Okabe (TSE:5959) Losses Worsen 47% Annually, Challenging Value Narrative Despite Discounted Price

Reviewed by Simply Wall St

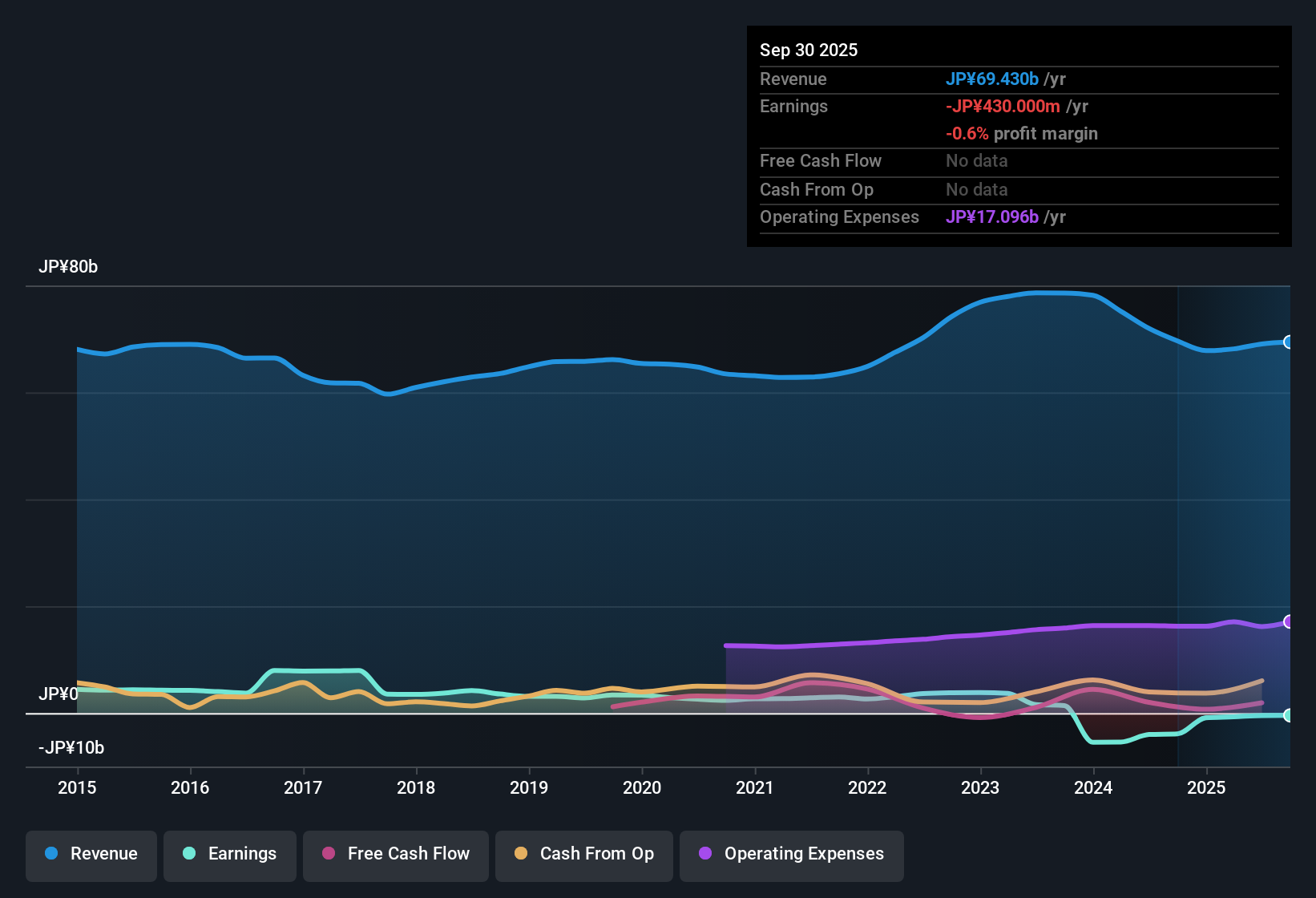

Okabe (TSE:5959) continues to be unprofitable, with losses worsening at a rate of 47.1% per year over the past five years. The company’s net profit margin remains in negative territory and, because of sustained losses, recent earnings growth cannot be meaningfully compared to past performance. With no available guidance on future revenue or profit trends, investors are left weighing the appeal of Okabe’s relatively low valuation against ongoing risks.

See our full analysis for Okabe.Now we will see how these results measure up when set against the wider market narrative and where the story might surprise you.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Margin Remains Deep in the Red

- Okabe’s net profit margin continues negative, reflecting more than five years of consistent unprofitability and a 47.1% annualized increase in losses.

- What stands out is that, despite periods of sector stability, Okabe has not established profitability. This raises caution for defensive-minded investors seeking durable earnings.

- With no signs of margin recovery mentioned, persistent bottom-line weakness poses a material risk to shareholder returns.

- Sector peers face their own cost pressures, but Okabe’s sustained margin deficits go further and reinforce anxieties about business resilience over time.

Dividend Sustainability Under Serious Pressure

- The filing points to a lack of sustainability in Okabe’s dividend payouts. Ongoing losses cast doubt on maintaining dividends at historic levels, with no evidence of positive earnings support.

- Bears argue that, absent a turnaround in profit trends, dividend cuts or suspensions may become unavoidable, especially as negative net margins and mounting losses erode available cash flows.

- This challenges the view that Okabe’s yield is a safe haven, since weak cash generation often precedes dividend reductions in similar companies.

- Unprofitable years naturally stress payout ability, so any long-term investor must seriously assess the risk of payout disruption if trends persist.

Valuation Discount Weighed Against Risks

- Okabe trades at a Price-to-Sales Ratio of 0.6x, which is below its DCF fair value (1239.83 vs current share price of 917.00 JPY) and looks attractive relative to the peer average (0.8x), but not compared to the industry average (0.5x).

- While prevailing discussion sees the valuation discount as intriguing, ongoing operating losses and lack of revenue or profit growth expectations mean many investors still favor caution.

- Relatively cheap multiples become less compelling when fundamentals such as sustained negative margins undercut the case for recovery.

- The contrast between discounted price and relentless loss trends shows why a low valuation alone does not automatically signal an opportunity.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Okabe's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Ongoing losses, negative profit margins, and serious doubts about dividend sustainability make Okabe a risky pick for investors seeking stable income.

If you want to prioritize consistent payouts and financial strength, check out these 2000 dividend stocks with yields > 3% to discover companies offering more reliable yields and resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5959

Okabe

Manufactures and sells construction and civil engineering products in Japan, North America, and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives