Benign Growth For Takatori Corporation (TSE:6338) Underpins Stock's 25% Plummet

Takatori Corporation (TSE:6338) shares have had a horrible month, losing 25% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 34% in that time.

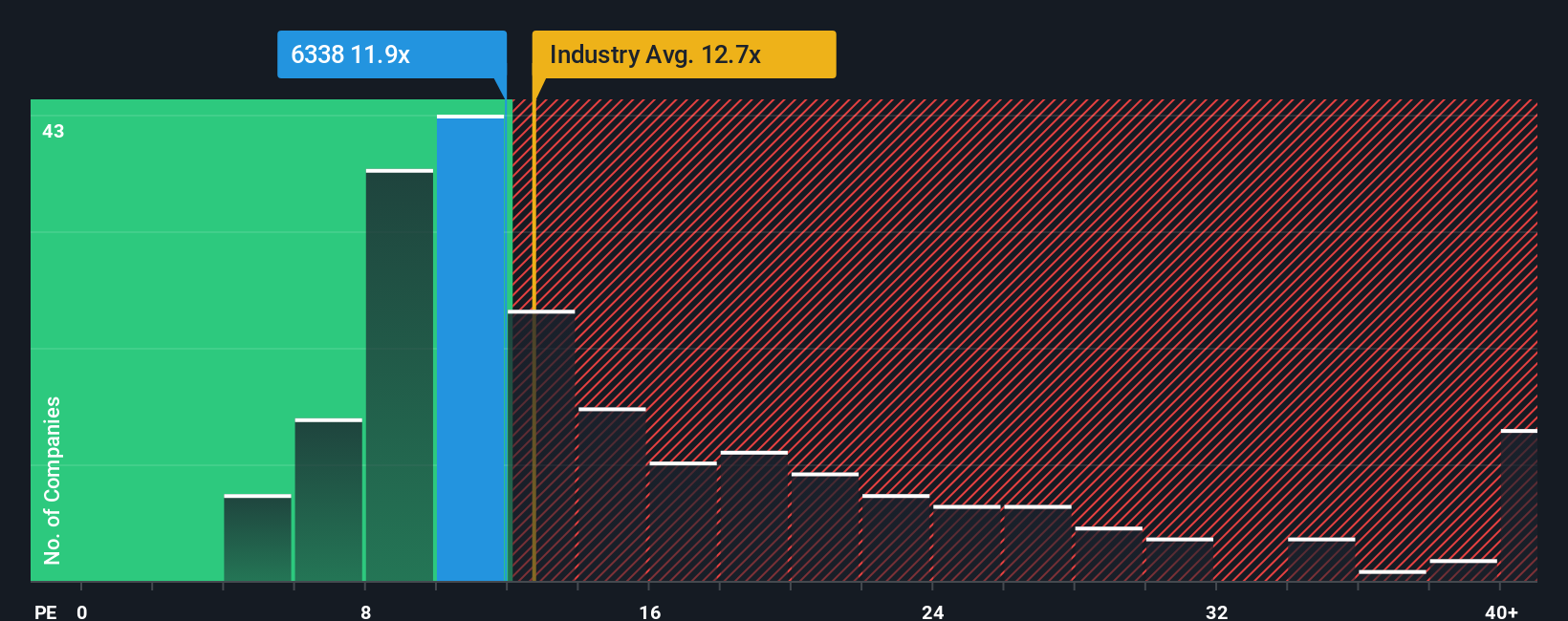

Although its price has dipped substantially, given about half the companies in Japan have price-to-earnings ratios (or "P/E's") above 15x, you may still consider Takatori as an attractive investment with its 11.9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

As an illustration, earnings have deteriorated at Takatori over the last year, which is not ideal at all. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for Takatori

Is There Any Growth For Takatori?

In order to justify its P/E ratio, Takatori would need to produce sluggish growth that's trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 70%. As a result, earnings from three years ago have also fallen 43% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 9.1% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we are not surprised that Takatori is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

The softening of Takatori's shares means its P/E is now sitting at a pretty low level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Takatori maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 4 warning signs we've spotted with Takatori.

Of course, you might also be able to find a better stock than Takatori. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Takatori might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6338

Takatori

Manufactures and sells semiconductor and liquid crystal related equipment, multi wire saws and textile machinery, and medical devices primarily in Japan and internationally.

Excellent balance sheet with slight risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026