- Taiwan

- /

- Semiconductors

- /

- TPEX:5314

Undiscovered Gems in Global Markets to Watch This November 2025

Reviewed by Simply Wall St

As global markets grapple with AI-related concerns and fluctuating economic indicators, small-cap indices like the S&P MidCap 400 and Russell 2000 have shown resilience despite broader market losses. In this environment, identifying promising stocks often involves looking beyond immediate market sentiment to uncover companies with strong fundamentals and growth potential that may not yet be fully appreciated by the market.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Jetwell Computer | 34.75% | 16.24% | 27.51% | ★★★★★★ |

| Xiamen Jiarong TechnologyLtd | 8.54% | -5.04% | -25.38% | ★★★★★★ |

| Nanfang Black Sesame GroupLtd | 44.30% | -13.35% | 24.08% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| JiaXing Gas Group | 49.18% | 19.35% | 19.32% | ★★★★★☆ |

| Li Ming Development Construction | 183.36% | 8.59% | 19.98% | ★★★★☆☆ |

| Tai Sin Electric | 37.42% | 10.92% | 7.66% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Myson Century (TPEX:5314)

Simply Wall St Value Rating: ★★★★★☆

Overview: Myson Century, Inc. designs, manufactures, and sells integrated circuit systems across Taiwan, Mainland China, and internationally with a market capitalization of NT$30.58 billion.

Operations: Myson Century generates revenue primarily from the design, manufacturing, and sale of integrated circuit systems. The company's net profit margin has shown a noticeable trend over recent periods.

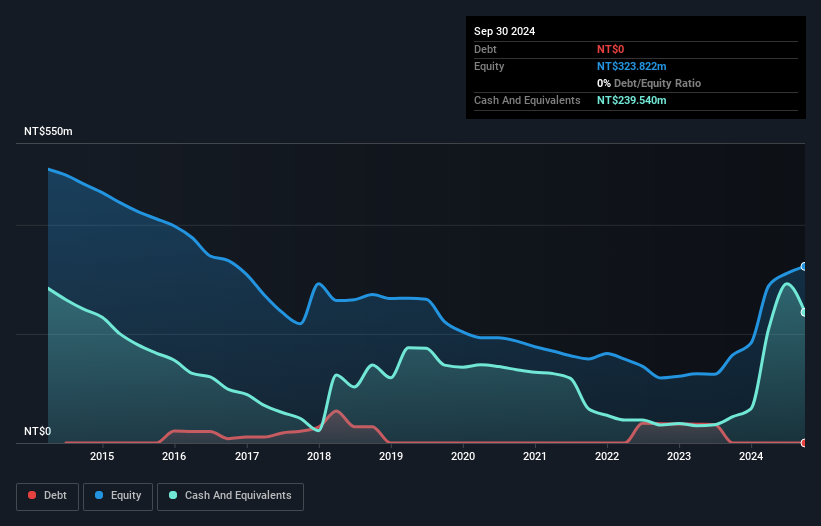

Myson Century, a player in the semiconductor field, has shown remarkable earnings growth of 500.3% over the past year, outpacing its industry peers. Despite a volatile share price recently, it offers value by trading at 47.6% below estimated fair value. Its debt to equity ratio rose from 0% to 11.4% over five years but remains manageable with more cash than total debt and high-quality earnings ensuring interest coverage isn't an issue. Recently added to the S&P Global BMI Index, Myson reported Q3 sales of TWD 773 million and net income of TWD 317 million, showcasing strong financial performance this year.

- Navigate through the intricacies of Myson Century with our comprehensive health report here.

Gain insights into Myson Century's past trends and performance with our Past report.

Union Tool (TSE:6278)

Simply Wall St Value Rating: ★★★★★★

Overview: Union Tool Co. specializes in the design, manufacture, and sale of cutting tools, linear motion products, and metal machining equipment across Japan, China, Taiwan, and other international markets with a market cap of ¥140.96 billion.

Operations: Union Tool Co. generates revenue through the sale of cutting tools, linear motion products, and metal machining equipment across various international markets. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

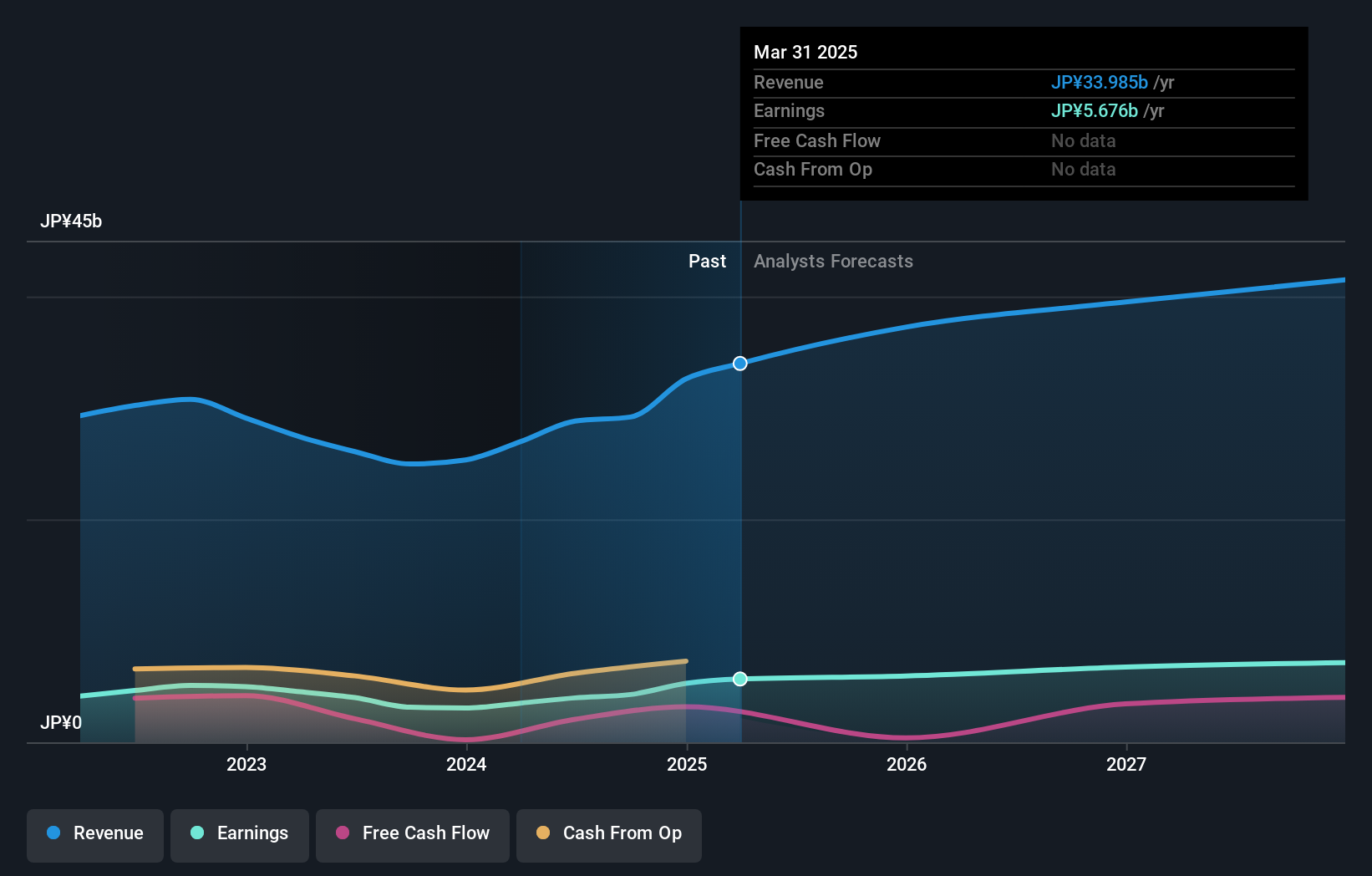

Union Tool, a company with no debt over the past five years, is trading at 31.9% below its estimated fair value, suggesting potential undervaluation. Its earnings have surged by 48.8% in the last year, outpacing the Machinery industry's growth of 12.5%. This robust performance is supported by high-quality earnings and positive free cash flow. Recently, Union Tool announced plans to expand its production capacity with a new factory building at Nagaoka Plant for carbide drills used in PCBs, investing approximately ¥6.2 billion from internal funds, indicating confidence in future growth prospects despite recent share price volatility.

- Click here to discover the nuances of Union Tool with our detailed analytical health report.

Examine Union Tool's past performance report to understand how it has performed in the past.

Thunder Tiger (TWSE:8033)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Thunder Tiger Corp. is engaged in the manufacturing and sale of remote-controlled vehicles and medical devices across Taiwan, the United States, and internationally, with a market capitalization of NT$19.92 billion.

Operations: Thunder Tiger generates revenue primarily from the sale of remote-controlled vehicles and medical devices. The company's financial performance is highlighted by a net profit margin that reflects its operational efficiency.

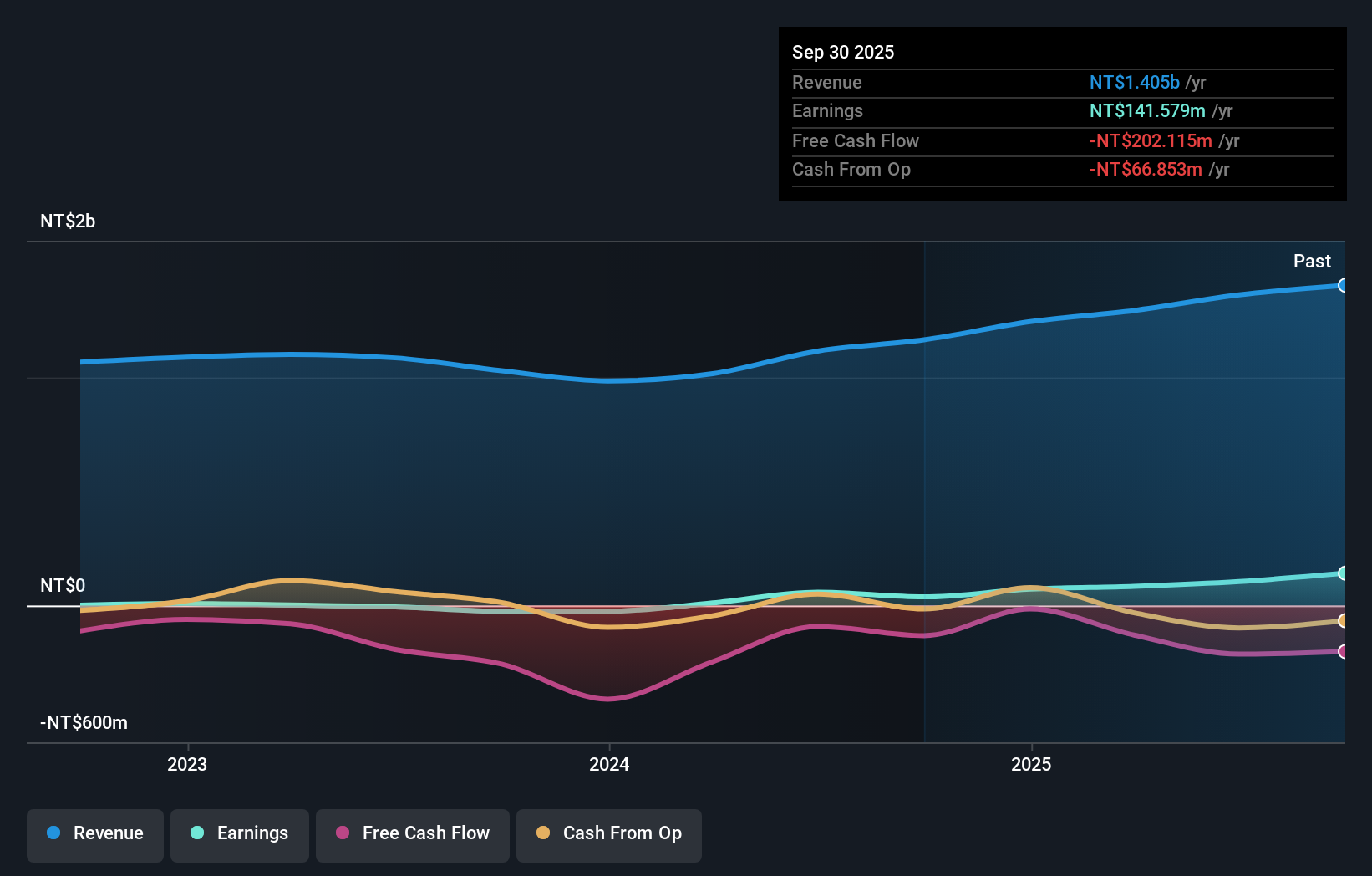

Thunder Tiger, a smaller player in the industry, has shown impressive earnings growth of 275.4% over the past year, outpacing its peers in the Leisure sector. The company's debt to equity ratio has improved significantly from 43.6% to 17.8% over five years, indicating a healthier balance sheet with more cash than total debt. Despite recent share price volatility, Thunder Tiger reported third-quarter sales of TWD 324.97 million and net income of TWD 5.77 million compared to a loss last year, translating into basic earnings per share of TWD 0.03 from a previous loss per share of TWD 0.21.

Turning Ideas Into Actions

- Take a closer look at our Global Undiscovered Gems With Strong Fundamentals list of 3014 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5314

Myson Century

Together with its subsidiaries and designs, manufacturers, and sells integrated circuit systems in Taiwan, Mainland China, and internationally.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success