AGC (TSE:5201) Valuation in Focus After New Biotech Partnership Expands mRNA Therapy Ambitions

Reviewed by Simply Wall St

AGC (TSE:5201) is in the spotlight after announcing a partnership between AGC Biologics and Repair Biotechnologies to develop a novel mRNA therapy targeting chronic cardiovascular disease. This move signals a broader application of AGC’s proven biotech capabilities.

See our latest analysis for AGC.

AGC’s recent collaboration builds on its established presence in the biotech manufacturing arena, following earlier contributions to COVID-19 vaccine production. That positive momentum has carried through the stock, with a 7.7% share price return over the past month and an impressive 18.7% total shareholder return in the past year. This reflects optimism about both short-term and long-term prospects.

If AGC’s latest move has you thinking more broadly about innovation opportunities, this could be the perfect moment to discover See the full list for free.

But with shares already up nearly 19% over the last year and trading near major analyst targets, investors are left to wonder if AGC is undervalued, or if the market is already pricing in its next wave of growth.

Most Popular Narrative: 5.3% Overvalued

With AGC’s last close at ¥5,230 and the most popular narrative setting fair value at ¥4,965, the consensus sees current prices sitting just above projected worth. There is notable tension between recent momentum and what analysts collectively price in for future performance.

Advancements in product offerings, manufacturing expansion, and strategic exits are set to improve AGC's margins, profitability, and growth capacity across core business segments. Rising global demand for energy-efficient and technologically advanced glass, driven by regulations and urbanization, provides sustained tailwinds for long-term revenue and earnings growth.

Why has the consensus landed above today's market price? The growth story fueling this valuation is powered by ambitious margin expansion and an upgraded earnings outlook. Intrigued to uncover which bold financial assumptions underpin this price target? Find out what market movers are betting on inside the full narrative.

Result: Fair Value of ¥4,965 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in demand or additional pricing pressures for AGC's core products could disrupt the optimistic outlook reflected in current valuations.

Find out about the key risks to this AGC narrative.

Another View: Market Multiples Tell a Different Story

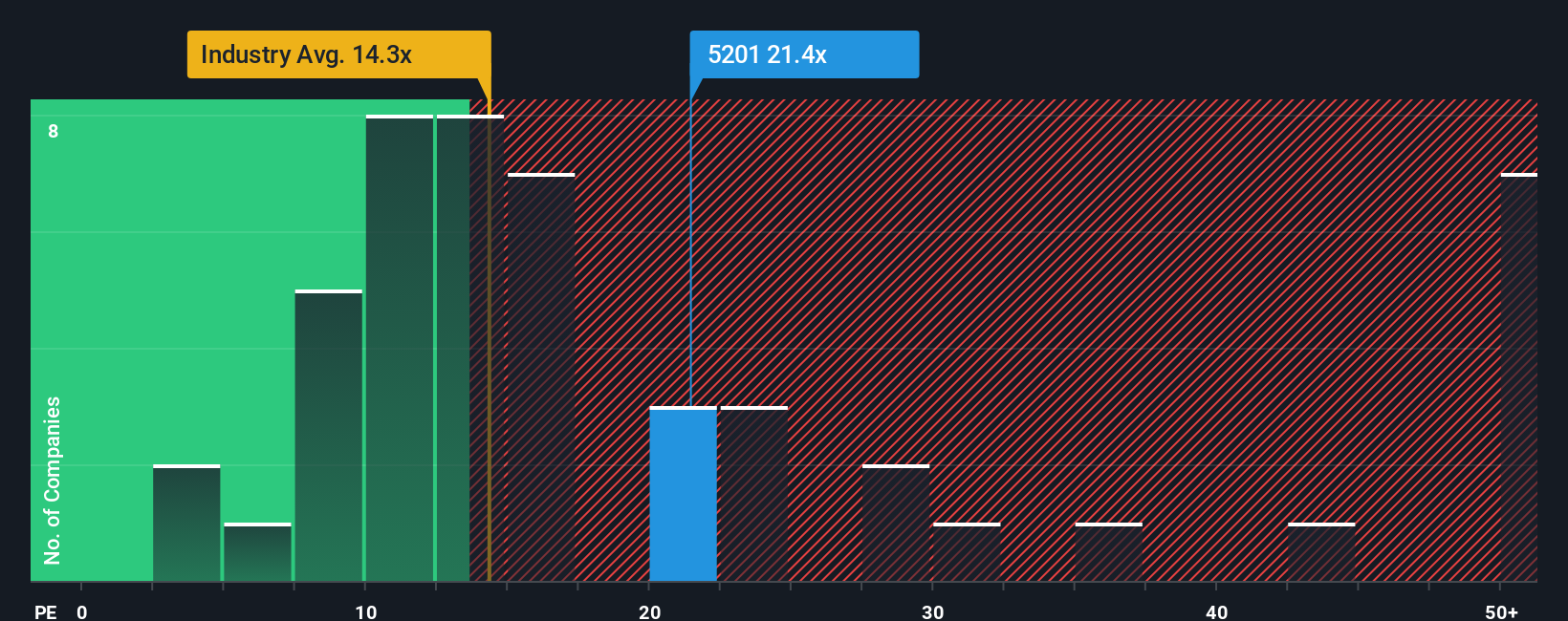

Looking at AGC's valuation through the lens of its price-to-earnings ratio, the picture shifts. AGC trades at 21.4 times earnings, which is below the average for its peers at 60.7 but above the industry average of 14.3 and under its fair ratio of 23.6. This means AGC could be moderately priced compared to direct competitors, but pricier than the broader sector. So is there real upside, or are risks being overlooked?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AGC Narrative

If you have a different perspective or prefer to dive into the details on your own, you can easily shape your own narrative in just a few minutes with Do it your way.

A great starting point for your AGC research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't limit your potential. Uncover smart opportunities by using our screeners designed for strategic thinkers. Miss out and you might overlook tomorrow's biggest gainers.

- Amplify your returns by zeroing in on stable income. Start by checking out these 16 dividend stocks with yields > 3% offering reliable yields above 3%.

- Unlock the future of healthcare breakthroughs and see which companies are driving innovation through these 30 healthcare AI stocks.

- Ride the wave of digital assets and bold technology trends by targeting growth with these 81 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5201

AGC

Manufactures and sells architectural glass, electronics, chemicals, automotive, and ceramics worldwide.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives