- Japan

- /

- Entertainment

- /

- TSE:9697

Exploring Kakaku.com And 2 Other High Growth Tech Stocks In Japan

Reviewed by Simply Wall St

As Japan's stock markets wrapped up a volatile month with notable gains in the Nikkei 225 and TOPIX indices, investors are keeping a close eye on high-growth tech stocks amid renewed economic optimism. In this article, we explore Kakaku.com and two other promising tech companies that have shown resilience and potential for growth in the current market landscape.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 51.80% | 61.94% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.97% | 30.50% | ★★★★★★ |

| SHIFT | 20.25% | 32.08% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Material Group | 17.82% | 28.74% | ★★★★★☆ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| ExaWizards | 22.69% | 62.99% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

We'll examine a selection from our screener results.

Kakaku.com (TSE:2371)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kakaku.com, Inc., along with its subsidiaries, offers purchase support and restaurant review services in Japan and has a market cap of ¥494.41 billion.

Operations: Kakaku.com, Inc. generates revenue primarily through its purchase support and restaurant review services in Japan. The company leverages its online platforms to facilitate consumer decisions and provide detailed reviews, contributing significantly to its financial performance.

Kakaku.com, a prominent player in Japan's tech landscape, boasts an impressive earnings growth of 23.4% over the past year, significantly outpacing the Interactive Media and Services industry at 14.5%. With forecasted annual profit growth of 8.9%, it stands to grow faster than the JP market's 8.6%. Despite its high volatility in share price recently, Kakaku.com's revenue is anticipated to rise by 8.7% annually, surpassing the broader market's expected growth of 4.3%.

- Navigate through the intricacies of Kakaku.com with our comprehensive health report here.

Evaluate Kakaku.com's historical performance by accessing our past performance report.

SHIFT (TSE:3697)

Simply Wall St Growth Rating: ★★★★★★

Overview: SHIFT Inc. provides software quality assurance and testing solutions in Japan with a market cap of ¥240.15 billion.

Operations: The company specializes in software quality assurance and testing solutions within Japan. With a market cap of ¥240.15 billion, it generates revenue primarily through its services in this niche sector.

SHIFT, a notable player in Japan's tech sector, has seen its earnings grow at an impressive 36.3% per year over the past five years. Forecasts suggest continued robust growth with revenue expected to rise by 20.3% annually and earnings anticipated to increase by 32.1% per year, outpacing the broader Japanese market's growth of 4.3%. A significant portion of this growth is driven by their investment in R&D, which constitutes a substantial part of their budget and underscores their commitment to innovation in software testing and quality assurance services.

- Delve into the full analysis health report here for a deeper understanding of SHIFT.

Gain insights into SHIFT's past trends and performance with our Past report.

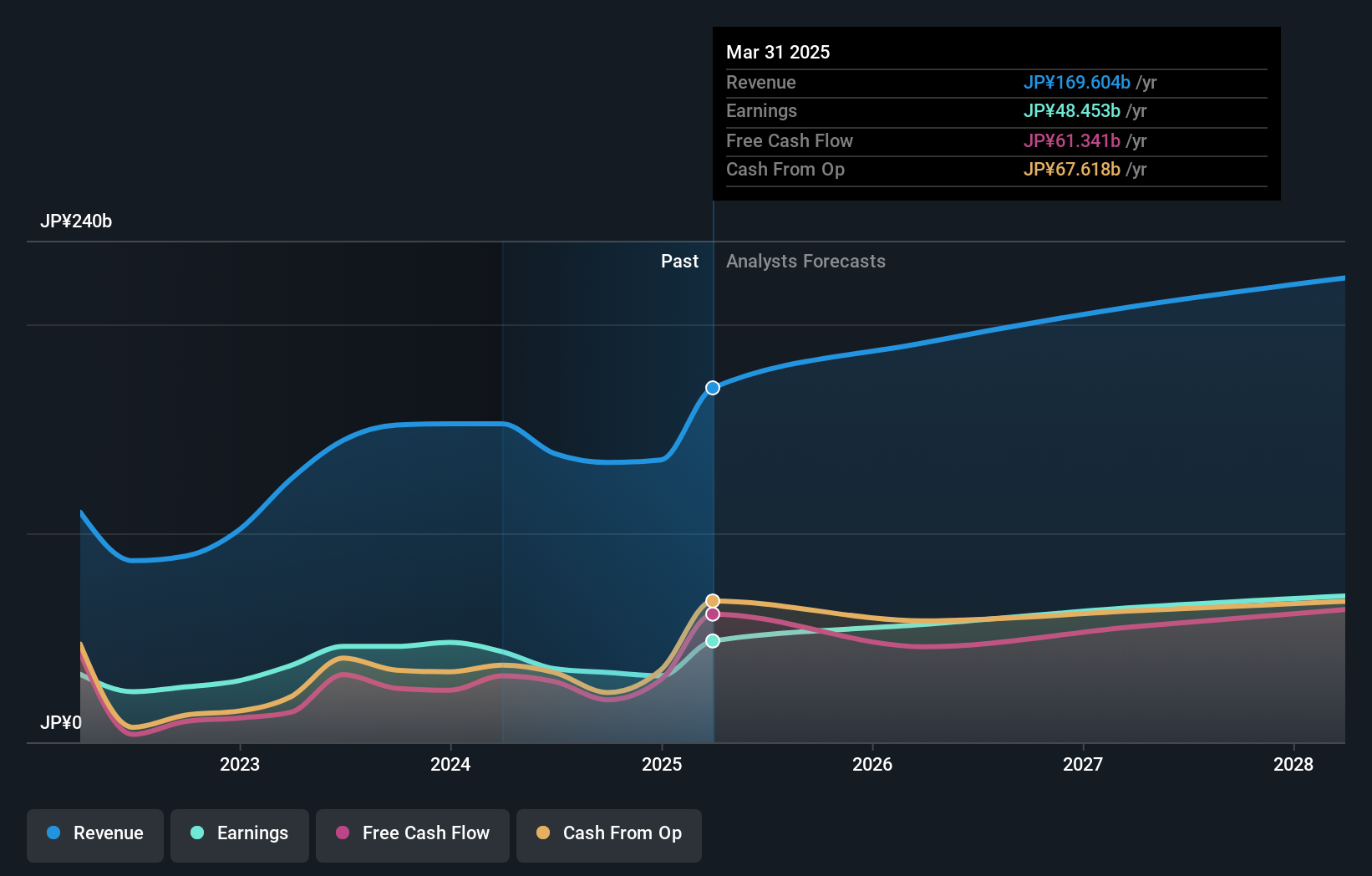

Capcom (TSE:9697)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capcom Co., Ltd. is a global company engaged in planning, developing, manufacturing, selling, and distributing home video games, online games, mobile games, and arcade games with a market cap of ¥1.33 trillion.

Operations: Capcom generates revenue primarily from Digital Content, which accounts for ¥103.38 billion, followed by Amusement Facilities at ¥20.09 billion and Amusement Equipment at ¥10.34 billion. The company is involved in the entire lifecycle of game development and distribution across various platforms both domestically and internationally.

Capcom's earnings are forecast to grow 14.5% annually, outpacing the broader Japanese market's 8.6%. With revenue expected to increase by 9.5% per year, Capcom is investing significantly in R&D, which accounted for ¥20 billion ($0.14 billion) last year, underscoring their commitment to innovation in gaming and software development. Despite a volatile share price over the past three months and a recent -23.3% earnings growth decline compared to the entertainment industry average of -17.1%, Capcom remains focused on future growth prospects through strategic investments and advancements in AI-driven game development technology.

- Click here and access our complete health analysis report to understand the dynamics of Capcom.

Explore historical data to track Capcom's performance over time in our Past section.

Turning Ideas Into Actions

- Reveal the 129 hidden gems among our Japanese High Growth Tech and AI Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9697

Capcom

Plans, develops, manufactures, sells, and distributes home video games, online games, mobile games, and arcade games in Japan and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.