Japan Steel Works (TSE:5631): Valuation in Focus After Surge on Policy Optimism and Market Volatility

Reviewed by Kshitija Bhandaru

Japan Steel Works (TSE:5631) caught the spotlight after Japanese equities surged, following expectations for expansionary economic policy under Sanae Takaichi’s likely leadership. Investors reacted to renewed optimism around pro-growth government spending and a weaker yen.

See our latest analysis for Japan Steel Works.

Japan Steel Works has seen its momentum build as investors bet on increased government spending and a weaker yen. The stock climbed more than 12% in the past week alone before a recent pullback. While there has been plenty of volatility, the company’s 1-year total shareholder return stands at an impressive 72%, and the 5-year total return has exceeded 400%, highlighting both strong short-term momentum and a robust long-term track record.

If you’re interested in uncovering what else might be fueling strong moves in industrials and related sectors, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

After such a dramatic rally fueled by political optimism and policy speculation, the real question is whether Japan Steel Works remains undervalued, or if the market has already priced in all the expected growth ahead?

Price-to-Earnings of 37.8x: Is it justified?

Japan Steel Works is trading at a price-to-earnings (P/E) ratio of 37.8x, which sits far above both industry and market averages. At the most recent close of ¥9,616, this valuation sets a high bar for earnings growth moving forward.

The price-to-earnings ratio reveals how much investors are willing to pay for each yen of the company's earnings. For Japan Steel Works, this steep multiple suggests investors are paying a significant premium, perhaps for potential earnings acceleration or unique industry positioning.

This P/E is much higher than the JP Machinery industry average of 13.2x, and also well above the peer average of 20.1x. Compared to the estimated fair price-to-earnings ratio of 28.5x, the current multiple stands out as notably expensive. This may imply that the market is pricing in exceptional growth expectations. The fair ratio level could represent where the market might settle if sentiment shifts toward fundamentals.

Explore the SWS fair ratio for Japan Steel Works

Result: Price-to-Earnings of 37.8x (OVERVALUED)

However, slowing revenue growth and a lofty valuation could quickly sour sentiment if there are policy shifts or earnings disappoint in the coming quarters.

Find out about the key risks to this Japan Steel Works narrative.

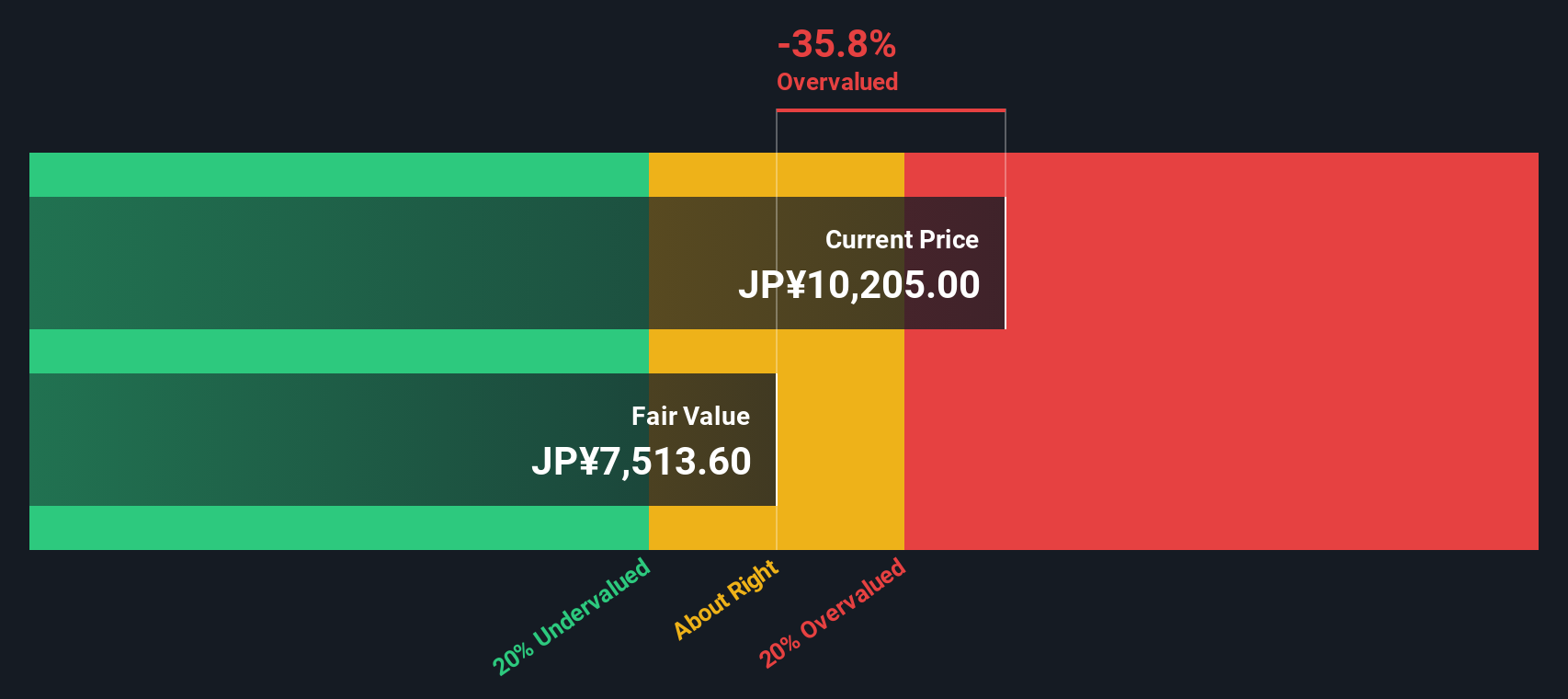

Another View: Discounted Cash Flow Perspective

While the market is placing a steep premium on Japan Steel Works based on its price-to-earnings ratio, our DCF model presents a different perspective. According to the SWS DCF model, the fair value is estimated at ¥7,555.55, which is below the current share price. This suggests the stock may be overvalued by this approach. Could the optimism included in the market price be exceeding the fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Japan Steel Works for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Japan Steel Works Narrative

If you would like to take a different angle or reach your own conclusions, it only takes a few minutes to craft your own perspective and Do it your way.

A great starting point for your Japan Steel Works research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Make smarter moves by expanding your portfolio with stocks that have standout potential across different sectors. There are high-conviction opportunities you don't want to miss.

- Find untapped value with these 899 undervalued stocks based on cash flows and target companies boasting strong fundamentals that may have been overlooked by the market.

- Capture future growth by checking out these 24 AI penny stocks, where innovation and artificial intelligence are powering the next wave of industry leaders.

- Boost your income with these 19 dividend stocks with yields > 3% that are rewarding shareholders with healthy yields above 3%, perfect for building a resilient investment stream.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5631

Japan Steel Works

Engages in the provision of industrial machinery products, and material and engineering solutions in Japan and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives