- China

- /

- Auto Components

- /

- SHSE:600741

HUAYU Automotive Systems And 2 High Quality Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a busy earnings season and mixed economic signals, investors are keenly observing the performance of major indices, which have shown some volatility amidst cautious corporate earnings reports and unexpected labor market data. In this environment, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those looking to balance growth with steady returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.08% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.52% | ★★★★★★ |

| Globeride (TSE:7990) | 4.04% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.16% | ★★★★★★ |

| Innotech (TSE:9880) | 4.75% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.11% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.55% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.94% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.44% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.00% | ★★★★★★ |

Click here to see the full list of 1932 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

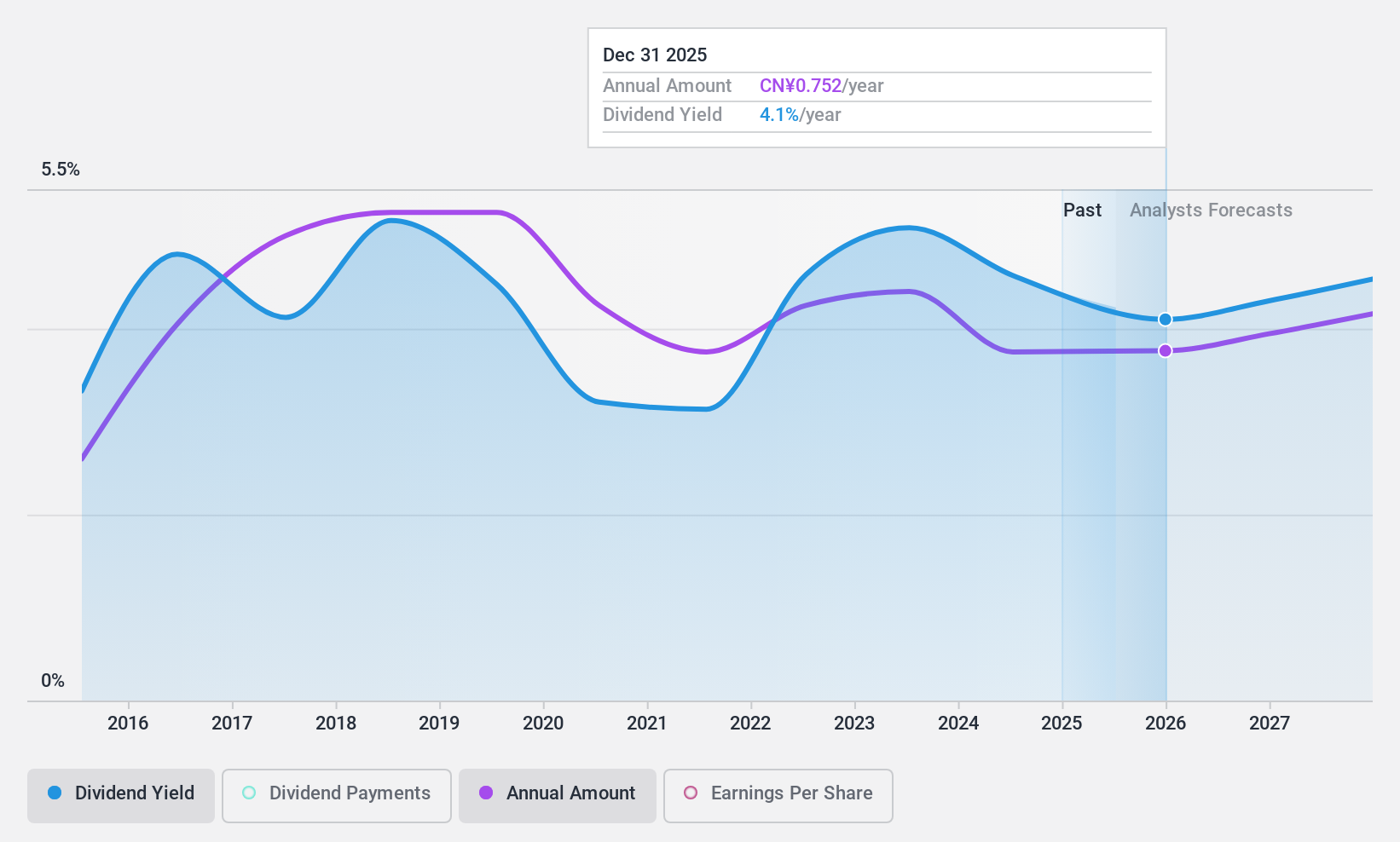

HUAYU Automotive Systems (SHSE:600741)

Simply Wall St Dividend Rating: ★★★★★★

Overview: HUAYU Automotive Systems Company Limited researches, develops, manufactures, and sells automotive parts globally with a market cap of CN¥51.07 billion.

Operations: HUAYU Automotive Systems Company Limited generates its revenue through the research, development, manufacturing, and sale of automotive parts worldwide.

Dividend Yield: 4.6%

HUAYU Automotive Systems offers a stable and attractive dividend yield of 4.63%, placing it in the top 25% of dividend payers in the Chinese market. Its dividends are well-covered by earnings, with a payout ratio of 34%, and cash flows, with a cash payout ratio of 44.1%. Despite recent slight declines in sales and net income, its dividends have grown consistently over the past decade without volatility, suggesting reliability for income-focused investors.

- Click to explore a detailed breakdown of our findings in HUAYU Automotive Systems' dividend report.

- The valuation report we've compiled suggests that HUAYU Automotive Systems' current price could be quite moderate.

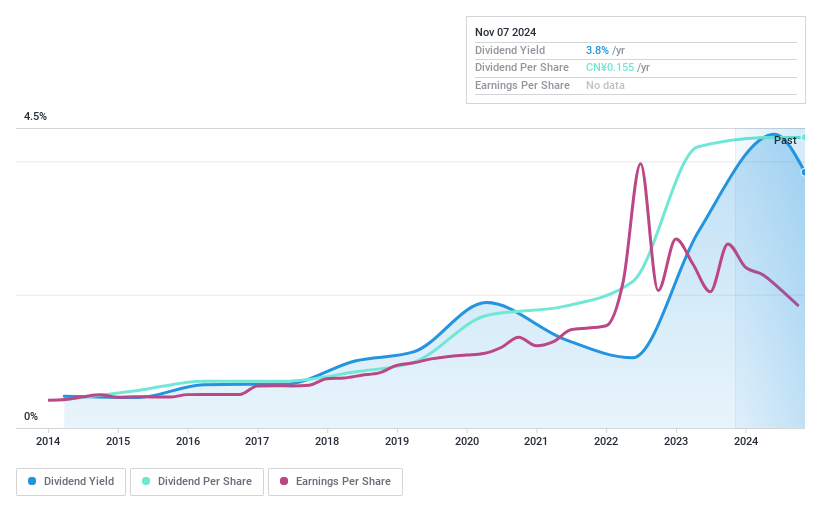

Guangdong Construction Engineering Group (SZSE:002060)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Guangdong Construction Engineering Group Co., Ltd. operates in the construction industry and has a market cap of CN¥15.17 billion.

Operations: Unfortunately, the provided Business operations text does not include specific revenue segment information for Guangdong Construction Engineering Group Co., Ltd. If you have more detailed data or another source of information regarding their revenue segments, I would be happy to help summarize it for you.

Dividend Yield: 3.8%

Guangdong Construction Engineering Group's dividend yield of 3.84% ranks in the top 25% among Chinese dividend payers, though it lacks coverage by free cash flows. Despite stable dividends over the past decade with a low payout ratio of 47.3%, recent earnings declines—sales fell to CNY 41.21 billion and net income to CNY 644.4 million—raise concerns about sustainability, as operating cash flow does not adequately cover debt obligations.

- Click here to discover the nuances of Guangdong Construction Engineering Group with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Guangdong Construction Engineering Group is trading behind its estimated value.

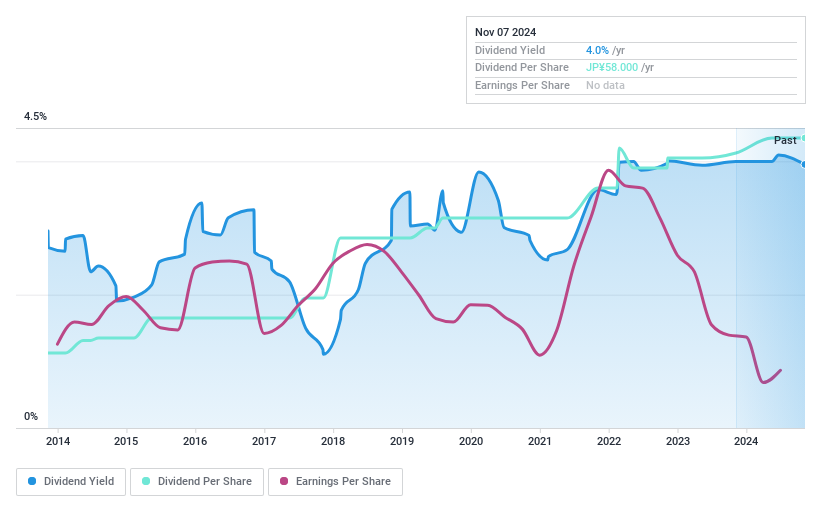

ALCONIX (TSE:3036)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ALCONIX Corporation is involved in the import, export, and sale of non-ferrous metal products both in Japan and internationally, with a market cap of ¥44.25 billion.

Operations: ALCONIX Corporation's revenue segments include Manufacturing - Metal Processing at ¥32.40 billion, Trading - Aluminum and Copper Products at ¥74.07 billion, Manufacturing - Equipment and Materials at ¥43.70 billion, and Trading - Electronic and Advanced Materials at ¥32.83 billion.

Dividend Yield: 4%

Alconix offers a dividend yield of 3.95%, placing it in the top 25% of Japanese dividend payers. Despite trading at a significant discount to its estimated fair value, the company's dividends have been volatile over the past decade. While current payouts are covered by earnings and free cash flows, with an earnings payout ratio of 81.7% and a low cash payout ratio of 14.9%, profit margins have decreased from last year, which may impact future sustainability.

- Click here and access our complete dividend analysis report to understand the dynamics of ALCONIX.

- Upon reviewing our latest valuation report, ALCONIX's share price might be too optimistic.

Key Takeaways

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1929 more companies for you to explore.Click here to unveil our expertly curated list of 1932 Top Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HUAYU Automotive Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600741

HUAYU Automotive Systems

Researches and develops, manufactures, and sells automotive parts worldwide.

6 star dividend payer and undervalued.