- Japan

- /

- Trade Distributors

- /

- TSE:2768

What Sojitz (TSE:2768)'s Latin America Healthcare Expansion Means For Shareholders

Reviewed by Sasha Jovanovic

- On November 20, 2025, Auna S.A. announced it had signed a Memorandum of Understanding with Sojitz Corporation of America to pursue joint business opportunities in Latin America's healthcare sector, starting with a planned US$500 million expansion in Mexico over the next three to five years.

- This collaboration seeks to combine Auna's healthcare expertise and Sojitz's investment capability to develop modern, scalable healthcare infrastructure in one of the fastest-growing markets in the region.

- We'll take a look at how Sojitz's move into Latin American healthcare could reshape investor views on its international growth strategy.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Sojitz Investment Narrative Recap

Sojitz's broad appeal lies in its efforts to diversify beyond cyclical commodities, aiming to improve earnings stability and long-term growth. The alliance with Auna in Latin American healthcare is a step toward international expansion, but in the short term, it is unlikely to offset Sojitz’s main exposure to commodity price swings or meaningfully shift the significant risk of earnings volatility tied to commodity markets and investing cycles.

The most immediately relevant prior announcement is Sojitz’s partnership with Genomatica to commercialize plant-based nylon-6, which aligns with the company’s push into new, high-growth business areas. Initiatives like these support the ongoing catalyst of entering rapidly expanding industries, potentially balancing out Sojitz’s heavy commodity exposure while adding future revenue streams.

However, while these moves may broaden Sojitz's growth avenues, investors should also be aware that, in contrast, the company’s rising SG&A expenses from new business ventures could...

Read the full narrative on Sojitz (it's free!)

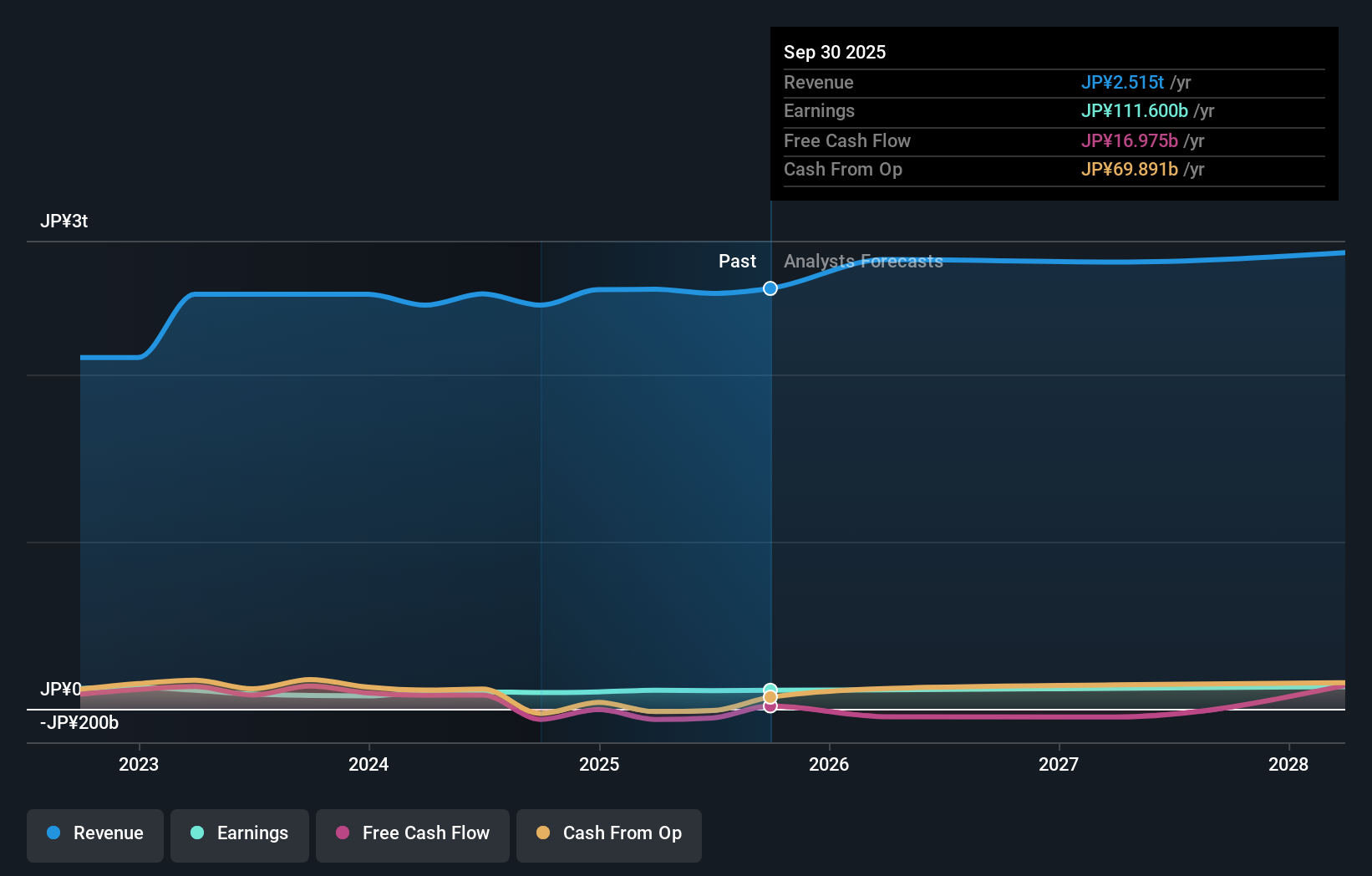

Sojitz's narrative projects ¥2,765.9 billion in revenue and ¥131.2 billion in earnings by 2028. This requires 3.6% yearly revenue growth and a ¥22.5 billion earnings increase from the current ¥108.7 billion.

Uncover how Sojitz's forecasts yield a ¥4397 fair value, in line with its current price.

Exploring Other Perspectives

Two individual fair value estimates from the Simply Wall St Community span a wide range, from ¥2,963 to ¥4,397 per share. This variety stands in contrast to the continuing risk of commodity-driven earnings volatility, showing how market participants can weigh Sojitz's diversification moves very differently.

Explore 2 other fair value estimates on Sojitz - why the stock might be worth as much as ¥4397!

Build Your Own Sojitz Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sojitz research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sojitz research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sojitz's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2768

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives