- Japan

- /

- Trade Distributors

- /

- TSE:5834

SBI Leasing (TSE:5834) Net Margin Climbs to 12.1%, Reinforcing Bullish Profitability Narratives

Reviewed by Simply Wall St

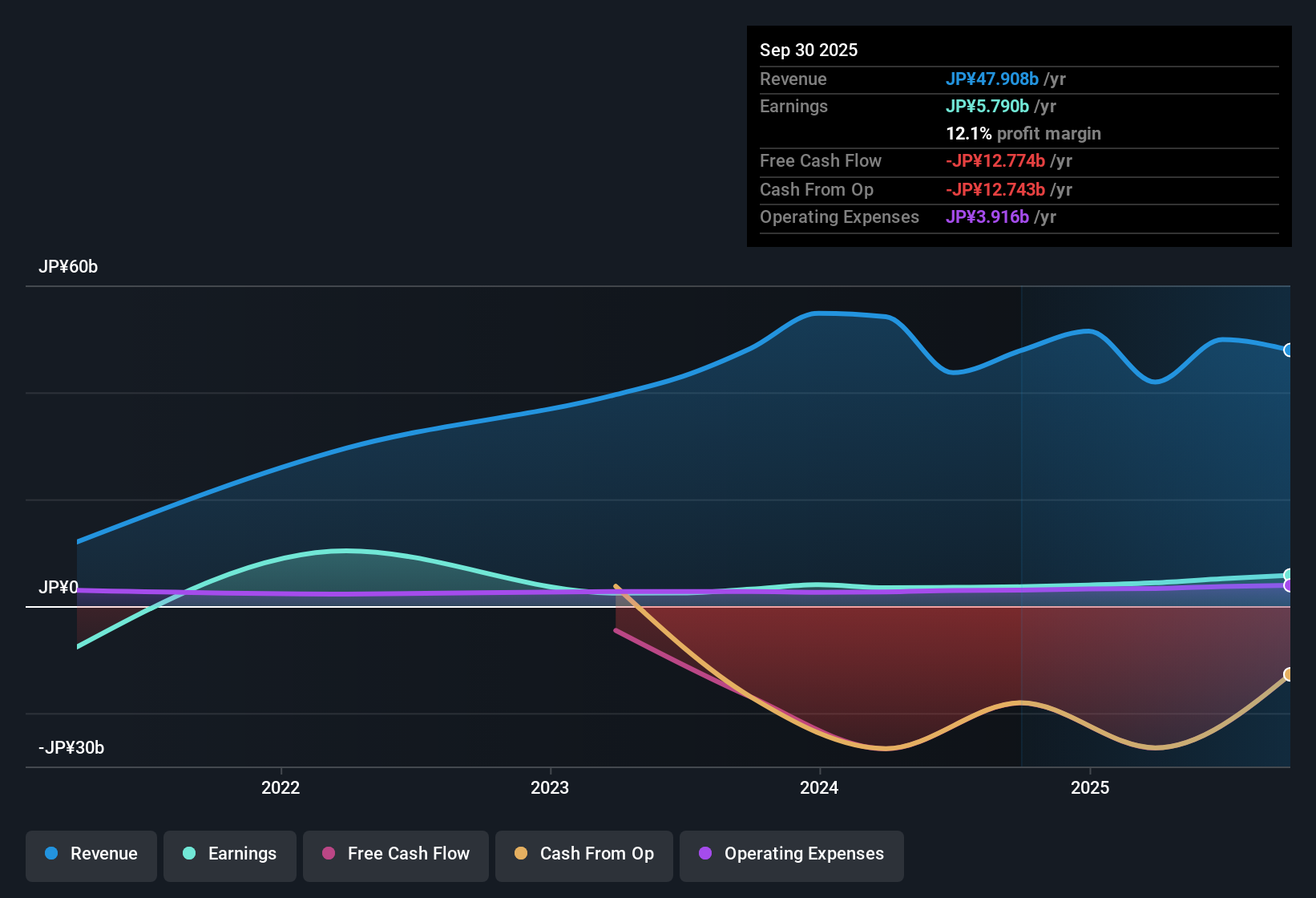

SBI Leasing Services (TSE:5834) reported net profit margins of 12.1%, up from last year’s 7.6%, with earnings growth of 59.9% over the past year. Over the past five years, annual earnings growth averaged 30.3%, highlighting consistently robust performance. With high-quality earnings and a Price-to-Earnings ratio of 6.9x, which is below both peer (11.9x) and industry (10x) averages, the company looks attractively valued. However, the current share price of ¥5,040 sits above the estimated fair value of ¥2,561.33. Investors will be weighing these strengths against flagged risks such as dividend sustainability and overall financial position, alongside notable growth signals.

See our full analysis for SBI Leasing Services.We will next compare these results against the most widely followed narratives to see where the numbers confirm market beliefs and where they might challenge them.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Jump as Net Profit Hits 12.1%

- Net profit margins increased from 7.6% to 12.1%, marking a substantial rise not just since last year but also as a signal of improving profitability outpacing historical averages.

- Recent margin expansion strongly supports the bullish view that SBI Leasing’s business model is proving resilient. Sustained improvements like these often reflect operational discipline and stronger underlying lease performance.

- Supporters point out that maintaining a five-year average earnings growth of 30.3% per year, with a recent year-on-year surge of nearly 60%, showcases a notable durability in profit generation.

- The company’s consistent ability to translate revenue into growing profit margins, even as the sector faces cyclical and macroeconomic pressures, adds further weight to the argument for long-term earnings quality.

Dividend Sustainability Concerns Linger

- Dividend sustainability has been specifically flagged as a risk, with the company’s overall financial position underlined as another potential vulnerability to monitor.

- Critics highlight that while profit margins and historical growth appear strong, lingering concerns about how reliably these translate into ongoing dividend payouts may undercut the bullish thesis.

- Bears argue that apparent headline strength is being offset in the risk assessment by doubts over whether current performance is enough to guarantee future distributions, especially in a rising rate environment.

- The flagged risks regarding dividend sustainability serve as a reminder that healthy earnings do not always guarantee shareholder returns if underlying cash flows or capital buffers become strained.

Valuation Stays Attractive Despite Share Price Premium

- The current Price-to-Earnings ratio of 6.9x is notably below peers (11.9x) and industry average (10x). The share price of ¥5,040 trades at nearly double the DCF fair value of ¥2,561.33.

- What stands out is that, despite trading well above its calculated fair value, the company is still perceived as offering good value due to rapid and sustained earnings growth relative to sector norms.

- The deep discount in P/E multiples compared to rivals, even with the share price premium, continues to attract investor attention as a possible value opportunity.

- However, the significant gap to DCF fair value leaves some investors cautious about upside potential without new growth catalysts or improvements in financial robustness.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on SBI Leasing Services's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While SBI Leasing boasts robust growth and attractive valuation multiples, concerns about dividend sustainability and its overall financial strength highlight potential risks for shareholders.

If you want to prioritize healthier financial foundations, check out solid balance sheet and fundamentals stocks screener (1985 results) to discover companies with sturdy balance sheets that can better weather uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5834

SBI Leasing Services

Engages in the arrangement and selling of investment funds in the operating lease business primarily focused on aircraft and ships.

Solid track record with mediocre balance sheet.

Market Insights

Community Narratives