- Japan

- /

- Electrical

- /

- TSE:5310

Asian Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate through a period of monetary policy adjustments and economic uncertainties, Asian economies are experiencing mixed performances, with China's slowdown contrasting Japan's steady growth. In this context, dividend stocks in Asia can offer investors a potential source of income stability; selecting those with strong fundamentals and consistent payout histories could be particularly appealing amidst fluctuating market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.17% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.69% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.26% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.78% | ★★★★★★ |

| NCD (TSE:4783) | 4.09% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.79% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| Daicel (TSE:4202) | 4.25% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.64% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.47% | ★★★★★★ |

Click here to see the full list of 1008 stocks from our Top Asian Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

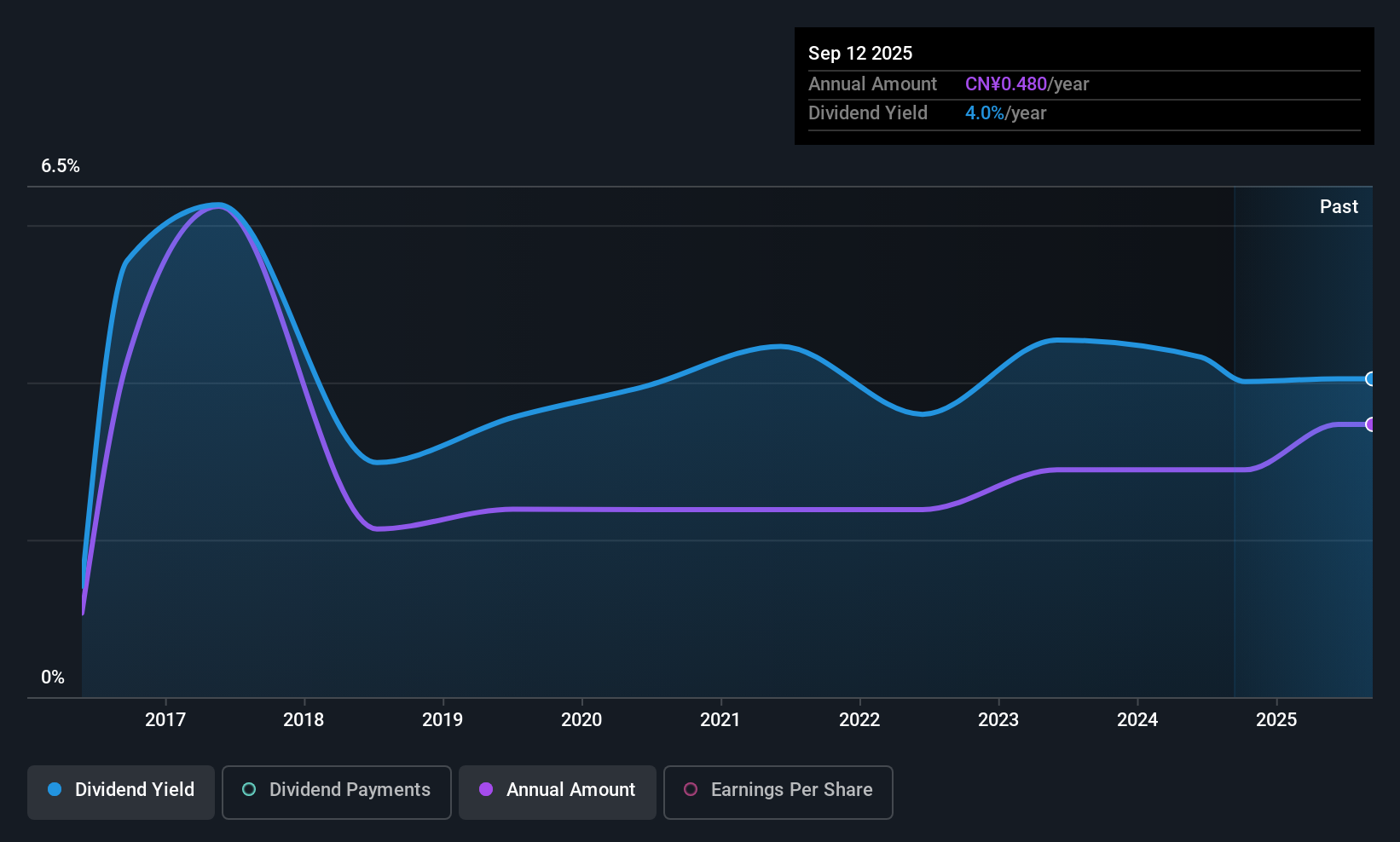

Guangdong Vanward New Electric (SZSE:002543)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Guangdong Vanward New Electric Co., Ltd. specializes in kitchen and bathroom appliances as well as hot water heating systems, with a market cap of CN¥9.36 billion.

Operations: Guangdong Vanward New Electric Co., Ltd. generates revenue through its kitchen and bathroom appliances and hot water heating systems both domestically in China and internationally.

Dividend Yield: 3.8%

Guangdong Vanward New Electric's dividend yield of 3.8% ranks in the top 25% of CN market payers, yet is not well-covered by free cash flows due to a high cash payout ratio (604.7%). Despite a low earnings payout ratio (28.6%), dividends have been volatile and recently decreased to CNY 0.20 per 10 shares for H1 2025, reflecting ongoing challenges in sustainability and reliability despite solid earnings growth of 33.7% last year.

- Click here to discover the nuances of Guangdong Vanward New Electric with our detailed analytical dividend report.

- Our valuation report here indicates Guangdong Vanward New Electric may be undervalued.

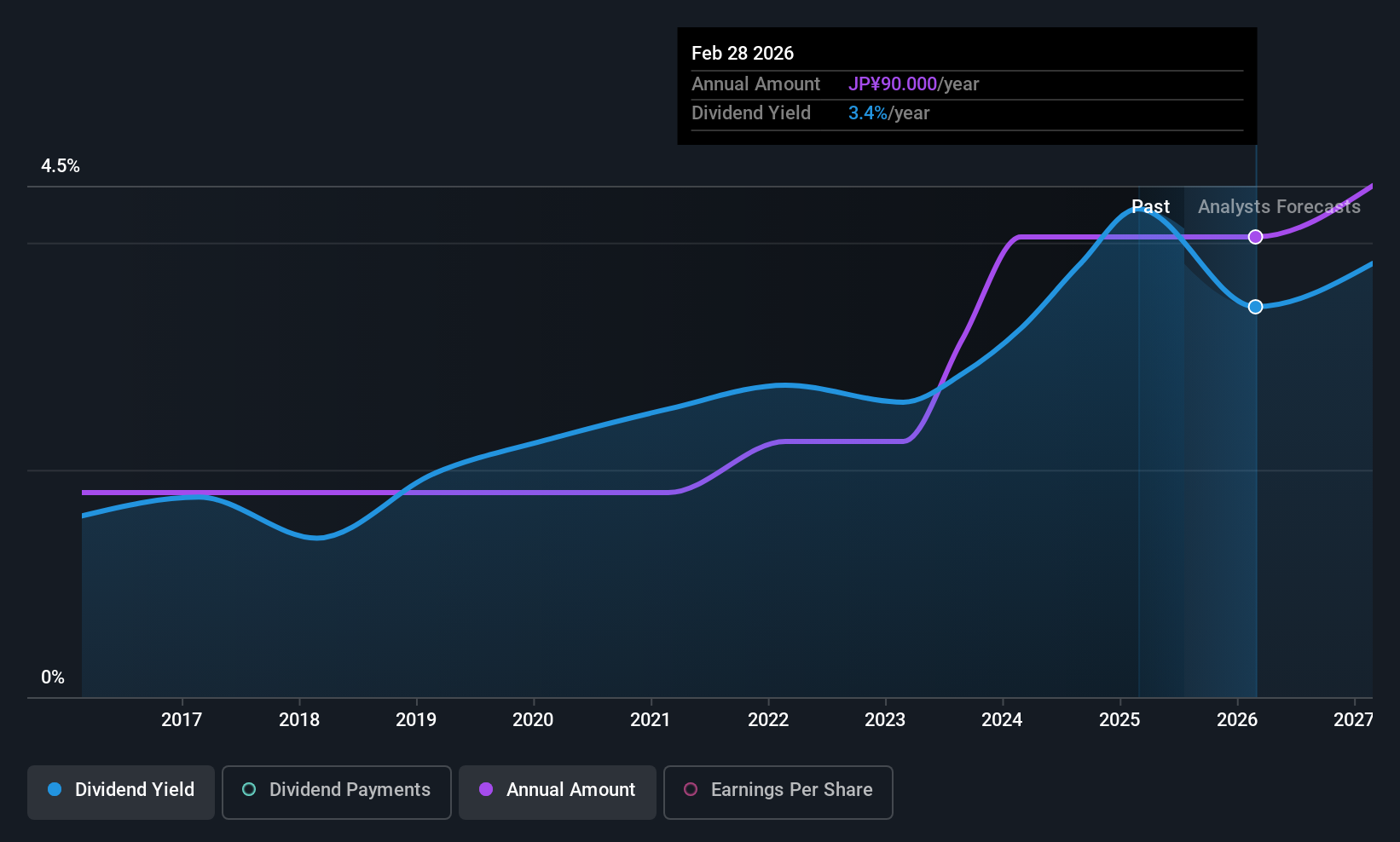

Warabeya Nichiyo Holdings (TSE:2918)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Warabeya Nichiyo Holdings Co., Ltd. manufactures and sells food products for convenience stores in Japan and internationally, with a market cap of ¥52.21 billion.

Operations: Warabeya Nichiyo Holdings Co., Ltd.'s revenue is primarily derived from its Food Products Business at ¥201.26 billion, followed by the Logistics Business at ¥18.81 billion and the Food Materials Businesses at ¥11.68 billion.

Dividend Yield: 3%

Warabeya Nichiyo Holdings maintains a stable dividend of JPY 45.00 per share, consistent with last year, but its 3.01% yield is below the top JP market payers. The payout ratio of 58.1% suggests dividends are covered by earnings, yet lack free cash flow support raises sustainability concerns. Despite lower profit margins compared to last year and large one-off items affecting results, dividends have grown steadily over the past decade without volatility.

- Dive into the specifics of Warabeya Nichiyo Holdings here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Warabeya Nichiyo Holdings is trading behind its estimated value.

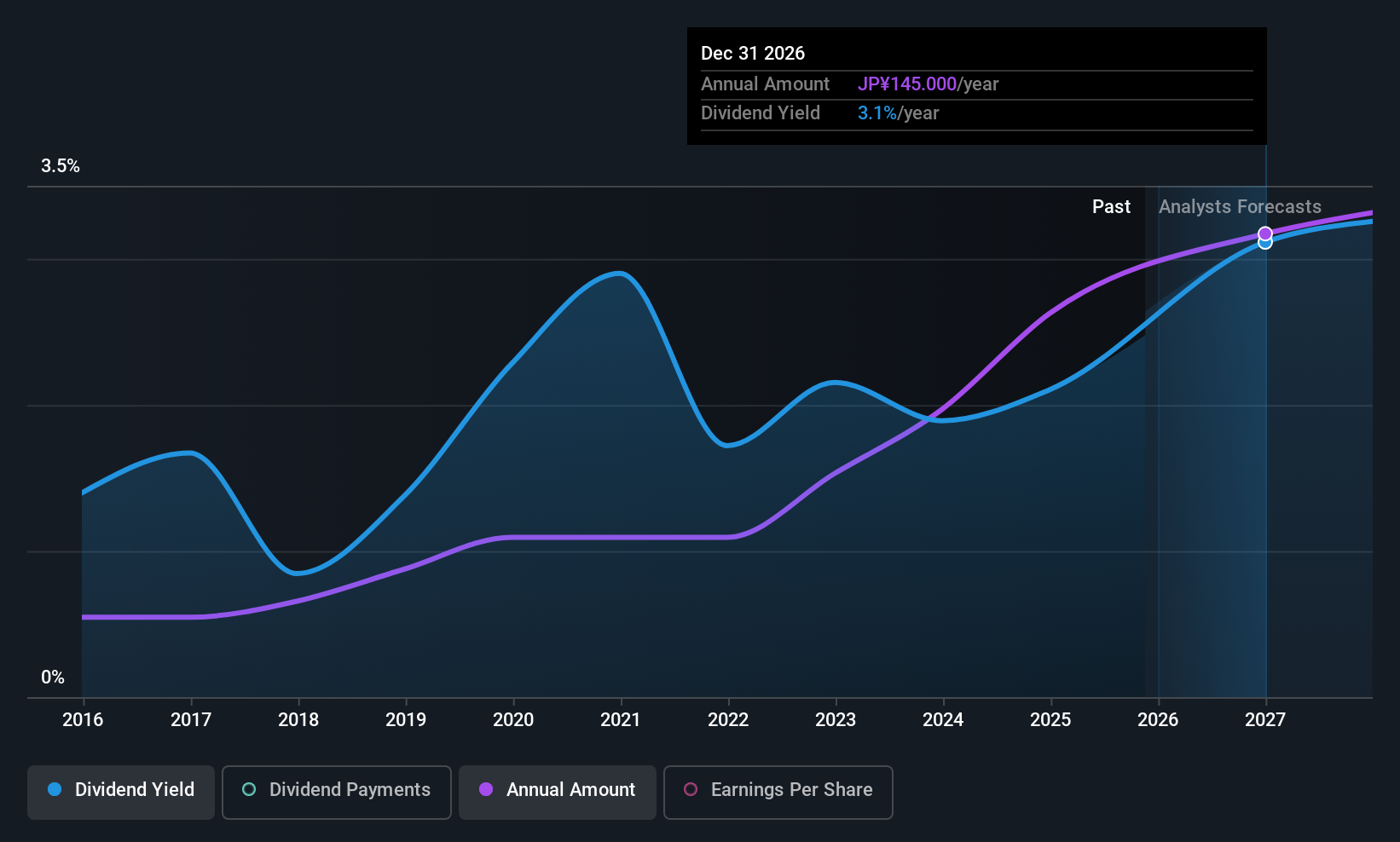

Toyo Tanso (TSE:5310)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Toyo Tanso Co., Ltd. is involved in the production and sale of carbon materials both in Japan and internationally, with a market cap of ¥91.86 billion.

Operations: Toyo Tanso Co., Ltd.'s revenue is derived from several regions, with ¥36.40 billion from Japan, ¥12.97 billion from Asia, ¥5.21 billion from Europe, and ¥4.72 billion from the United States of America.

Dividend Yield: 3.3%

Toyo Tanso's dividend yield of 3.31% is below the top quartile in Japan, and while dividends have grown steadily over the past decade, they are not supported by free cash flows. The payout ratio of 40.6% indicates coverage by earnings, but sustainability concerns remain due to lack of cash flow support. Recent guidance revisions lowered profit expectations for 2025 with net sales now at ¥48 billion and operating profit at ¥7.5 billion, impacting future dividend potential.

- Get an in-depth perspective on Toyo Tanso's performance by reading our dividend report here.

- Our expertly prepared valuation report Toyo Tanso implies its share price may be lower than expected.

Seize The Opportunity

- Click through to start exploring the rest of the 1005 Top Asian Dividend Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyo Tanso might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5310

Toyo Tanso

Produces and sells carbon materials in Japan and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives