Is DMG Mori's (TSE:6141) New Buyback a Sign of Strategic Agility or Idle Capital?

Reviewed by Sasha Jovanovic

- On October 30, 2025, DMG Mori Co., Ltd. announced board approval for a share repurchase program of 2,500,000 shares, representing 1.76% of its share capital, up to ¥7,500 million, with a goal to enhance shareholder returns and maintain flexible capital management.

- This initiative highlights the company's use of buybacks as a tool to respond directly to changes in its business environment.

- Let's explore how this substantial buyback authorization may influence DMG Mori's investment narrative, particularly in terms of capital allocation flexibility.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is DMG Mori's Investment Narrative?

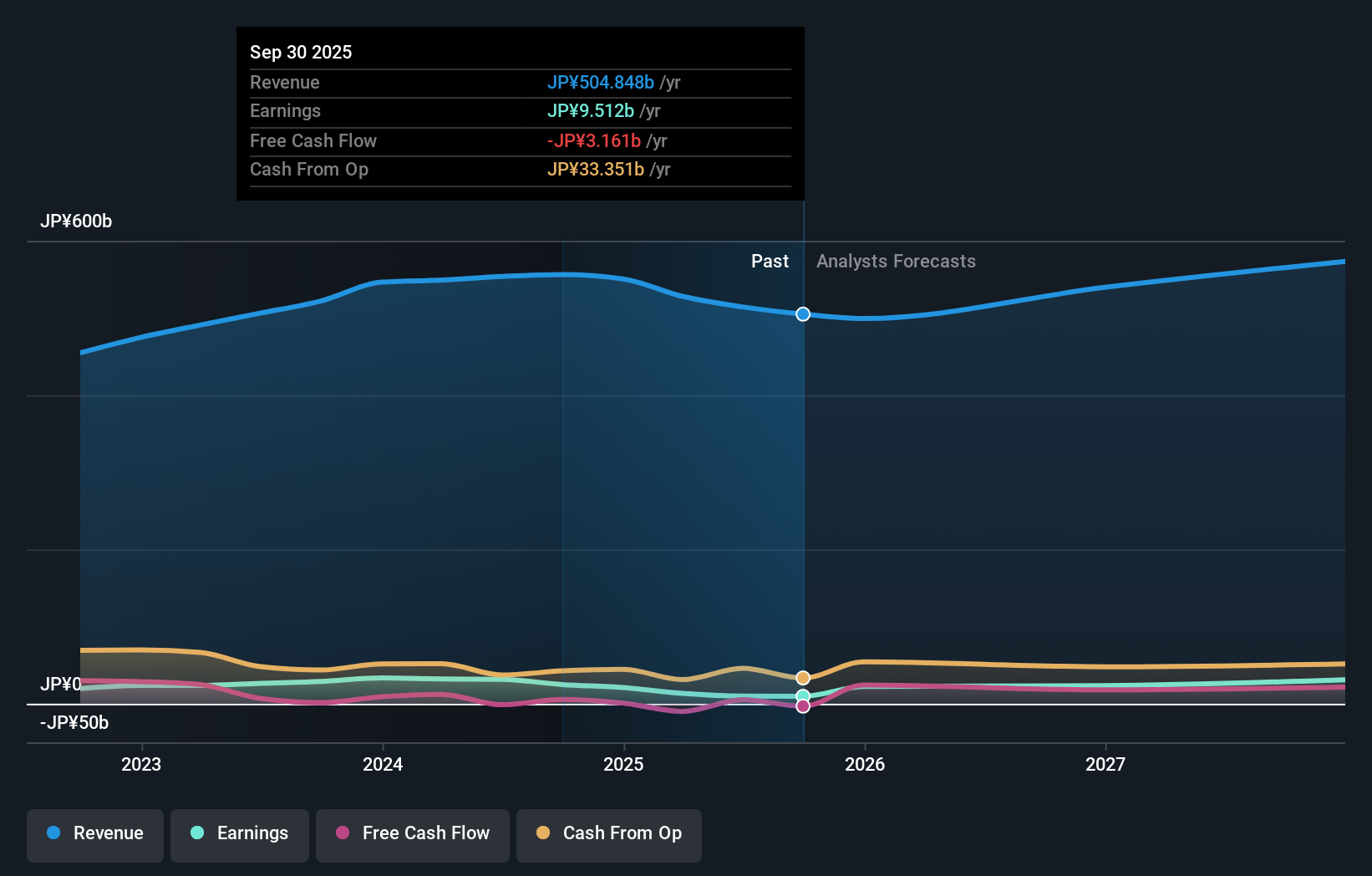

To be a long-term shareholder in DMG Mori, it’s important to believe in the company’s ability to steadily execute its capital allocation strategy and maintain resilience amid industry cycles and changing macro conditions. The recent share buyback plan, authorized just as the company reaffirmed its full-year guidance, may offer a buffer to investor sentiment after a period of share price decline and helps showcase management’s willingness to enhance returns. However, with profit margins compressed versus last year and broader market underperformance, questions remain about the sustainability of earnings growth and how buybacks might offset these pressures. The share repurchase may contribute to short-term support, but it likely won’t change the bigger catalysts and current risks, particularly those arising from elevated debt loads and ongoing margin challenges. On the flip side, rising debt and weaker profit margins can’t be ignored as key risks for shareholders.

Despite retreating, DMG Mori's shares might still be trading 13% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on DMG Mori - why the stock might be worth as much as 15% more than the current price!

Build Your Own DMG Mori Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DMG Mori research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free DMG Mori research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DMG Mori's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6141

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives