- Japan

- /

- Trade Distributors

- /

- TSE:2768

Sojitz (TSE:2768) Dividend Increase Puts Spotlight on Valuation and Growth Prospects

Reviewed by Simply Wall St

Sojitz (TSE:2768) just revealed it will raise its second quarter dividend to JPY 82.50 per share for the year ending March 2026, up from last year’s JPY 75.00. The payout, set for December 1, highlights management’s confidence in the company’s current trajectory.

See our latest analysis for Sojitz.

After a stellar year for shareholders, Sojitz's decision to boost its dividend only underscores the momentum building behind the stock. The share price has soared nearly 31% so far this year, while the total shareholder return over the past year stands at an impressive 36%. This run follows a strong stretch: Sojitz has delivered a remarkable 94% total return over three years and more than quadrupled investors’ money over five years, reflecting growing confidence and robust business fundamentals.

If Sojitz’s strong performance has you thinking broader, now could be the perfect time to discover fast growing stocks with high insider ownership

Yet with Sojitz rallying strongly this year and trading just 4% below analyst price targets, investors must ask themselves whether there is room for further upside or if the market has already priced in all the company’s future growth.

Most Popular Narrative: 4.1% Undervalued

Sojitz's fair value, based on the most popular narrative, sits slightly above its recent closing price. This invites a closer look at what could continue to drive the valuation higher.

Expansion into high-growth sectors such as chemicals (for example, full acquisition of NIPPON A&L for lithium-ion battery materials and resins) and value chain moves into manufacturing are likely to strengthen Sojitz's presence in rapidly growing industries tied to global electrification, increasing potential revenue and net margins over time.

What is behind this premium? The fair value relies on a framework for earnings growth, higher margins, and a profit multiple usually reserved for the industry’s top performers. Want to know what projections and financial moves the narrative is relying on? The key to Sojitz’s story is right inside this valuation.

Result: Fair Value of ¥4,396.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent volatility in commodity markets or rising costs from new ventures could present challenges to Sojitz's growth story if trends shift unexpectedly.

Find out about the key risks to this Sojitz narrative.

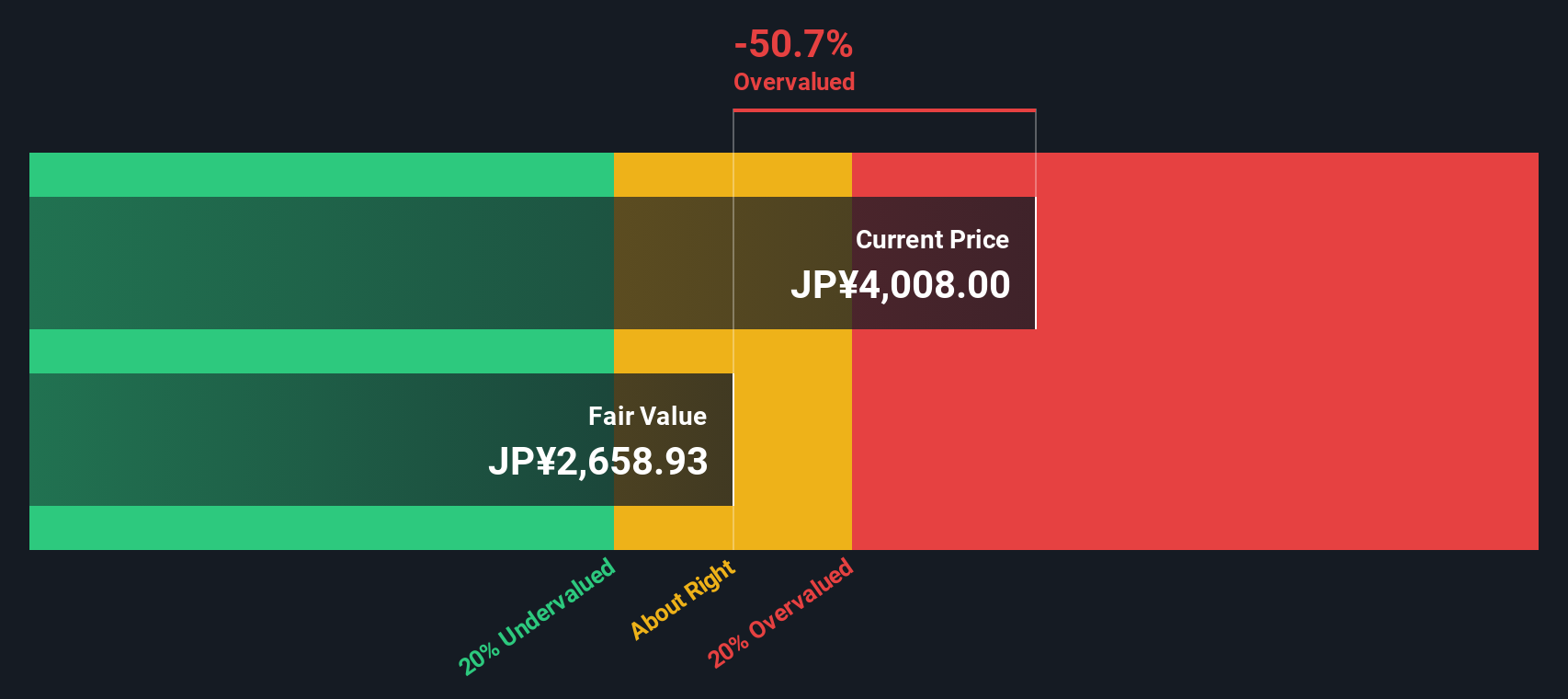

Another View: SWS DCF Model Suggests a Different Story

While the popular narrative points to Sojitz being undervalued, our DCF model tells a less optimistic tale. According to this method, Sojitz is actually trading above its estimated fair value. This could mean the market is factoring in more optimistic assumptions than fundamentals support. Is the recent optimism fully justified, or is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sojitz for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 843 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sojitz Narrative

If you are eager to do your own digging or see things differently, it's easy to build a narrative from the ground up in just a few minutes. So why not Do it your way?

A great starting point for your Sojitz research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want to get ahead of the curve, now is the time to check out other forward-looking investment opportunities targeted by Simply Wall Street’s powerful Screener.

- Unearth unusually strong dividends by reviewing these 20 dividend stocks with yields > 3%. This puts stable, high-yield income plays within your reach before they’re widely noticed.

- Catalyze your portfolio’s potential by targeting innovation and dramatic growth with these 26 AI penny stocks to see which companies are leading in artificial intelligence.

- Safeguard your capital and maximize value by pinpointing undervalued market gems through these 843 undervalued stocks based on cash flows. This ensures you seize opportunities other investors might miss.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2768

Sojitz

Operates as a general trading company that engages in various business activities worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives