OSG (TSE:6136): Assessing Valuation After Steady Share Price Gains

Reviewed by Simply Wall St

OSG (TSE:6136) has caught some attention after a stable stretch in its share price. The stock moved up 1% over the past week and nearly 10% in the past 3 months. Investors seem to be taking a closer look at recent results and trends, seeking value amid steady long-term growth.

See our latest analysis for OSG.

With its share price sitting at ¥2,257 and momentum building this year, OSG has caught some fresh attention. The company's year-to-date share price return of 23% outpaces broader market trends, while a strong 1-year total shareholder return of 31% suggests both recent optimism and solid long-term value for investors.

If steady gains like these have you wondering what else could outperform, now is the perfect time to broaden your view and discover fast growing stocks with high insider ownership

But with OSG’s robust returns and shares trading close to analyst targets, investors may wonder whether there is still potential value left for new buyers or if the market has already priced in the company’s future growth prospects.

Price-to-Earnings of 13.9x: Is it justified?

OSG’s stock trades at a price-to-earnings (PE) ratio of 13.9x, slightly below the average for its peer group and slightly above the industry average. With the last close at ¥2,257, this ratio provides insights into how the market is assessing current and future company profitability.

The price-to-earnings ratio is a key measure that shows how much investors are willing to pay for each yen of company earnings. For OSG, a 13.9x multiple suggests moderately optimistic expectations, reflecting its profitability track record and future growth outlook in the machinery sector.

Taking a broader view, OSG’s PE of 13.9x is lower than the peer group average of 15.3x, suggesting the market is not assigning it a premium compared to similar companies. However, it trades at a premium to the broader machinery industry’s 13.2x, indicating that investors still regard it as holding above-average value compared to more generalized peers. Compared to the estimated fair PE of 13.4x, the stock appears just slightly expensive, leaving limited cushion should market sentiment change from current levels.

Explore the SWS fair ratio for OSG

Result: Price-to-Earnings of 13.9x (ABOUT RIGHT)

However, ongoing revenue growth remains modest. Any slowdown in net income could limit upside, making continued outperformance far from guaranteed.

Find out about the key risks to this OSG narrative.

Another View: Is the Market Overlooking Hidden Value?

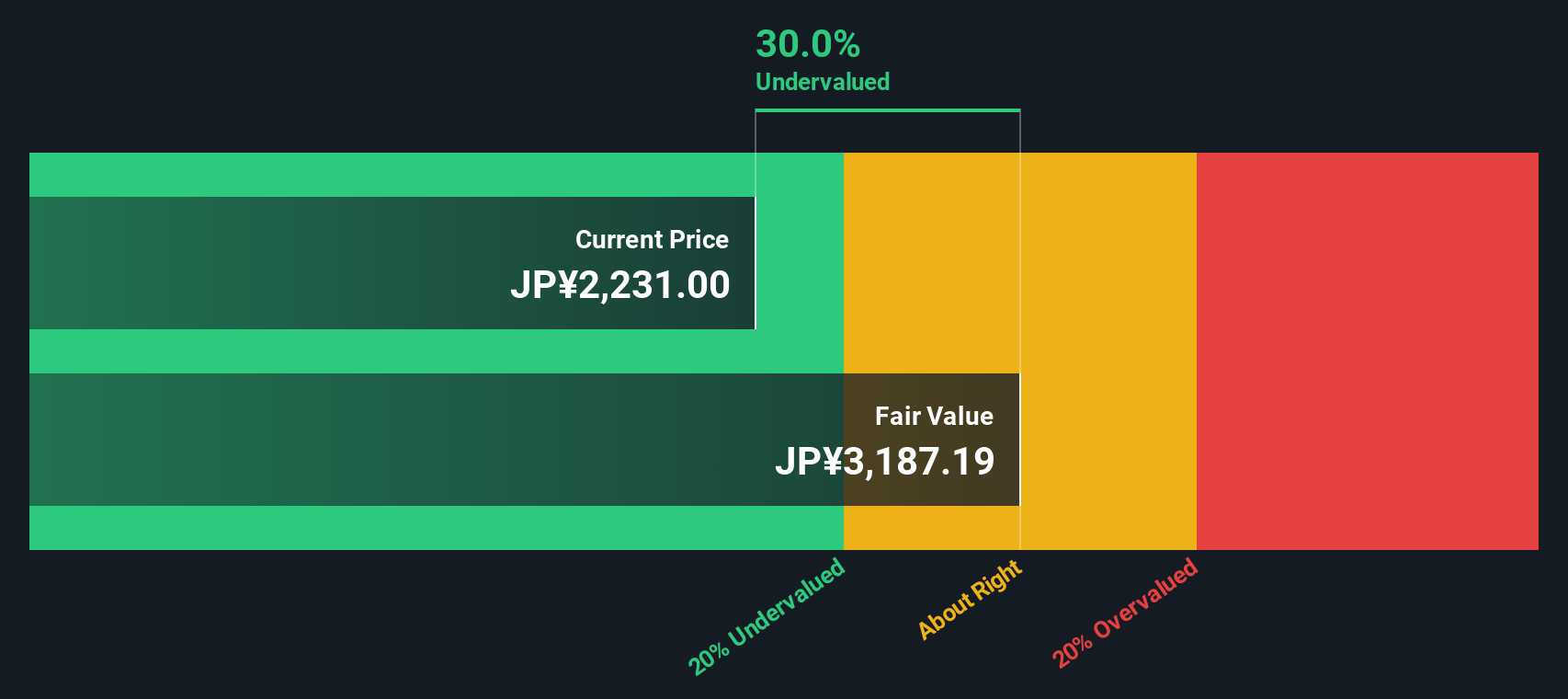

Looking from a different angle, the SWS DCF model finds OSG’s shares trading about 27% below its estimated fair value of ¥3,086. That suggests the current price may not reflect the company’s full cash flow potential. Could this gap point to a genuine opportunity, or is the market rightfully cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out OSG for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 863 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own OSG Narrative

If you see the story differently or want to dive deeper yourself, you can put together your own narrative with ease in just a few minutes. Let your research lead the way. Do it your way

A great starting point for your OSG research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Seize fresh opportunities by scanning leading stocks that fit your favorite themes. Open the door to smart alternatives before everyone else catches on.

- Boost your income potential by starting with these 16 dividend stocks with yields > 3% offering attractive yields for steady cash flow.

- Tap into next-gen healthcare by seeking out these 32 healthcare AI stocks that is transforming patient outcomes and diagnostics with advanced technology.

- Ride the momentum of cutting-edge innovation with these 24 AI penny stocks as they drive real-world change and capture the market’s attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6136

OSG

Manufactures and sells precision machinery tools in Japan, the Americas, Europe, Africa, and Asia.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives