Investors push Danto Holdings (TSE:5337) 11% lower this week, company's increasing losses might be to blame

Some Danto Holdings Corporation (TSE:5337) shareholders are probably rather concerned to see the share price fall 41% over the last three months. But in stark contrast, the returns over the last half decade have impressed. We think most investors would be happy with the 161% return, over that period. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. Ultimately business performance will determine whether the stock price continues the positive long term trend. Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 68% decline over the last twelve months.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

View our latest analysis for Danto Holdings

Because Danto Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last half decade Danto Holdings' revenue has actually been trending down at about 2.6% per year. Given that scenario, we wouldn't have expected the share price to rise 21% per year, but that's what it did. It just goes to show tht the market is forward looking, and it's not always easy to predict the future based on past trends. Still, we are a bit cautious in this kind of situation.

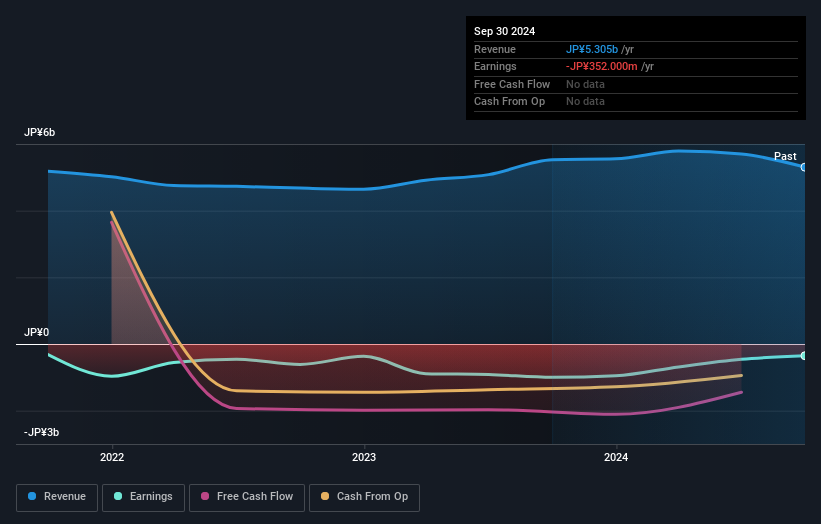

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Danto Holdings' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 15% in the last year, Danto Holdings shareholders lost 68%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 21%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Danto Holdings is showing 4 warning signs in our investment analysis , and 3 of those are significant...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5337

Slight with mediocre balance sheet.