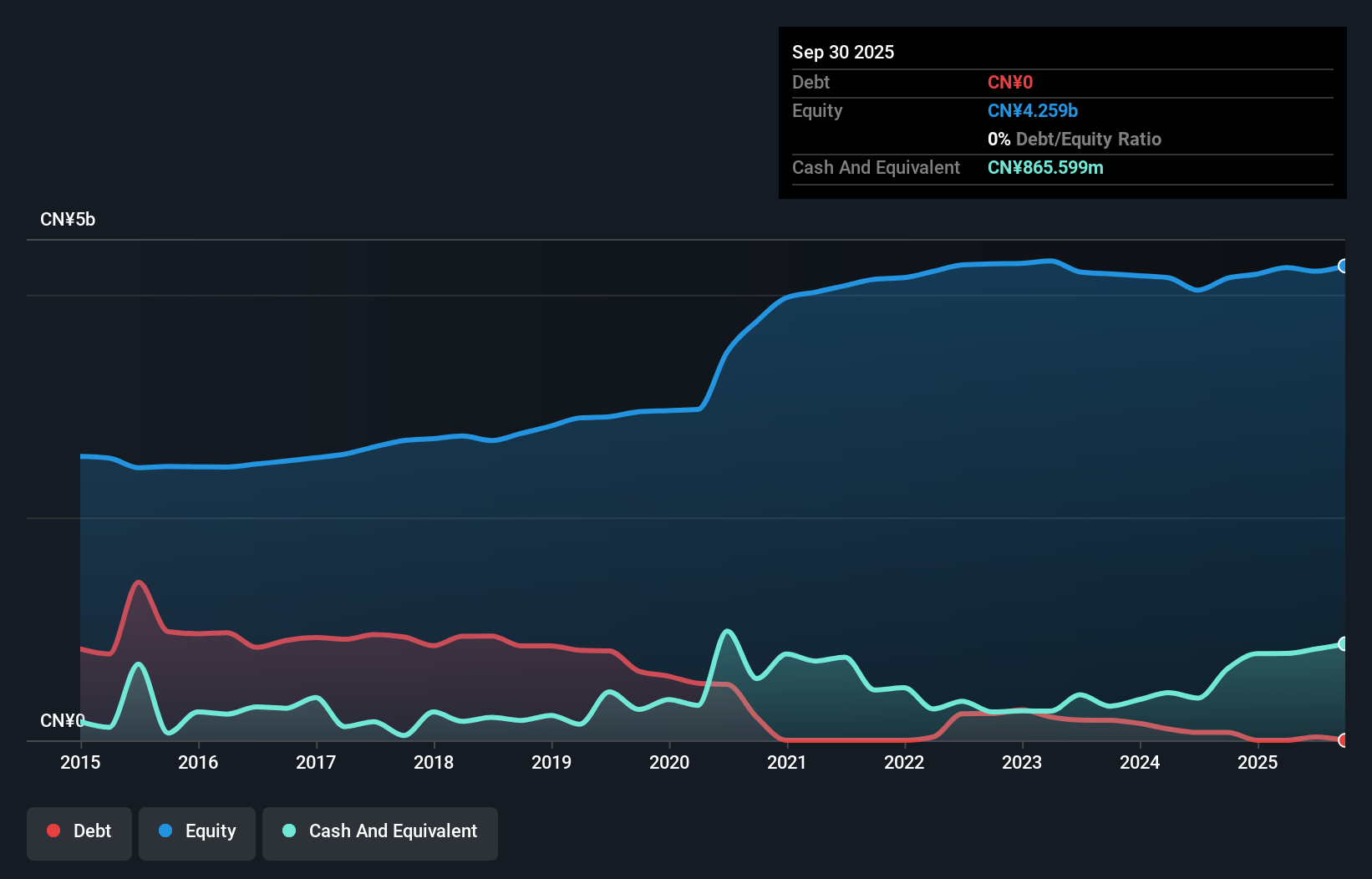

Gem-Year Industrial, a small-cap player in the machinery sector, showcases intriguing financial dynamics. Its earnings skyrocketed by 886% over the past year, significantly outpacing the industry's -0.06% growth. The company trades at a substantial discount of 89.6% below its estimated fair value, suggesting potential undervaluation. Over five years, it has impressively reduced its debt-to-equity ratio from 21% to just 1.7%, indicating effective debt management and a strong balance sheet with more cash than total debt. A recent extraordinary shareholders meeting hints at strategic decisions ahead that could shape its future trajectory in the industry.

- Get an in-depth perspective on Gem-Year IndustrialLtd's performance by reading our health report here.

Learn about Gem-Year IndustrialLtd's historical performance.

Mega Union Technology (TPEX:6944)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mega Union Technology Inc. specializes in the planning and design of water and wastewater recovery systems for industrial applications, with a market cap of NT$28.91 billion.

Operations: Mega Union Technology generates revenue primarily through the planning and design of water and wastewater recovery systems for industrial applications. The company has a market capitalization of NT$28.91 billion.

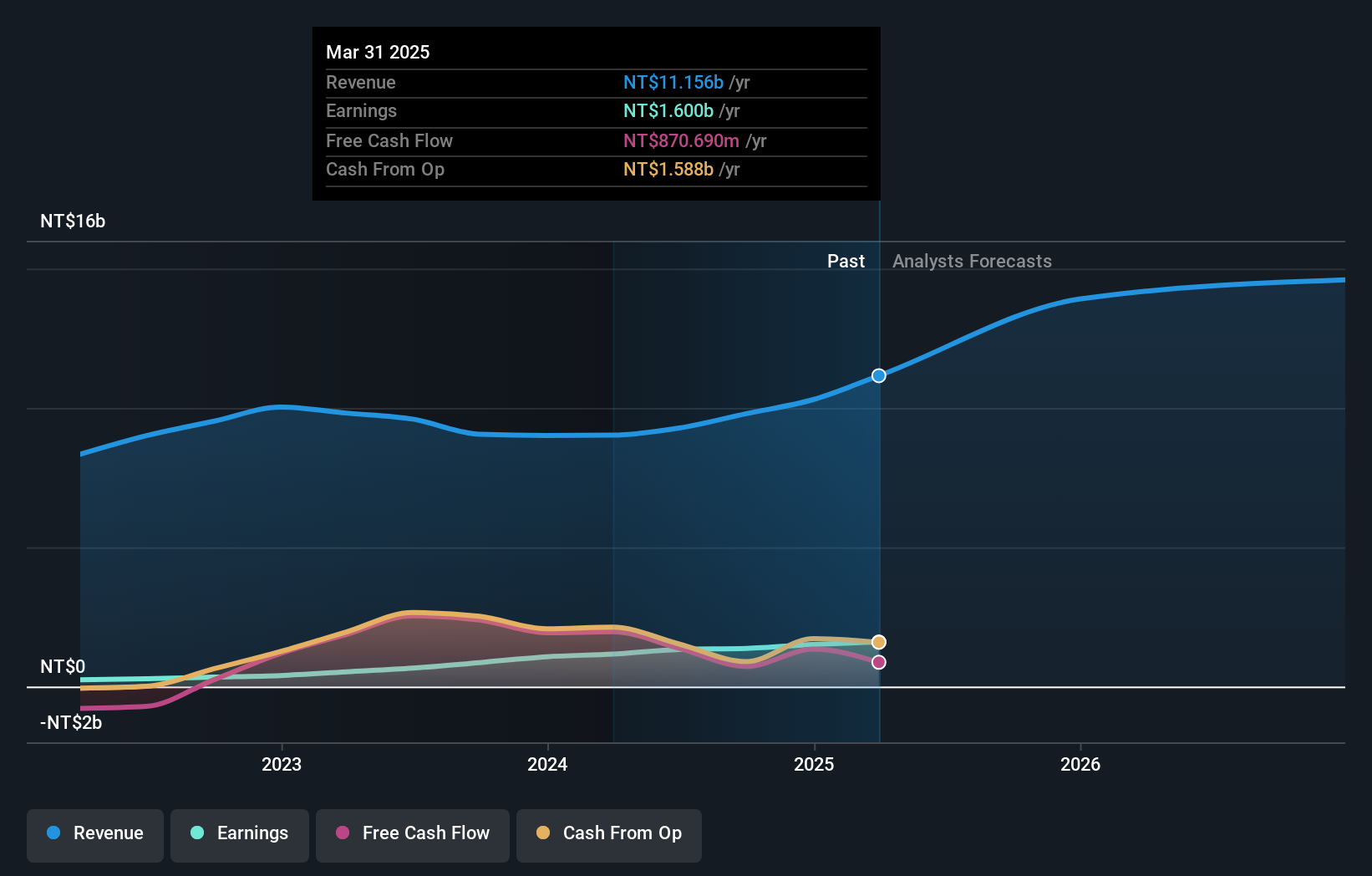

Mega Union Technology has shown impressive growth, with earnings rising by 58.8% over the past year, outpacing the Machinery industry's 14.6%. The company boasts more cash than its total debt, indicating a solid financial position. Recent financial results highlight sales of TWD 2,597 million in Q3 compared to TWD 2,082 million last year and net income of TWD 331 million up from TWD 297 million. With basic EPS from continuing operations at TWD 4.89 versus last year's TWD 4.43, Mega Union appears well-positioned for continued success in its sector.

Hokuetsu Industries (TSE:6364)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hokuetsu Industries Co., Ltd. specializes in the manufacture and sale of air compressors under the AIRMAN brand, serving both domestic and international markets, with a market cap of ¥57.70 billion.

Operations: The company's primary revenue stream is derived from the manufacture and sale of air compressors under the AIRMAN brand, catering to both domestic and international markets. It has a market cap of ¥57.70 billion.

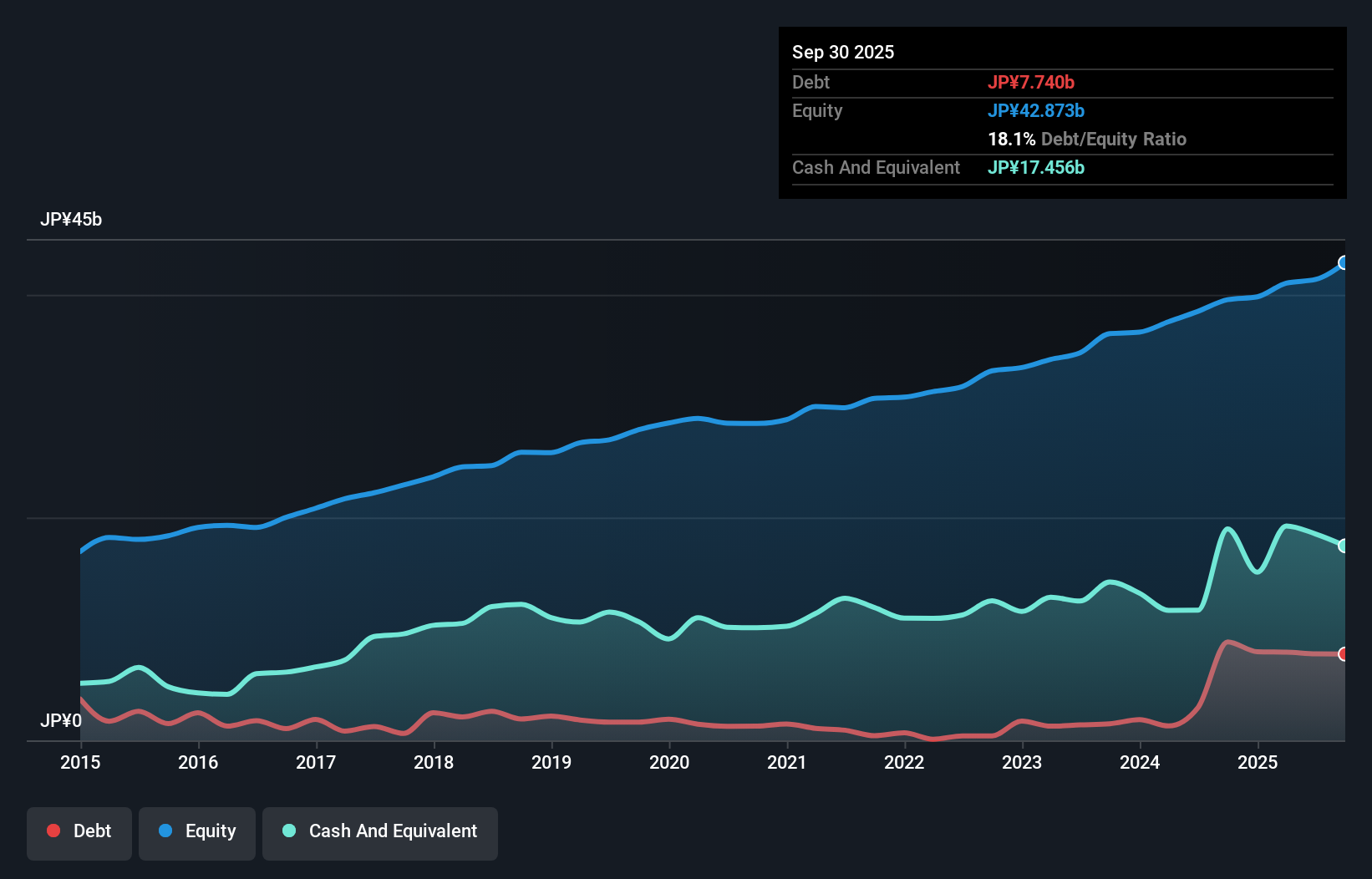

Hokuetsu Industries, a player in the machinery sector, has shown notable resilience with its earnings growth of 10.2% over the past year, outpacing the industry's 4%. With a price-to-earnings ratio of 11.6x, it trades below Japan's market average of 13.3x, indicating potential value for investors. The company's debt to equity ratio rose from 6.7% to 20% over five years; however, it holds more cash than total debt and maintains positive free cash flow. Recently completing a buyback of ¥462 million worth of shares further underscores management's confidence in its financial health and future prospects.

- Navigate through the intricacies of Hokuetsu Industries with our comprehensive health report here.

Understand Hokuetsu Industries' track record by examining our Past report.

Taking Advantage

- Investigate our full lineup of 4721 Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601002

Gem-Year IndustrialLtd

Engages in the research, development, production, and sale of fasteners and hardware tools in China, the United States, Japan, Europe, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives