AGC (TSE:5201) Returns to Profit, but ¥176.1bn One-Off Loss Clouds Recovery Narrative

Reviewed by Simply Wall St

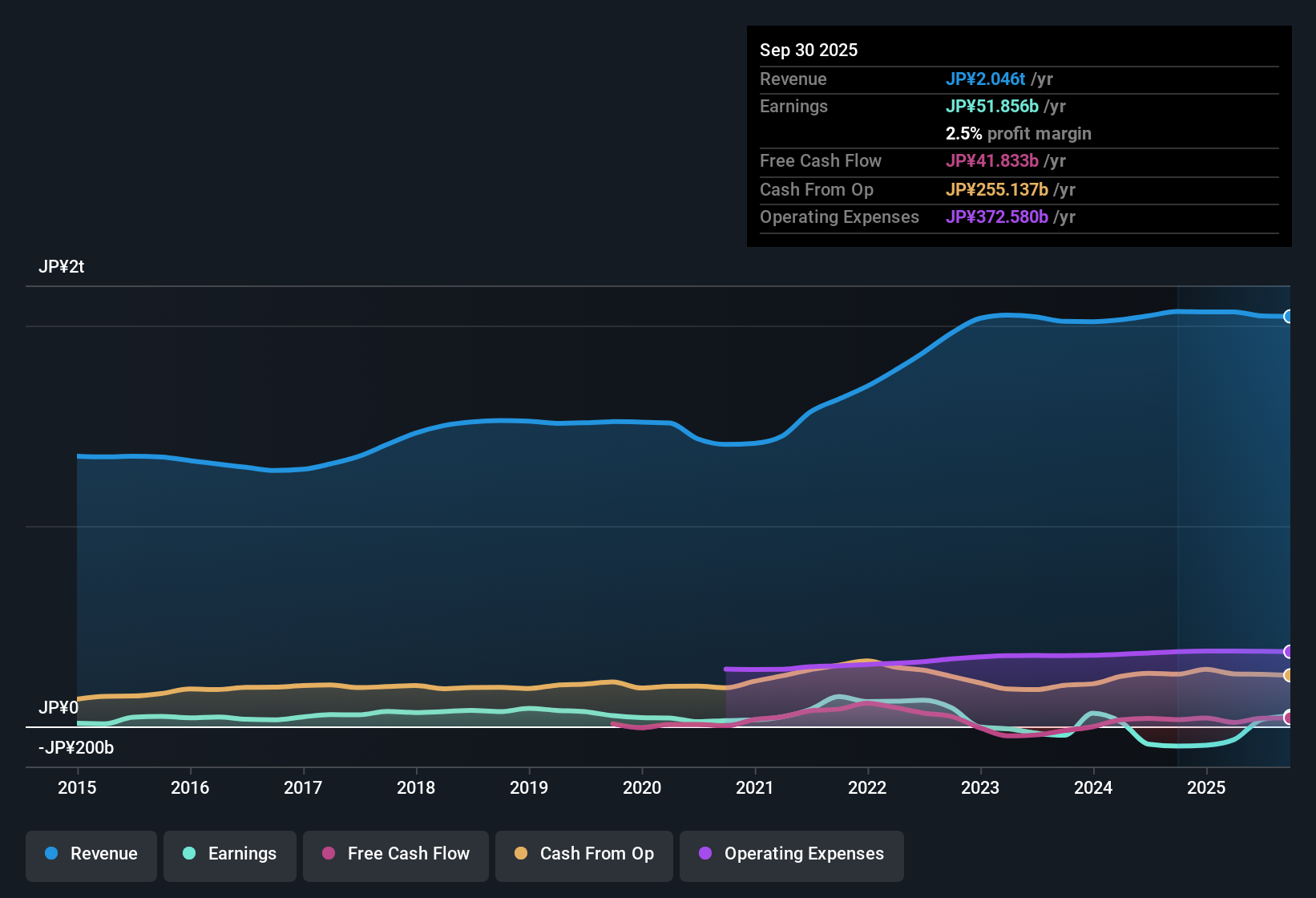

AGC (TSE:5201) has returned to profitability after years of steep earnings decline, with its earnings forecast to grow 18.9% per year, outpacing the Japanese market’s 7.9% annual growth expectation. Revenue is set to grow just 2.5% per year, behind the JP market average of 4.4%, while a significant one-off loss of ¥176.1 billion weighed on the most recent twelve-month results through September 30, 2025. Against this backdrop, investors are paying close attention to the sustainability of the company’s renewed profit trajectory and whether ongoing earnings growth can be maintained despite recent volatility.

See our full analysis for AGC.Next up, we will see how these earnings headline figures stack up against the broader narratives in the market, highlighting where consensus stands and where assumptions may be tested.

See what the community is saying about AGC

Margin Expansion Backed by Rising Profit Estimates

- Profit margins are projected to climb from 1.7% today to 4.8% in three years, paired with earnings growth to ¥106.1 billion by September 2028.

- Analysts' consensus view sees AGC's mix of product upgrades and streamlined operations driving better profitability, but high analyst disagreement adds tension:

- The most optimistic forecasts call for up to ¥116.8 billion in 2028 earnings, while the most cautious see just ¥78.3 billion. This underlines how product mix and cost discipline could tip results either way.

- Projections depend heavily on AGC executing capacity expansions and maintaining margin improvements. Disappointment in those areas could swing earnings well below the high end of market expectations.

- Given that analysts expect the number of shares outstanding to remain consistent, any improvement in profitability should directly translate to stronger per-share numbers across the forecast period.

- The balanced view emerges as AGC could benefit from demand tailwinds and product innovation, but the actual scale of profitability hinges on avoiding fresh cost overruns or delays in execution.

Want to see what both bulls and bears are saying about these profit targets? Dive into the full consensus narrative for a deeper look at the debate. 📊 Read the full AGC Consensus Narrative.

One-Off Loss Raises Questions on Earnings Quality

- The latest twelve-month results included a significant one-off loss of ¥176.1 billion, a figure that skews profitability metrics and clouds the true underlying business performance.

- Analysts' consensus view notes that although structural reforms, such as AGC's strategic exit from its loss-making U.S. biopharmaceutical division, will help strip out persistent drags on profit,

- Such large write-downs underscore risks that earnings could remain noisy if more restructuring is needed, or if fledgling segments fail to stabilize.

- While the recent return to profit signals progress, investors will be focused on the sustainability of margins after years in decline and must weigh continued high capital intensity and unpredictable charges against potential growth.

Valuation Sits in the Middle: Peer Discount but Sector Premium

- AGC trades at a 31.7x Price-to-Earnings ratio, comfortably below the peer average of 60.3x but above the wider Japanese building industry's 14.9x. This puts its shares in a middle zone on valuation.

- According to the analysts' consensus view, the current share price of ¥5130.0 is slightly above the consensus analyst price target of ¥4927.5, suggesting the stock is fairly valued versus average expectations:

- Some investors may see value thanks to AGC’s below-peer multiples, but the modest premium to sector reflects lingering operational risks and the need for sustained earnings quality.

- The lack of a steep discount means investor conviction will depend on seeing those forecasted margin gains materialize rather than being rewarded just for taking recovery risk.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for AGC on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the numbers? Put your perspective into action and shape your own narrative in minutes: Do it your way.

A great starting point for your AGC research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

AGC’s recovery depends on sustaining margin gains amid recent one-off losses and unpredictable profit swings, which leaves its earnings quality and growth path uncertain.

If you prefer steadier results, use our stable growth stocks screener (2074 results) to focus on companies consistently delivering reliable revenue and earnings through market ups and downs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5201

AGC

Manufactures and sells architectural glass, electronics, chemicals, automotive, and ceramics worldwide.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives