- Japan

- /

- Trade Distributors

- /

- TSE:3064

How Investors May Respond To MonotaRO (TSE:3064) Strong October Sales Growth and Revenue Expansion

Reviewed by Sasha Jovanovic

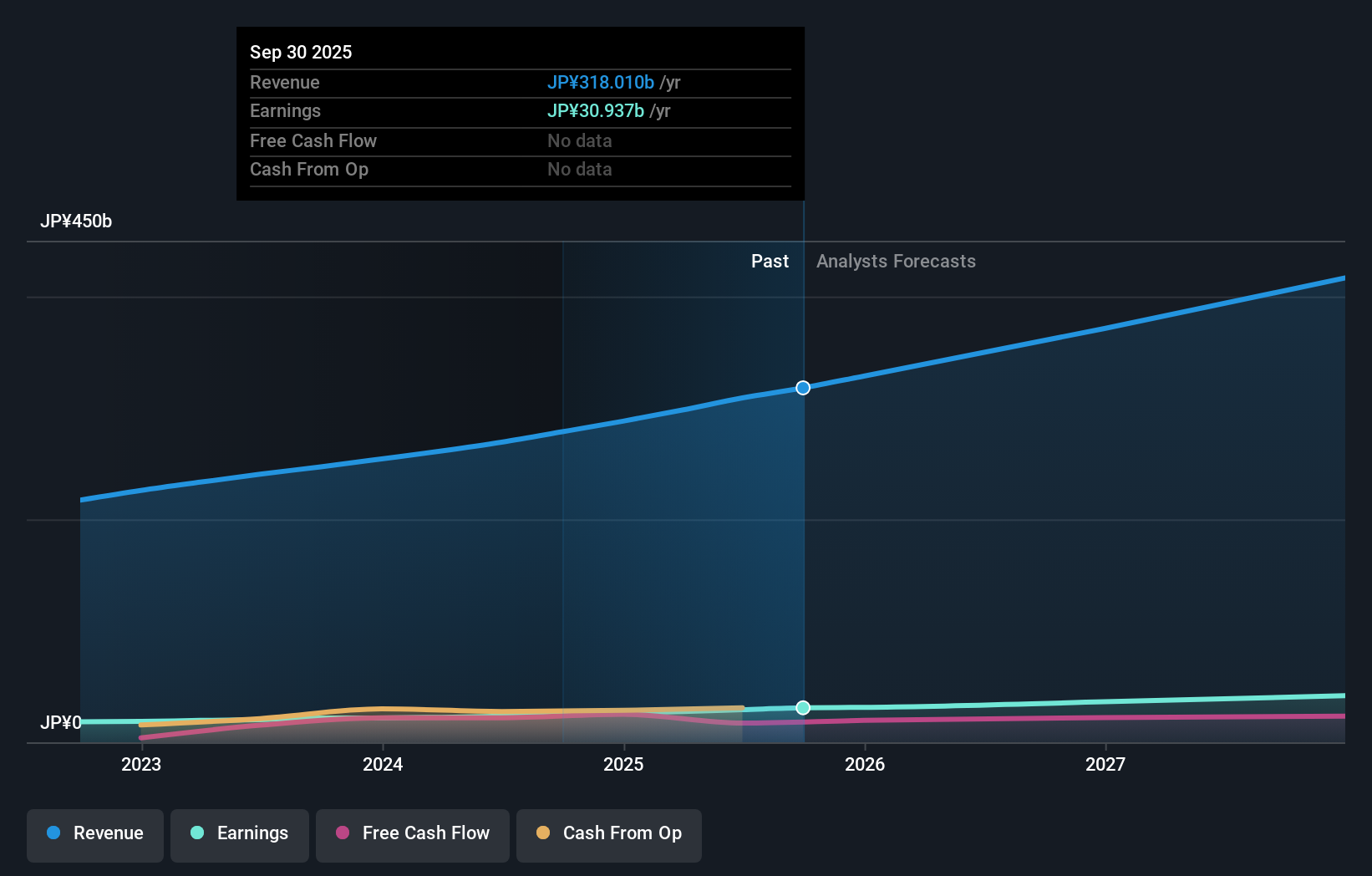

- MonotaRO Co., Ltd. reported non-consolidated sales results for October 2025, with sales reaching ¥29,423 million compared to ¥25,354 million in the same month last year.

- This significant year-over-year sales increase offers insight into sustained demand and the company's ongoing ability to expand its revenue base.

- We'll explore how the substantial October sales growth informs MonotaRO's investment narrative and potential trajectory for future performance.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is MonotaRO's Investment Narrative?

To believe in MonotaRO as a shareholder, you have to trust in its ability to convert Japan’s industrial supply shift to online into ongoing revenue and margin strength, especially as strong sales like October’s jump to ¥29,423 million offer evidence of durable demand. This latest sales update could become a key near-term catalyst, particularly since previous consensus didn’t reflect this surprise momentum. Short-term, the stock’s value case is complicated by a high price-to-earnings ratio versus peers, and recent volatility means positive news may not immediately resolve investor caution. While management has a seasoned track record and shareholder returns through dividends and buybacks, recent weak share performance and broader sector underperformance highlight competitive threats and the risk of sales growth decelerating from this peak. For now, the October sales result injects some optimism but doesn’t erase valuation and competition concerns. But even with this sales bump, the company’s valuation premium is front of mind for investors.

Despite retreating, MonotaRO's shares might still be trading 18% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore another fair value estimate on MonotaRO - why the stock might be worth as much as 22% more than the current price!

Build Your Own MonotaRO Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MonotaRO research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MonotaRO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MonotaRO's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3064

MonotaRO

Operates an online MRO products store for factories in Japan and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives