How Investors Are Reacting To Amada (TSE:6113) Upward Earnings Revision After Strong Q2 and Yen Tailwinds

Reviewed by Sasha Jovanovic

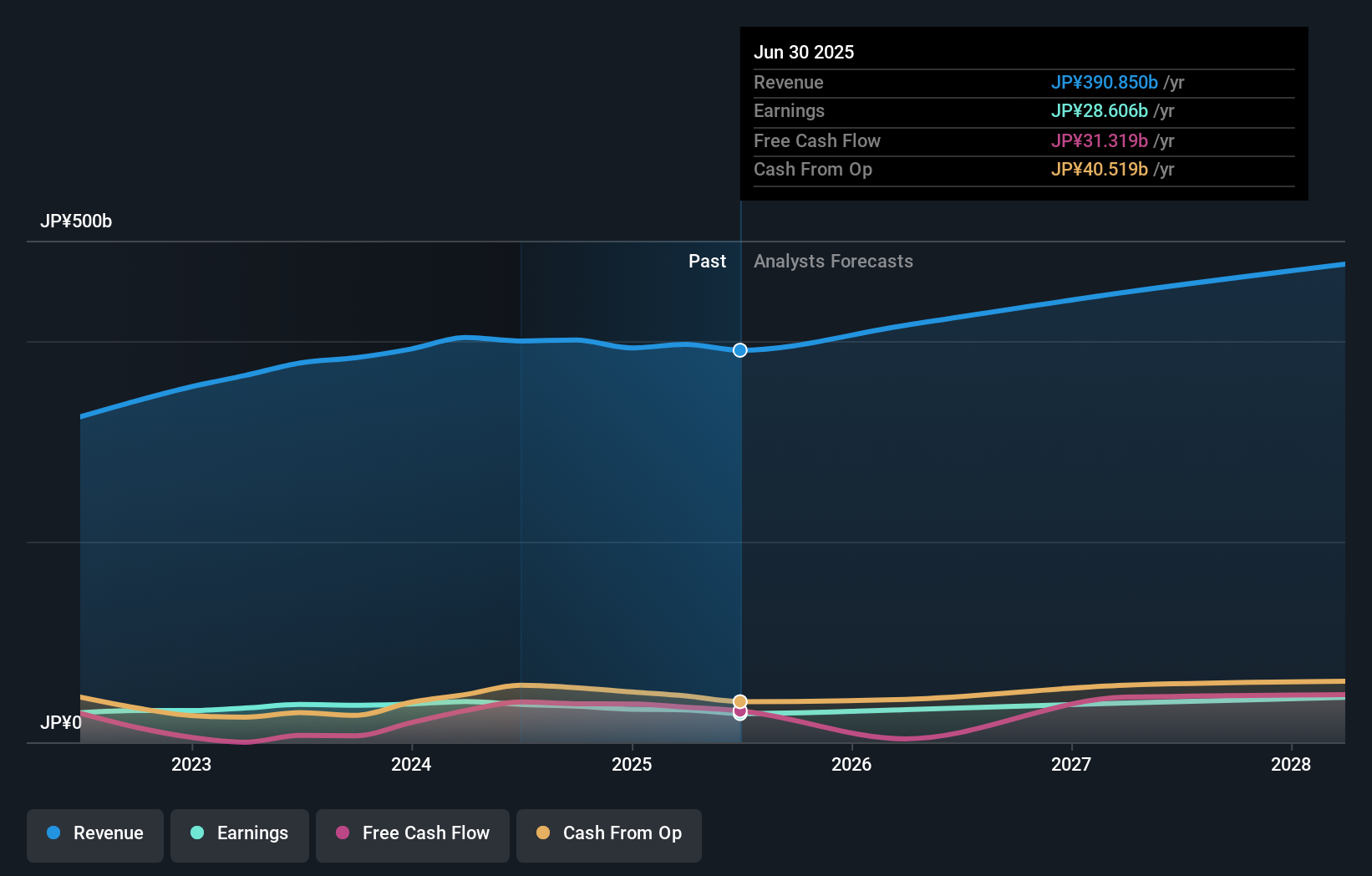

- On November 13, 2025, Amada Co., Ltd. announced it had raised its consolidated earnings guidance for the fiscal year ending March 31, 2026, attributing the improvement to stronger-than-expected second quarter results, currency tailwinds from a weaker yen, and the consolidation of Via Mechanics Co., Ltd. as a subsidiary.

- This revision reflects how currency fluctuations and recent acquisitions can play a material role in shaping a company's financial outlook.

- We'll explore how Amada's upward earnings revision, driven by its second quarter performance and currency movements, influences its investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Amada's Investment Narrative?

For anyone considering Amada, the investment thesis now orbits around its ability to deliver steady earnings growth, maintain strong shareholder returns and adapt to external variables like currency movements and acquisitions. The recent guidance revision, raising full-year forecasts by a meaningful margin on the back of Q2 outperformance, yen weakness, and the addition of Via Mechanics, has provided short-term momentum and tempered immediate downside risks. While the improved profit outlook could support confidence in near-term catalysts like continued buybacks or dividend stability, it's important to note these catalysts are at least partly dependent on favorable market and currency conditions remaining in place. That said, Amada’s rich valuation relative to its industry, its weaker net profit margins versus last year, and a mixed longer-term growth story mean upside may not be open-ended from here. Ultimately, this upgraded outlook shifts some risks to longer-term profit sustainability and ongoing cost discipline, as operational pressures and competitive threats persist in the machinery sector. On the flip side, investors should keep an eye on the company’s lower net margins versus last year.

Despite retreating, Amada's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore another fair value estimate on Amada - why the stock might be worth as much as 10% more than the current price!

Build Your Own Amada Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amada research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Amada research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amada's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6113

Amada

Manufactures and sells metalworking machinery, software, and peripheral equipment in Japan, North America, Europe, Asia, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives