Positive Sentiment Still Eludes Sumitomo Heavy Industries, Ltd. (TSE:6302) Following 29% Share Price Slump

Sumitomo Heavy Industries, Ltd. (TSE:6302) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. The recent drop has obliterated the annual return, with the share price now down 9.5% over that longer period.

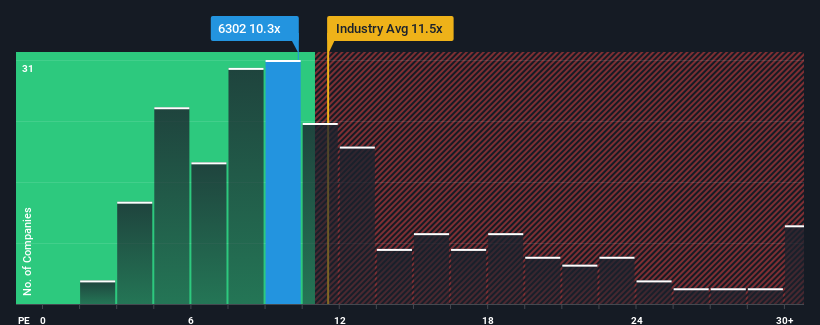

Although its price has dipped substantially, Sumitomo Heavy Industries' price-to-earnings (or "P/E") ratio of 10.3x might still make it look like a buy right now compared to the market in Japan, where around half of the companies have P/E ratios above 14x and even P/E's above 21x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Sumitomo Heavy Industries has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Sumitomo Heavy Industries

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Sumitomo Heavy Industries' is when the company's growth is on track to lag the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 156% last year. Pleasingly, EPS has also lifted 35% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 16% each year during the coming three years according to the four analysts following the company. That's shaping up to be materially higher than the 9.6% each year growth forecast for the broader market.

With this information, we find it odd that Sumitomo Heavy Industries is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Sumitomo Heavy Industries' P/E has taken a tumble along with its share price. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Sumitomo Heavy Industries' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for Sumitomo Heavy Industries you should be aware of.

If you're unsure about the strength of Sumitomo Heavy Industries' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6302

Sumitomo Heavy Industries

Manufactures and sells general machinery worldwide.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives