- Mexico

- /

- Food and Staples Retail

- /

- BMV:FRAGUA B

Global Stock Picks Estimated To Be Trading At Discounts Of Up To 47.3%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed performances and economic policy shifts, investors are keenly observing the impact of recent rate adjustments and trade negotiations. In this environment, identifying undervalued stocks can be particularly appealing as they may offer potential value amidst broader market fluctuations. A good stock pick in such conditions typically involves assessing fundamentals that suggest a company is trading below its intrinsic value, providing an opportunity for growth when market sentiments stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Takara Bio (TSE:4974) | ¥911.00 | ¥1815.86 | 49.8% |

| STEICO (XTRA:ST5) | €19.72 | €39.39 | 49.9% |

| Recupero Etico Sostenibile (BIT:RES) | €6.42 | €12.84 | 50% |

| PVA TePla (XTRA:TPE) | €24.02 | €47.55 | 49.5% |

| New Zealand King Salmon Investments (NZSE:NZK) | NZ$0.195 | NZ$0.39 | 49.5% |

| Guoquan Food (Shanghai) (SEHK:2517) | HK$4.00 | HK$7.97 | 49.8% |

| Daldrup & Söhne (XTRA:4DS) | €15.80 | €31.43 | 49.7% |

| CHEMTRONICS.Co.Ltd (KOSDAQ:A089010) | ₩36500.00 | ₩72273.34 | 49.5% |

| B&S Group (ENXTAM:BSGR) | €5.94 | €11.83 | 49.8% |

| Atea (OB:ATEA) | NOK149.40 | NOK298.49 | 49.9% |

Here's a peek at a few of the choices from the screener.

Corporativo Fragua. de (BMV:FRAGUA B)

Overview: Corporativo Fragua, S.A.B. de C.V. operates pharmacy stores under the Superfarmacia name in Mexico and has a market cap of MX$52.52 billion.

Operations: The company generates revenue primarily from its retail segment, specifically through the sale of drugs, amounting to MX$129.21 billion.

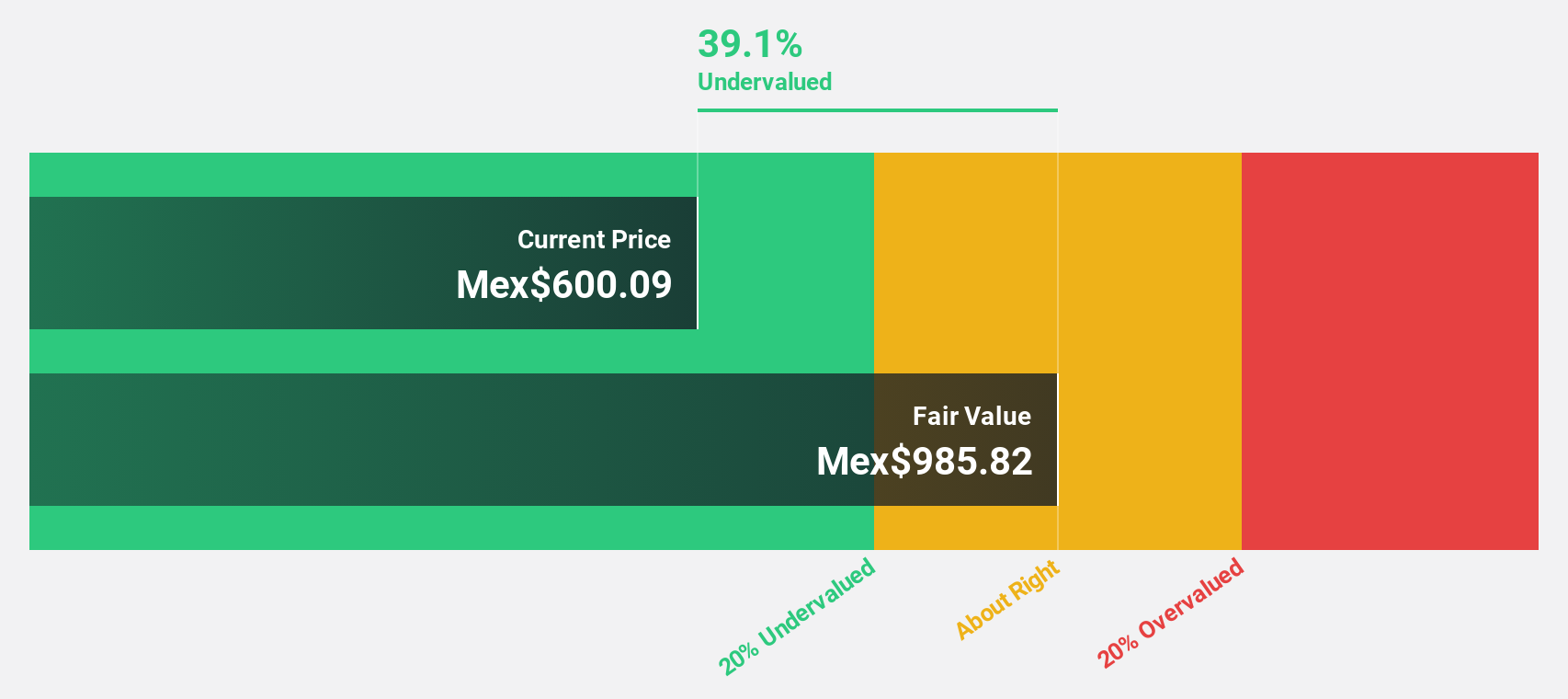

Estimated Discount To Fair Value: 47.3%

Corporativo Fragua is trading at MX$559.89, significantly below its estimated fair value of MX$1062.45, indicating potential undervaluation based on cash flows. Despite a modest annual earnings growth forecast of 14.32%, above the market average, recent financial results show stable revenue growth with third-quarter sales rising to MX$32.91 billion from MX$29.64 billion last year, though net income slightly decreased to MX$1.07 billion from MX$1.12 billion year-over-year.

- According our earnings growth report, there's an indication that Corporativo Fragua. de might be ready to expand.

- Get an in-depth perspective on Corporativo Fragua. de's balance sheet by reading our health report here.

Tongyu Communication (SZSE:002792)

Overview: Tongyu Communication Inc. is engaged in the research, development, manufacturing, sales, and servicing of mobile communication antennas, RF devices, optical modules, and other products globally with a market cap of CN¥10.12 billion.

Operations: Tongyu Communication Inc.'s revenue is primarily derived from its global activities in mobile communication antennas, RF devices, and optical modules.

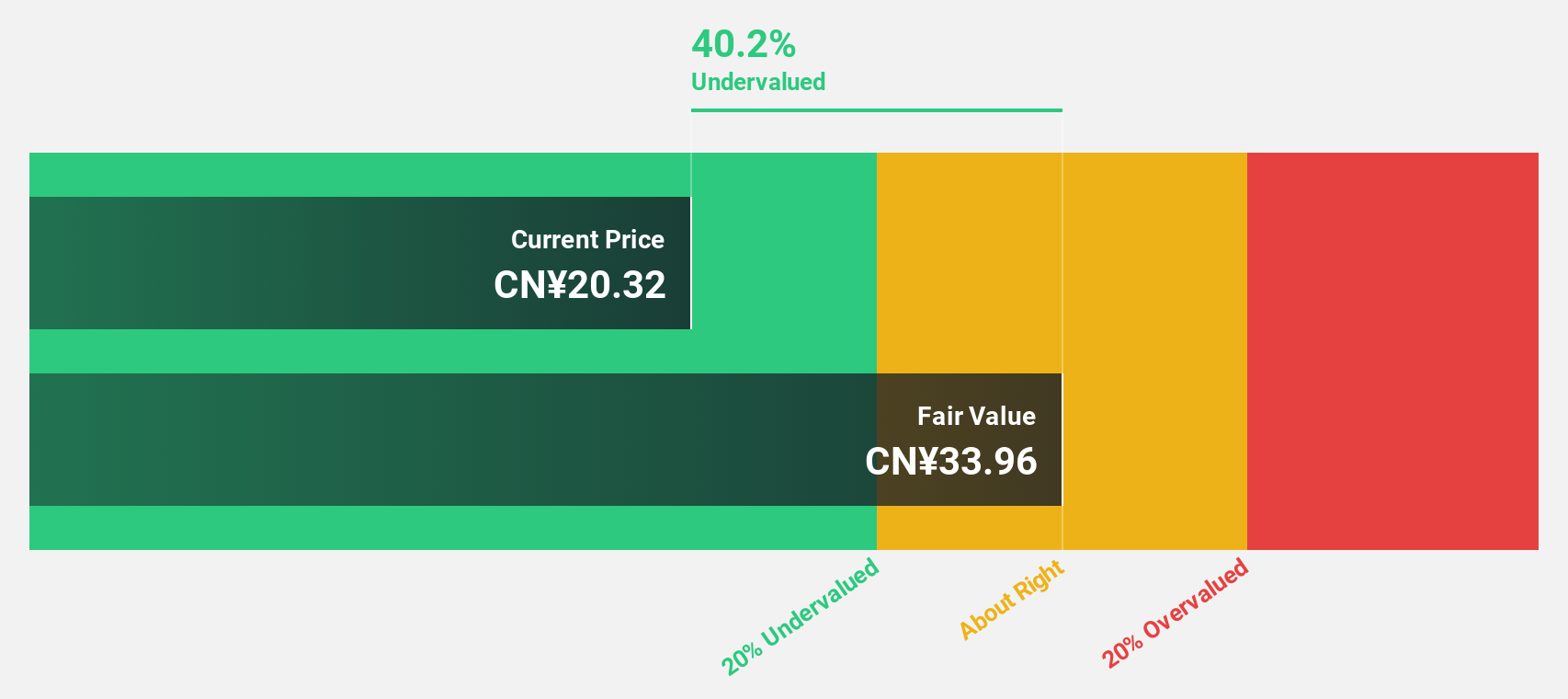

Estimated Discount To Fair Value: 40%

Tongyu Communication is trading at CN¥20.32, below its estimated fair value of CN¥33.89, suggesting potential undervaluation based on cash flows. Despite a decrease in net income to CN¥25.27 million for the nine months ending September 2025 from CN¥51.49 million the previous year, earnings are forecast to grow significantly at 61.9% annually, outpacing market expectations and indicating strong future potential despite recent financial challenges.

- Upon reviewing our latest growth report, Tongyu Communication's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Tongyu Communication.

DMG Mori (TSE:6141)

Overview: DMG Mori Co., Ltd. manufactures and sells machine tools globally, with a market cap of approximately ¥372.57 billion.

Operations: The company's revenue is primarily derived from Machine Tools, contributing ¥590.31 million, and Industrial Service, which adds ¥222.70 million.

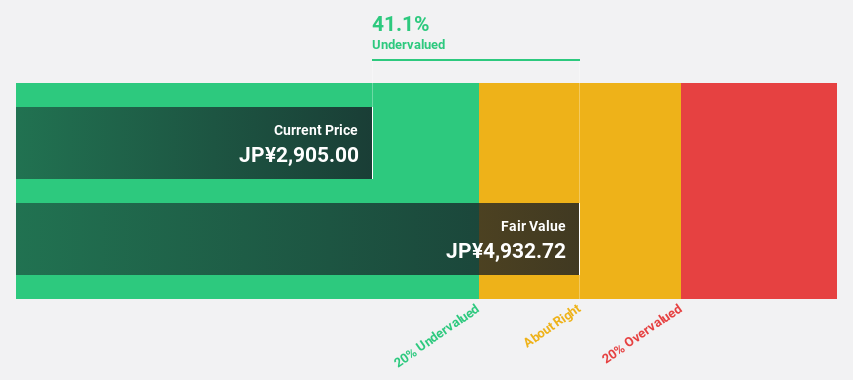

Estimated Discount To Fair Value: 14.3%

DMG Mori, trading at ¥2607, is below its estimated fair value of ¥3042.94, highlighting potential undervaluation based on cash flows. Despite a volatile share price and low profit margins of 1.9%, earnings are forecast to grow significantly at 38.5% annually, surpassing market expectations. The company announced a share repurchase program worth ¥7,500 million to enhance shareholder returns and adapt capital policies amid changing business conditions.

- The analysis detailed in our DMG Mori growth report hints at robust future financial performance.

- Click here to discover the nuances of DMG Mori with our detailed financial health report.

Where To Now?

- Delve into our full catalog of 505 Undervalued Global Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:FRAGUA B

Corporativo Fragua. de

Operates pharmacy stores under the Superfarmacia name in Mexico.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives