- Philippines

- /

- Infrastructure

- /

- PSE:ATI

3 Top Dividend Stocks To Consider With Yields Up To 8.8%

Reviewed by Simply Wall St

In a week marked by geopolitical tensions and concerns over consumer spending, global markets have shown mixed performance, with major U.S. indexes experiencing declines amid tariff fears and economic uncertainty. As investors navigate these turbulent times, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those seeking reliable returns in uncertain market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| CAC Holdings (TSE:4725) | 5.06% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.03% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.75% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.24% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.06% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.37% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.90% | ★★★★★★ |

Click here to see the full list of 2011 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

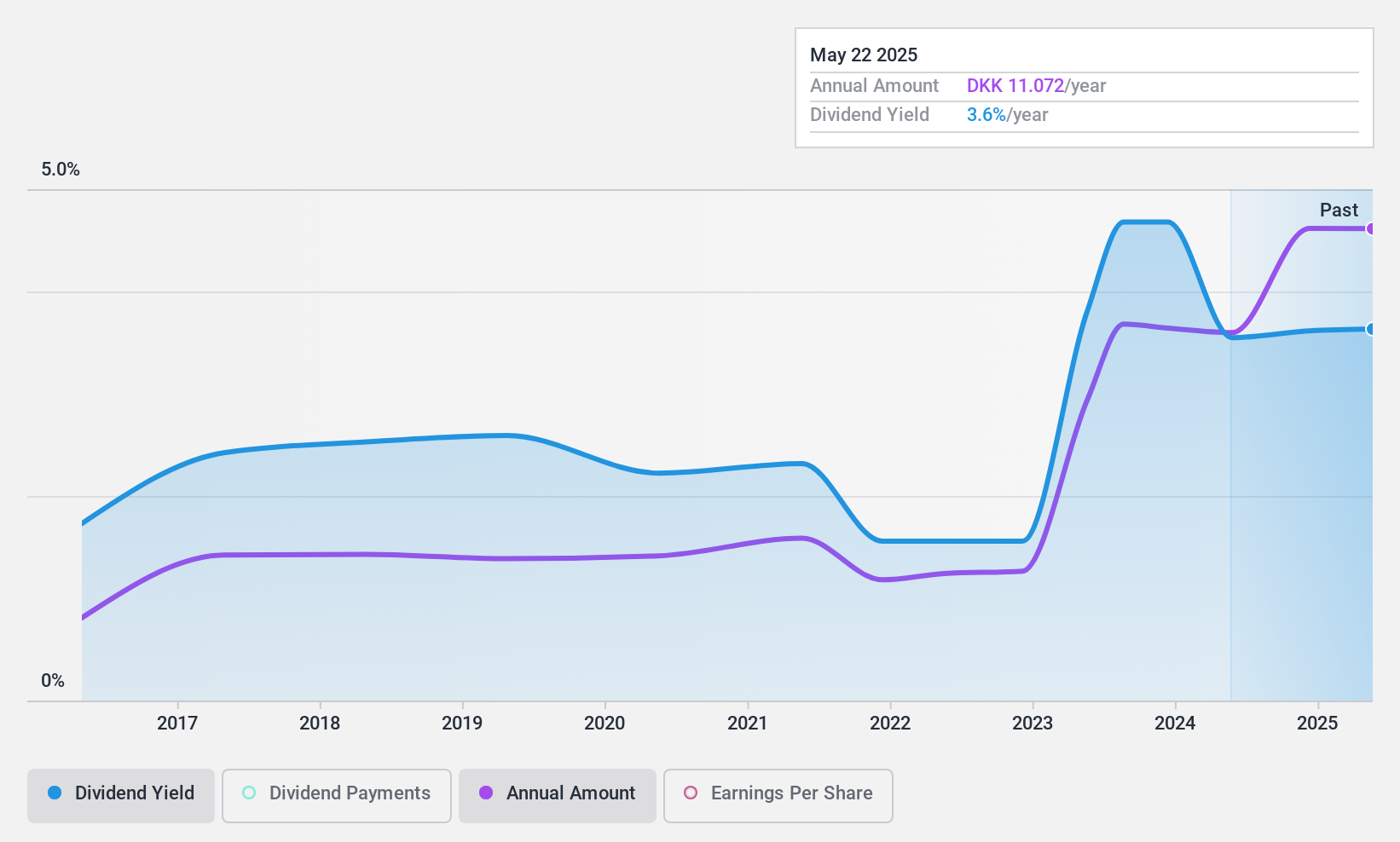

UIE (CPSE:UIE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: UIE Plc invests in the agro-industrial, industrial, and technology sectors across Malaysia, Indonesia, the United States, Europe, and internationally with a market cap of DKK9.57 billion.

Operations: UIE Plc's revenue segment primarily consists of $462.25 million from United Plantations Berhad (UP).

Dividend Yield: 3.6%

UIE's dividend payments have been volatile over the past decade, despite recent growth. The dividends are well covered by earnings and cash flows, with a low payout ratio of 22.6% and a cash payout ratio of 37.9%. However, large one-off items have impacted financial results, raising concerns about earnings quality. Trading at 24.2% below estimated fair value, UIE offers a lower yield than top-tier Danish dividend payers but maintains coverage sustainability amidst its unstable track record.

- Take a closer look at UIE's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that UIE is trading behind its estimated value.

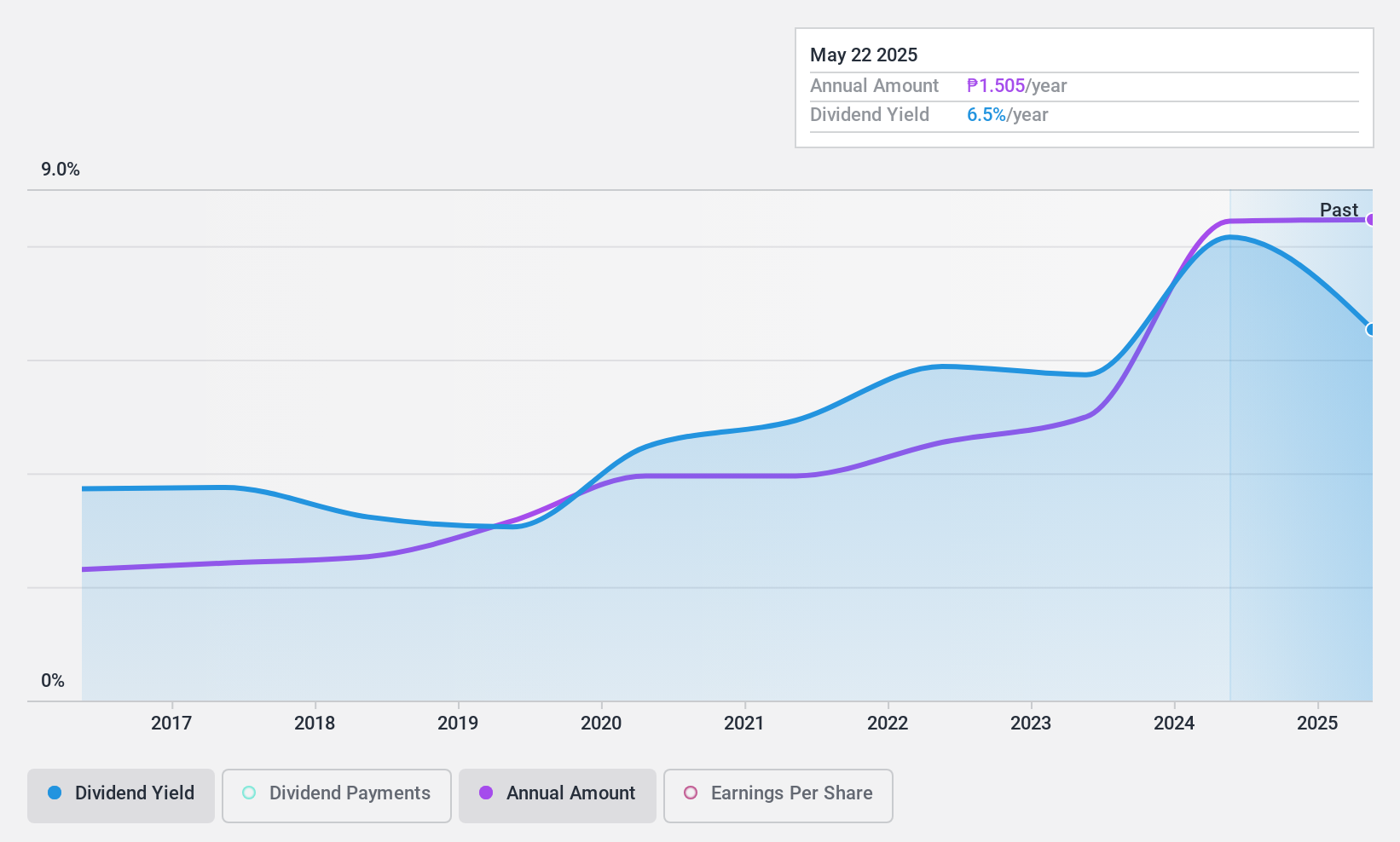

Asian Terminals (PSE:ATI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Asian Terminals, Inc. operates and manages key port facilities in the Philippines, including the South Harbor Port of Manila and the Port of Batangas, with a market cap of ₱33.97 billion.

Operations: Asian Terminals, Inc.'s revenue primarily comes from its Ports Business segment, generating ₱15.39 billion.

Dividend Yield: 8.8%

Asian Terminals offers a dividend yield of 8.81%, ranking in the top 25% among Philippine dividend payers, though it is not well covered by cash flows, with a high cash payout ratio of 110.4%. Despite this, dividends are stable and have grown over the past decade with a reasonable earnings payout ratio of 44.7%. A recent PHP 2 billion share buyback program could potentially enhance shareholder value through internally generated funds.

- Dive into the specifics of Asian Terminals here with our thorough dividend report.

- Our valuation report here indicates Asian Terminals may be overvalued.

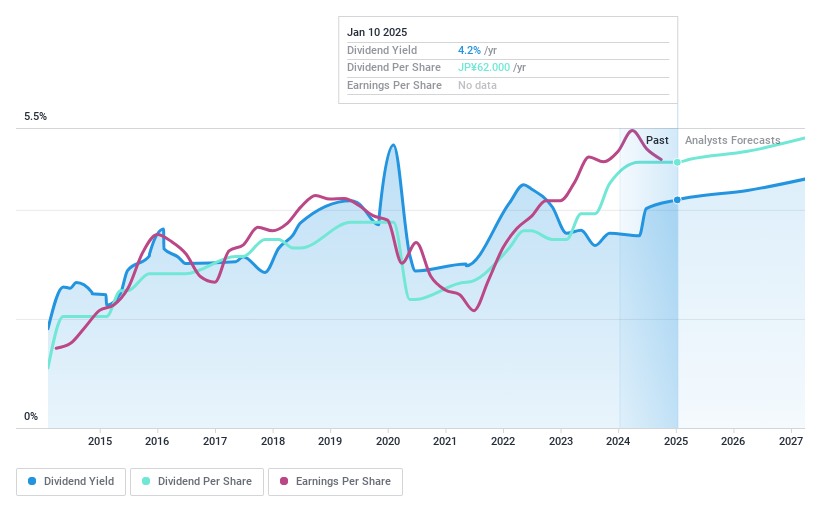

Amada (TSE:6113)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Amada Co., Ltd. and its subsidiaries operate in the manufacturing, sales, leasing, repair, maintenance, inspection of metalworking machinery, software, and peripheral equipment globally with a market cap of approximately ¥467.97 billion.

Operations: Amada Co., Ltd. generates revenue primarily from Metal Working Machinery, which accounts for ¥325.89 billion, and Metal Machine Tools, contributing ¥65.94 billion.

Dividend Yield: 4.3%

Amada's dividend yield of 4.27% is among the top 25% in Japan, supported by a reasonable payout ratio of 66.3% and a cash payout ratio of 52.3%. However, its dividend history has been volatile over the past decade despite recent growth. The company trades at a discount to its estimated fair value and analysts expect further price appreciation. Recent guidance forecasts revenue of ¥405 billion and profit attributable to owners at ¥36 billion for fiscal year ending March 2025.

- Navigate through the intricacies of Amada with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Amada's share price might be too pessimistic.

Summing It All Up

- Gain an insight into the universe of 2011 Top Dividend Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:ATI

Asian Terminals

Operates and manages the South Harbor Port of Manila and the Port of Batangas in Batangas City in the Philippines.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives