Aichi (TSE:6345) Margin Gains Reinforce Bull Case Despite Growth Concerns

Reviewed by Simply Wall St

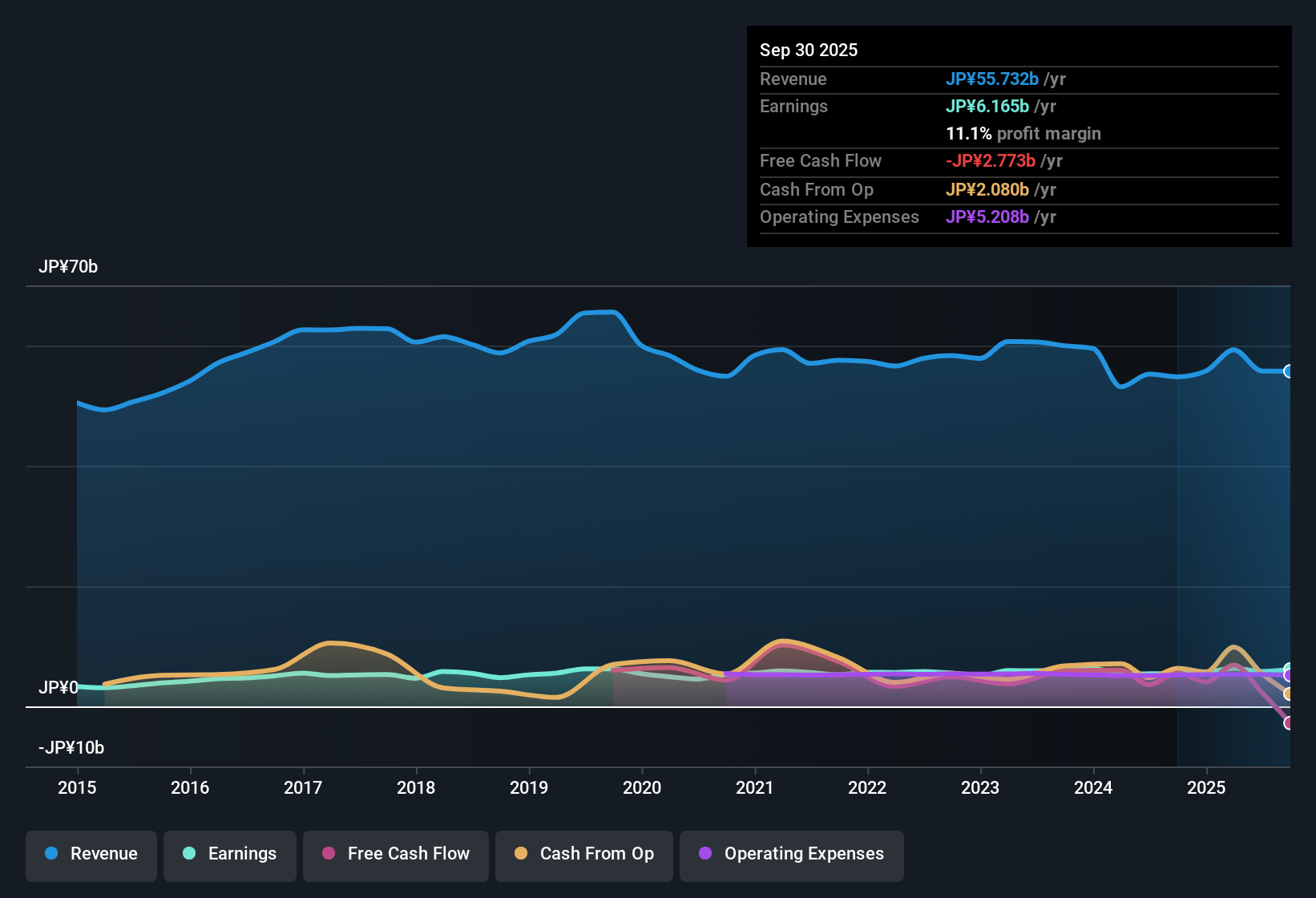

Aichi (TSE:6345) delivered net profit margins of 11.1%, up from last year’s 9.9%, while EPS growth posted a solid 13.3% over the past year. This is well ahead of its five-year average of 1.5% per year. Looking ahead, revenue is projected to grow 6.3% annually and future earnings growth is forecast at 4.4%, which is below the broader Japanese market’s 7.9% expectation. Investors will be watching improved margins and consistently rising profits, weighing attractive valuation levels against a moderate growth outlook.

See our full analysis for Aichi.The numbers tell their own story, but the next step is comparing these results to the most widely followed narratives for Aichi. Let’s see which themes get supported and which ones might need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

DCF Fair Value Sits Above Market Price

- Aichi’s shares are trading at ¥1,289, which is below the DCF fair value estimate of ¥1,465.77. This creates a discount that may catch value-focused investors’ attention.

- Contrary to the prevailing market view that often questions fair value discounts in a lower-growth scenario, Aichi’s current price not only undercuts sector peer averages (16x P/E vs. Aichi’s 13.5x). It also places the stock almost 13% below DCF fair value.

- This gap stands out given its margins are strengthening and revenue growth is forecast to run ahead of Japan’s broader market (6.3% vs. 4.5% sector expectation).

- Valuation support is further reinforced as the machinery industry average P/E matches Aichi’s, yet Aichi has improved its profitability more steadily in the past year.

Margin Expansion Bolsters Quality Narrative

- Net profit margins expanded to 11.1% from 9.9% last year, outpacing the reported five-year growth pace (13.3% last year vs. average 1.5%), which marks a notable shift for this machinery stock.

- The prevailing market view that margin strength is key for sustaining earnings is heavily supported by a rare combination of rising profitability and revenue upside, despite relatively moderate earnings growth guidance.

- Critics pointing to sector headwinds may miss that Aichi’s margin expansion is running ahead of its long-term trend, signaling durable operational gains even as market growth moderates.

- These strengthened margins carve out more room for valuation upside now that the stock also screens attractively against internal fair value models.

Dividend Sustainability Raises Watchpoint

- The only risk called out in filings is a concern about dividend sustainability, despite otherwise healthy profit and cash flow trends observed in the latest report.

- Addressing recurring market questions about potential dividend strain, the prevailing market view is that profit durability and improving margins provide some cushion. However, watchfulness is warranted since no explicit improvement in dividend coverage is mentioned.

- For investors seeking income reliability, this remains a valid area for caution, especially as sector-wide payout ratios come under greater scrutiny.

- This keeps the conversation balanced, spotlighting the single area where the numbers do not yet answer all market concerns.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Aichi's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite strong margin gains, Aichi’s main weakness is the lingering uncertainty over dividend sustainability. This remains a flagged risk in recent filings.

If reliable income is your top priority, now is the time to try these 2007 dividend stocks with yields > 3% to discover companies with stronger, more dependable dividend payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6345

Aichi

Manufactures and sells mechanized vehicles for electric utilities, telecommunications, construction, cargo handling, shipbuilding, and rail industries in Japan, Asia, Oceania, Europe, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives