- Japan

- /

- Trade Distributors

- /

- TSE:3157

GEOLIVE Group (TSE:3157) Margin Decline Challenges Dividend Sustainability Narrative

Reviewed by Simply Wall St

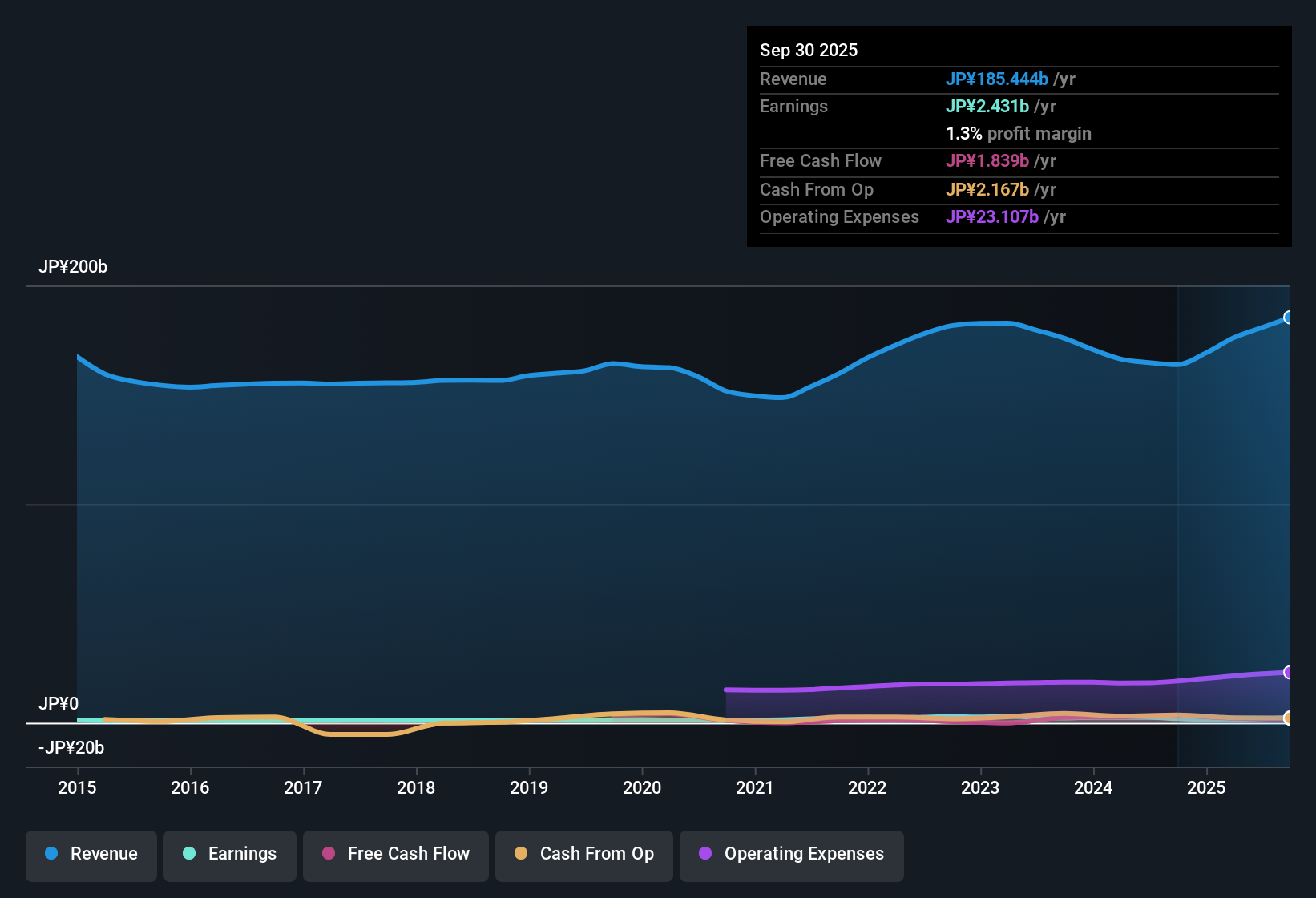

GEOLIVE Group (TSE:3157) reported a net profit margin of 1%, down from 1.5% last year, indicating a drop in profitability. Over the past five years, earnings have grown at an average of 3.6% per year, with the company recognized for high-quality earnings. Currently, shares are trading above fair value at ¥1417. The Price-To-Earnings ratio of 10.6x sits below the peer average but above the broader industry. Investors may focus on the recent margin compression and signals of pressure on the company’s ability to sustain dividends, even as multi-year earnings trends remain positive.

See our full analysis for GEOLIVE Group.Up next, we will see how these results measure up against the widely held market narratives, highlighting where consensus matches reality and where new questions might arise.

Curious how numbers become stories that shape markets? Explore Community Narratives

High-Quality Profits but Compressed Margins

- GEOLIVE Group has maintained high-quality earnings, with a 3.6% average annual growth rate over the past five years, but net profit margin decreased to 1% this year from 1.5% last year.

- The prevailing narrative highlights tension between the company’s positive multi-year earnings history and the recent deterioration in profitability.

- While a consistent growth trend would typically support a bullish outlook, the sudden margin compression marks a challenging shift, making it harder for bullish investors to maintain their optimism without seeing stabilization soon.

- Recent negative earnings growth, flagged in the EDGAR summary, casts doubt on how durable those quality profits may be if margin pressure persists.

Dividend Sustainability Faces Pressure

- The latest results signal risks to dividend sustainability, as net margin downturns and negative indicators for dividend continuation have surfaced this period.

- The prevailing market view emphasizes that even though the company has a record of profitable years, investors must monitor whether future cash flows remain robust enough to support regular dividend payments.

- The stress on profit margins amplifies concerns, since dividend cuts often follow prolonged periods of squeezed earnings.

- For income-focused investors, the flagged risks make the next cycles critical in determining if the payout can be retained at historical levels.

Trading Above DCF Fair Value Despite Peer Discount

- Shares currently trade at ¥1417, just above the DCF fair value of ¥1411.22; the Price-To-Earnings ratio of 10.6x is lower than the peer average (11.1x) but higher than the industry average (10.1x).

- The prevailing market view notes that while the relative value compared to peers appears attractive, the slight premium to the fair value suggests room for market skepticism.

- Bulls may argue the stock’s discount versus peer P/E offers upside, but the market is demanding evidence GEOLIVE can regain its previously higher profitability before justifying a lasting premium.

- The recent move above DCF fair value also limits the margin of safety, making good results or guidance key if shares are to keep outperforming.

Curious how numbers become stories that shape markets? Curious how numbers become stories that shape markets? Explore Community Narratives

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on GEOLIVE Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

GEOLIVE Group’s margin compression and mounting pressure on dividends highlight growing uncertainty around its ability to sustain robust shareholder payouts.

If income reliability matters to you, consider these 1987 dividend stocks with yields > 3% to find alternatives with more consistent dividend yields and stronger foundations for regular returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3157

GEOLIVE Group

Through its subsidiaries, sells building materials in Japan.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives