mRNA Heart Therapy Partnership Could Be a Game Changer for AGC (TSE:5201)

Reviewed by Sasha Jovanovic

- On November 19, 2025, Repair Biotechnologies announced a partnership with AGC Biologics to develop and manufacture a novel mRNA therapy aimed at reducing atherosclerotic plaques, a leading cause of heart attack and stroke globally.

- This collaboration highlights a shift for mRNA technology, as AGC Biologics applies its expertise to chronic cardiovascular diseases beyond its previous work in infectious disease therapies.

- We’ll explore how AGC Biologics’ expansion into chronic disease mRNA therapies could reshape the company’s investment outlook and growth strategy.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

AGC Investment Narrative Recap

For those considering AGC as a long-term holding, the story hinges on the company’s ability to transition its Life Science segment from persistent losses to a true growth pillar, while containing the drag of weak product demand and price pressure in its core materials businesses. The new partnership with Repair Biotechnologies leverages AGC’s strengths in mRNA manufacturing and broadens its reach into chronic disease treatments, but it does not materially change the company’s most important near-term catalyst, which remains a demand recovery across its core glass and chemicals markets. Structural profitability in Life Science and sustainable margins elsewhere are still essential challenges.

Among recent announcements, AGC’s decision to exit underperforming U.S. biopharma operations and refocus Life Science on single-use bag (SUB) technologies stands out. This move aligns with efforts to restore profitability and supports the segment’s potential to generate new growth from 2026, even as the company seeks to diversify partnerships like the one with Repair Biotechnologies.

In contrast, ongoing concerns about structural and recurring losses in the Life Science business remain information investors should be aware of if...

Read the full narrative on AGC (it's free!)

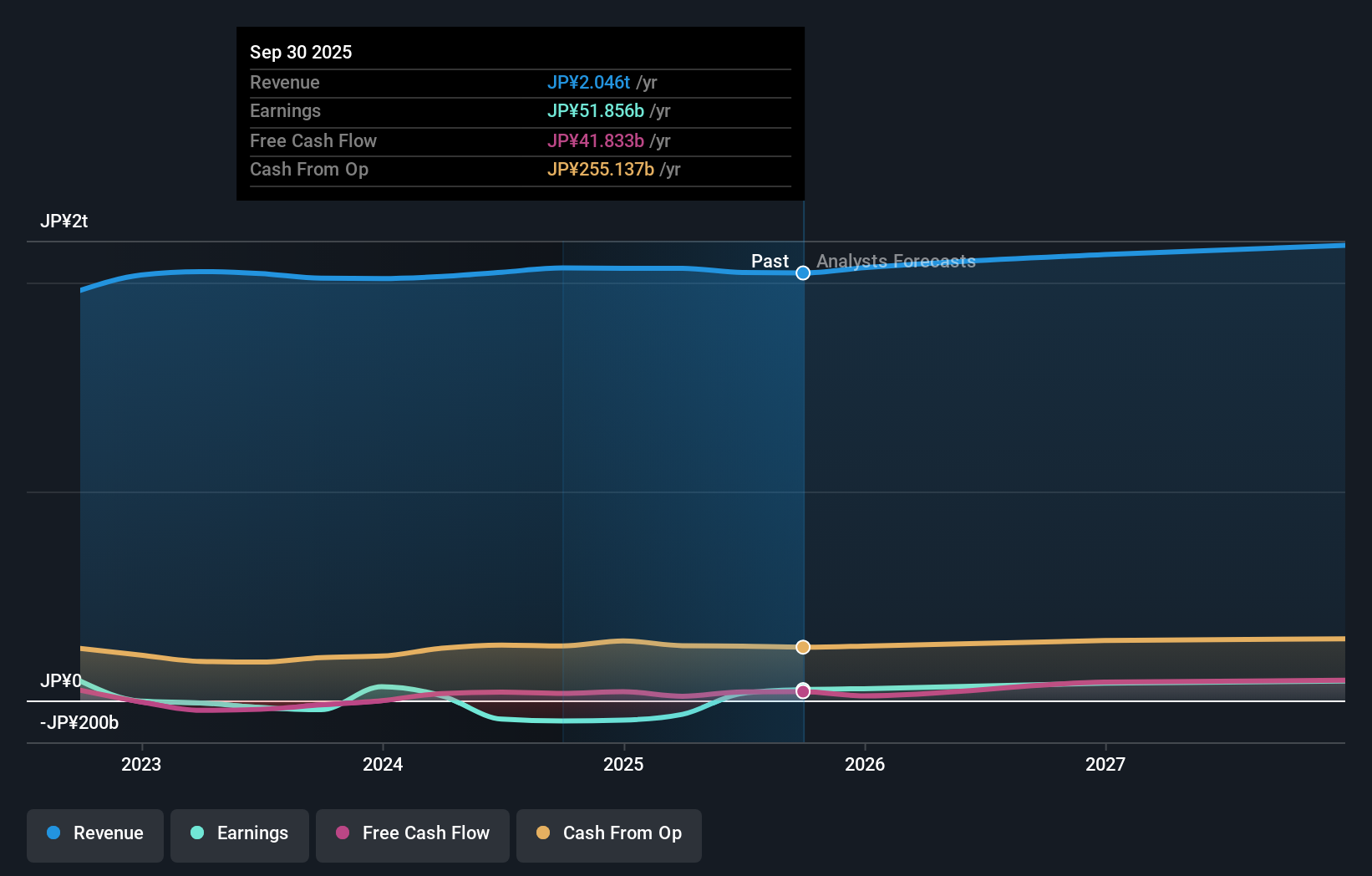

AGC's outlook forecasts revenue of ¥2208.7 billion and earnings of ¥106.1 billion by 2028. This is based on a projected annual revenue growth rate of 2.6% and an earnings increase of ¥71.7 billion from the current earnings of ¥34.4 billion.

Uncover how AGC's forecasts yield a ¥4965 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates span a wide range for AGC, from ¥4,965 to ¥10,538 per share. Amid this divergence, recurring losses and heavy reliance on early-stage biotech clients in Life Science continue to draw focus as a major performance driver, explore multiple viewpoints before reaching your own investment conclusion.

Explore 2 other fair value estimates on AGC - why the stock might be worth 5% less than the current price!

Build Your Own AGC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AGC research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AGC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AGC's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5201

AGC

Manufactures and sells architectural glass, electronics, chemicals, automotive, and ceramics worldwide.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives