- Japan

- /

- Industrials

- /

- TSE:4204

Does Sekisui Chemical's Buyback and Dividend Hike Offset Its Lower Earnings Outlook (TSE:4204)?

Reviewed by Sasha Jovanovic

- Sekisui Chemical Co., Ltd. recently announced a share repurchase program of 10,000,000 shares valued at ¥30,000 million, while also raising its dividend to ¥40.00 per share for the second quarter of fiscal 2026 and revising its full-year earnings guidance downwards.

- This combination of increased capital returns through buybacks and dividends alongside a more cautious earnings outlook highlights shifting priorities and challenges in the company's current business environment.

- We'll now explore how the newly announced buyback program could affect Sekisui Chemical's future earnings trajectory and investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Sekisui Chemical Investment Narrative Recap

To be a Sekisui Chemical shareholder today means believing the company can deliver steady growth amid challenging market conditions, particularly given its exposure to Japan’s slow housing sector and global currency fluctuations. The recent buyback and dividend increase represent a boost for capital returns, but the lowered full-year earnings guidance keeps the focus on near-term earnings performance, a key catalyst, while persistent weakness in core international and medical segments remains a material risk.

Among Sekisui Chemical's recent moves, the board’s authorization of a 10,000,000-share buyback plan is the most relevant to these developments. While this may enhance capital efficiency and support the share price, its impact on the core risks, particularly the ongoing pressure in the medical business and struggles to grow outside Japan, remains to be seen.

In contrast, it is important for investors to be aware of the company’s dependence on the Japanese housing market and how persistent weakness there could...

Read the full narrative on Sekisui Chemical (it's free!)

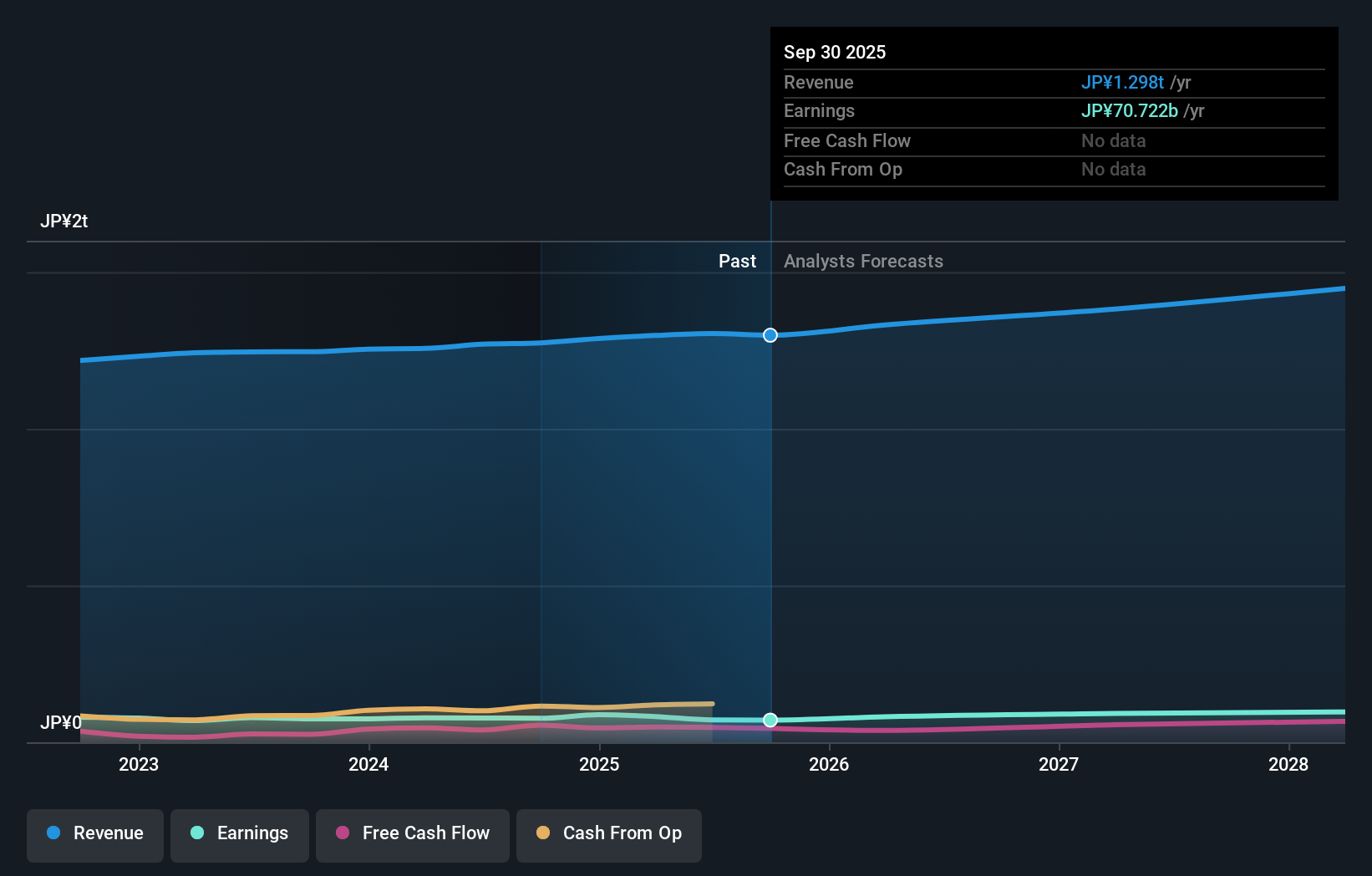

Sekisui Chemical's narrative projects ¥1,451.6 billion revenue and ¥103.4 billion earnings by 2028. This requires 3.6% yearly revenue growth and a ¥32.0 billion earnings increase from ¥71.4 billion today.

Uncover how Sekisui Chemical's forecasts yield a ¥2910 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Community fair value estimates from Simply Wall St members show a single view of ¥3,732 per share, suggesting consistency but limited breadth of opinion. As international expansion challenges persist, you may want to compare these perspectives and seek out alternative forecasts.

Explore another fair value estimate on Sekisui Chemical - why the stock might be worth just ¥3732!

Build Your Own Sekisui Chemical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sekisui Chemical research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sekisui Chemical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sekisui Chemical's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4204

Sekisui Chemical

Engages in the housing, urban infrastructure and environmental products, high performance plastics, and medical businesses in Japan, Europe, Asia, and the Americas.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives