Hirata's (TSE:6258) 69% YoY earnings expansion surpassed the shareholder returns over the past year

Diversification is a key tool for dealing with stock price volatility. But the goal is to pick stocks that do better than average. Hirata Corporation (TSE:6258) has done well over the last year, with the stock price up 23% beating the market return of 20% (not including dividends). Zooming out, the stock is up 20% in the last three years.

Since the stock has added JP¥6.3b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

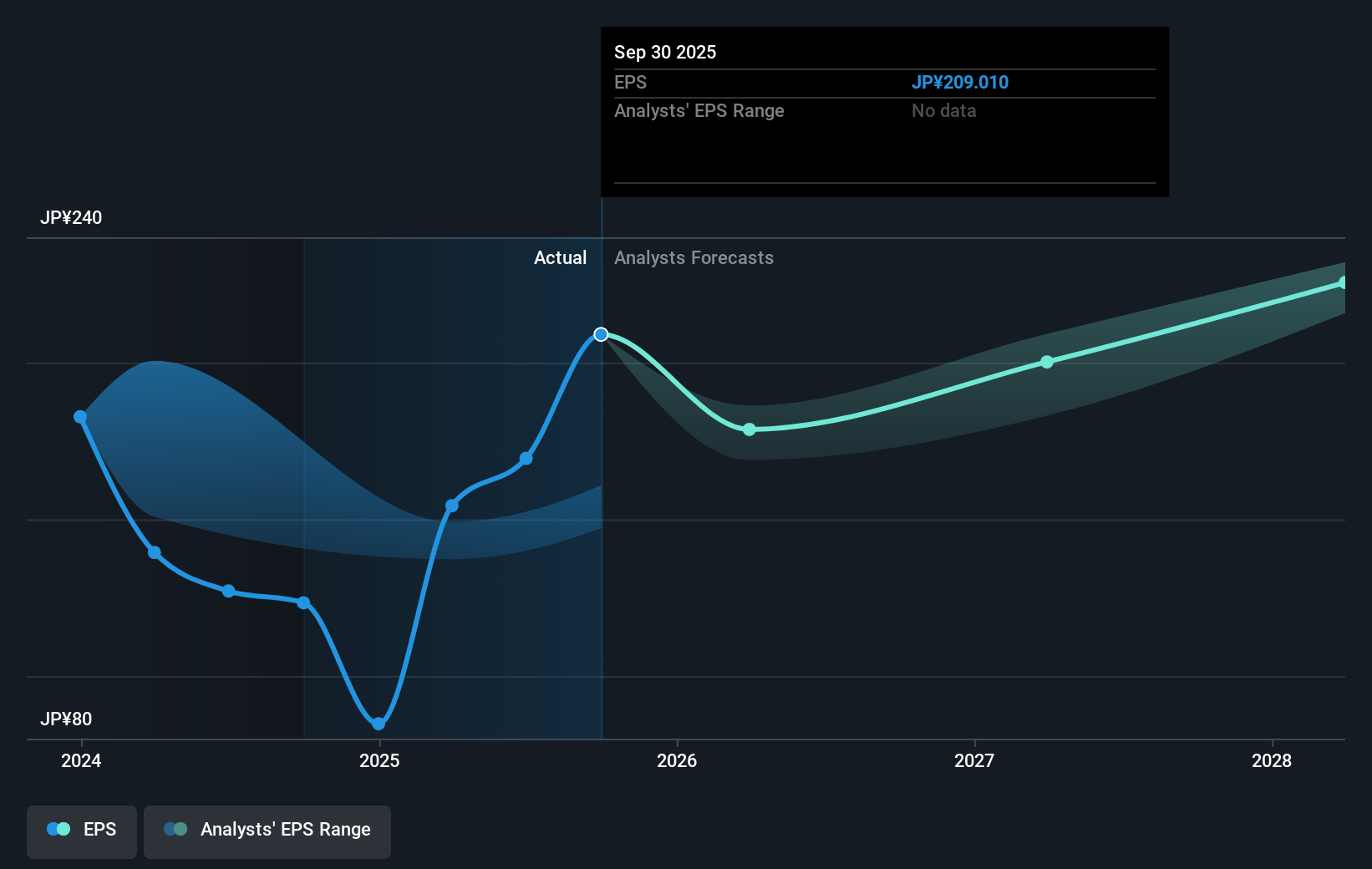

Hirata was able to grow EPS by 69% in the last twelve months. This EPS growth is significantly higher than the 23% increase in the share price. Therefore, it seems the market isn't as excited about Hirata as it was before. This could be an opportunity. The caution is also evident in the lowish P/E ratio of 10.38.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Hirata has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Hirata's TSR for the last 1 year was 26%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Hirata shareholders have received a total shareholder return of 26% over one year. And that does include the dividend. There's no doubt those recent returns are much better than the TSR loss of 0.4% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Hirata better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Hirata you should know about.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hirata might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6258

Hirata

Manufactures and sells various manufacturing line systems, industrial robots, and logistic equipment in Japan and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives