Undiscovered Gems in Japan 3 Small Caps with Promising Potential

Reviewed by Simply Wall St

Japan's stock markets have shown resilience, with the Nikkei 225 Index gaining 0.7% and the broader TOPIX Index up 1.0%, recovering much of the ground lost earlier in August due to renewed U.S. growth fears and yen carry trade unwinding. Amid this backdrop, small-cap stocks in Japan present intriguing opportunities for investors seeking hidden gems. In this article, we explore three small-cap companies that exhibit promising potential based on their innovative approaches and solid fundamentals, which are particularly compelling given the current market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NCD | 11.89% | 8.95% | 25.43% | ★★★★★★ |

| Tokyo Tekko | 10.81% | 7.30% | 7.30% | ★★★★★★ |

| QuickLtd | 0.73% | 9.61% | 14.56% | ★★★★★★ |

| Totech | 16.86% | 5.13% | 11.52% | ★★★★★★ |

| Nitto Fuji Flour MillingLtd | 0.80% | 6.26% | 4.41% | ★★★★★★ |

| Nice | 71.69% | -1.98% | 36.48% | ★★★★★★ |

| Soliton Systems K.K | 0.58% | 5.04% | 16.76% | ★★★★★★ |

| HeadwatersLtd | NA | 19.26% | 23.89% | ★★★★★★ |

| Techno Ryowa | 1.77% | 2.06% | 5.32% | ★★★★★☆ |

| Imuraya Group | 26.21% | 2.37% | 32.09% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Loadstar Capital K.K (TSE:3482)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Loadstar Capital K.K. engages in real estate investment business in Japan and has a market cap of ¥40.89 billion.

Operations: The company generates revenue primarily from its real estate-related business, amounting to ¥29.40 billion.

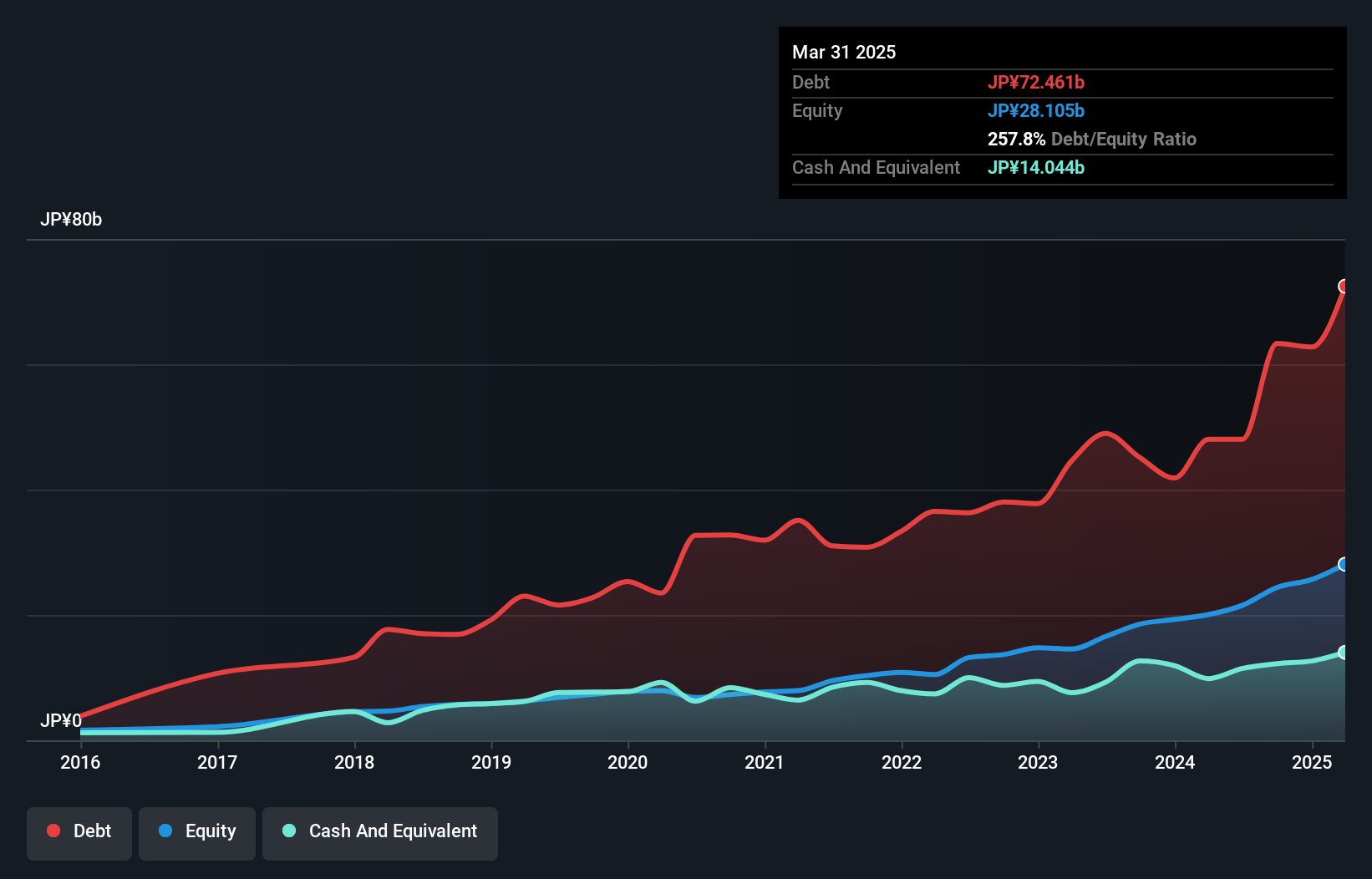

Loadstar Capital K.K. has shown impressive earnings growth of 47.1% over the past year, outpacing the Real Estate industry’s 16.3%. The company’s interest payments are well covered by EBIT at 9.4x coverage, indicating strong profitability. Despite a high net debt to equity ratio of 169.7%, this figure has improved from 315.3% five years ago, demonstrating better financial management over time. Additionally, Loadstar is trading at a significant discount—64.5% below its estimated fair value—making it an attractive option for investors seeking undervalued opportunities in Japan's real estate sector.

- Click to explore a detailed breakdown of our findings in Loadstar Capital K.K's health report.

Understand Loadstar Capital K.K's track record by examining our Past report.

Hokuetsu Industries (TSE:6364)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hokuetsu Industries Co., Ltd. manufactures and sells air compressors under the AIRMAN brand in Japan and internationally, with a market cap of ¥54.88 billion.

Operations: Hokuetsu Industries generates revenue primarily from its Industrial Machinery Business (¥9.99 billion) and Construction Machineries Business (¥43.35 billion).

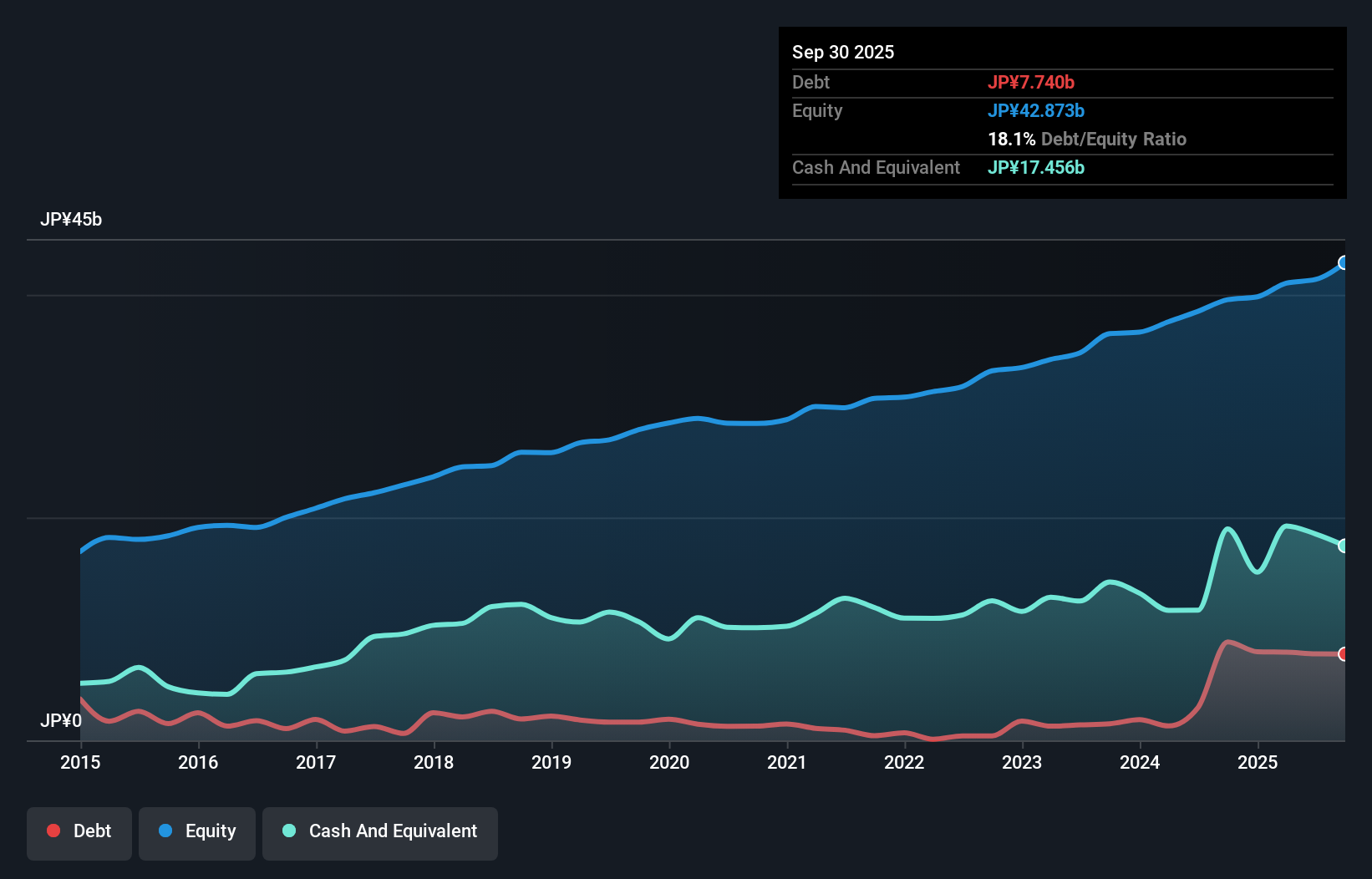

Hokuetsu Industries, a small-cap company in Japan, has shown impressive performance with earnings growth of 19.5% over the past year, outpacing the Machinery industry’s 13.1%. The firm’s price-to-earnings ratio stands at 10.7x, which is lower than the JP market average of 13.6x, indicating good value. Additionally, it has more cash than its total debt and sufficient interest coverage from profits. Earnings are forecast to grow by 12.34% annually going forward.

Fuji Seal International (TSE:7864)

Simply Wall St Value Rating: ★★★★★★

Overview: Fuji Seal International, Inc. offers packaging solutions mainly for the food, beverages, home and personal care, and medical fluid diet markets with a market cap of ¥121.75 billion.

Operations: The company generates revenue from its operations in ASEAN (¥18.09 billion), Japan (¥98.86 billion), Europe (¥31.14 billion), and the Americas (¥57.88 billion).

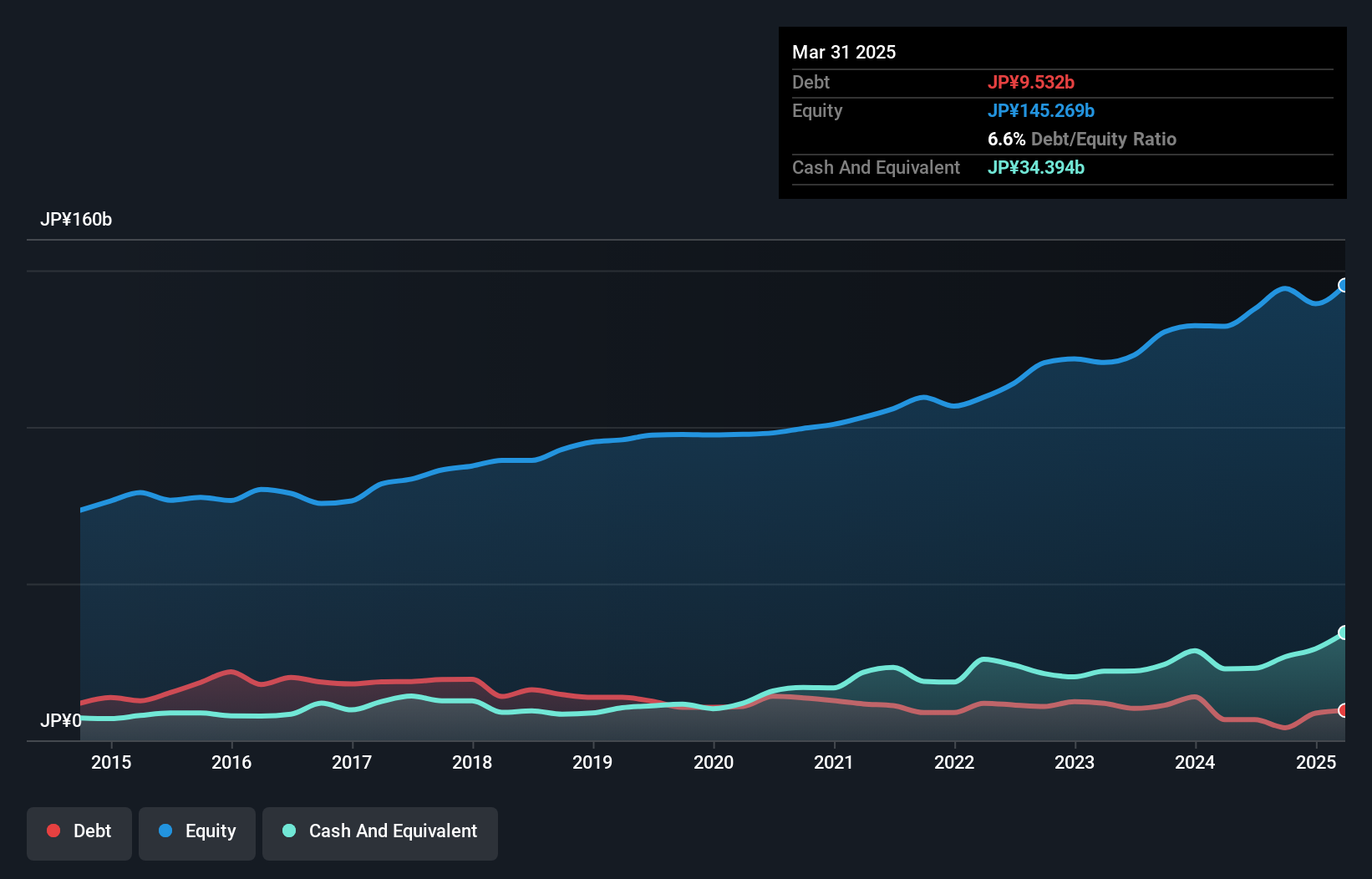

Fuji Seal International, a notable player in the packaging industry, has seen its earnings grow by 49.6% over the past year, outpacing the sector's 41.9%. The company's debt to equity ratio has impressively dropped from 14.3% to 5% over five years, indicating better financial health. Trading at 36.2% below its estimated fair value, Fuji Seal also announced a share repurchase program worth ¥3 billion to enhance shareholder returns and capital efficiency.

- Get an in-depth perspective on Fuji Seal International's performance by reading our health report here.

Evaluate Fuji Seal International's historical performance by accessing our past performance report.

Summing It All Up

- Investigate our full lineup of 751 Japanese Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7864

Fuji Seal International

Provides packaging solutions primarily for food, beverages, home and personal care, and medical fluid diet markets.

Flawless balance sheet established dividend payer.