- Japan

- /

- Construction

- /

- TSE:1980

A Look at Dai-Dan (TSE:1980) Valuation After Upgraded Outlook, Share Split, and Dividend Hike

Reviewed by Simply Wall St

Dai-Dan (TSE:1980) caught investor attention after revealing an upgraded outlook for its full fiscal year, along with plans for a 3-for-1 share split and substantial dividend increases. These moves come amid momentum in orders and project profitability.

See our latest analysis for Dai-Dan.

Dai-Dan’s recent flurry of upgrades and shareholder-friendly moves has fueled strong momentum, with the stock's share price surging 75% year-to-date. Even more impressive, Dai-Dan has delivered a remarkable 97% total shareholder return over the past year. This underscores real wealth gains for investors and highlights growing optimism surrounding its outlook and strategy.

If these robust gains caught your attention, it could be the perfect moment to broaden your investment radar and discover fast growing stocks with high insider ownership

With performance booming and management taking bold actions, the question for investors now is whether Dai-Dan's strong run has left room for further upside or if the market has already priced in the company's future growth story.

Price-to-Earnings of 11.8x: Is it justified?

Dai-Dan is currently trading at a price-to-earnings (P/E) ratio of 11.8x, which suggests it may be attractively valued compared to peer companies and its own fair value benchmarks.

The price-to-earnings ratio reflects how much investors are willing to pay today for a yen of the company’s earnings. In capital goods and construction, this multiple often signals how the market values the firm’s growth prospects and earnings quality.

At 11.8x, Dai-Dan’s P/E is below both its peer average (14.2x) and its estimated fair P/E (14.2x). This suggests that the market could be undervaluing the company’s strong recent profit expansion and above-industry returns, leaving potential upside if sentiment shifts. If the market moves closer to the fair multiple, Dai-Dan’s shares could rerate higher.

Explore the SWS fair ratio for Dai-Dan

Result: Price-to-Earnings of 11.8x (UNDERVALUED)

However, softer annual revenue growth and a recent dip in net income highlight that future financial performance is not assured.

Find out about the key risks to this Dai-Dan narrative.

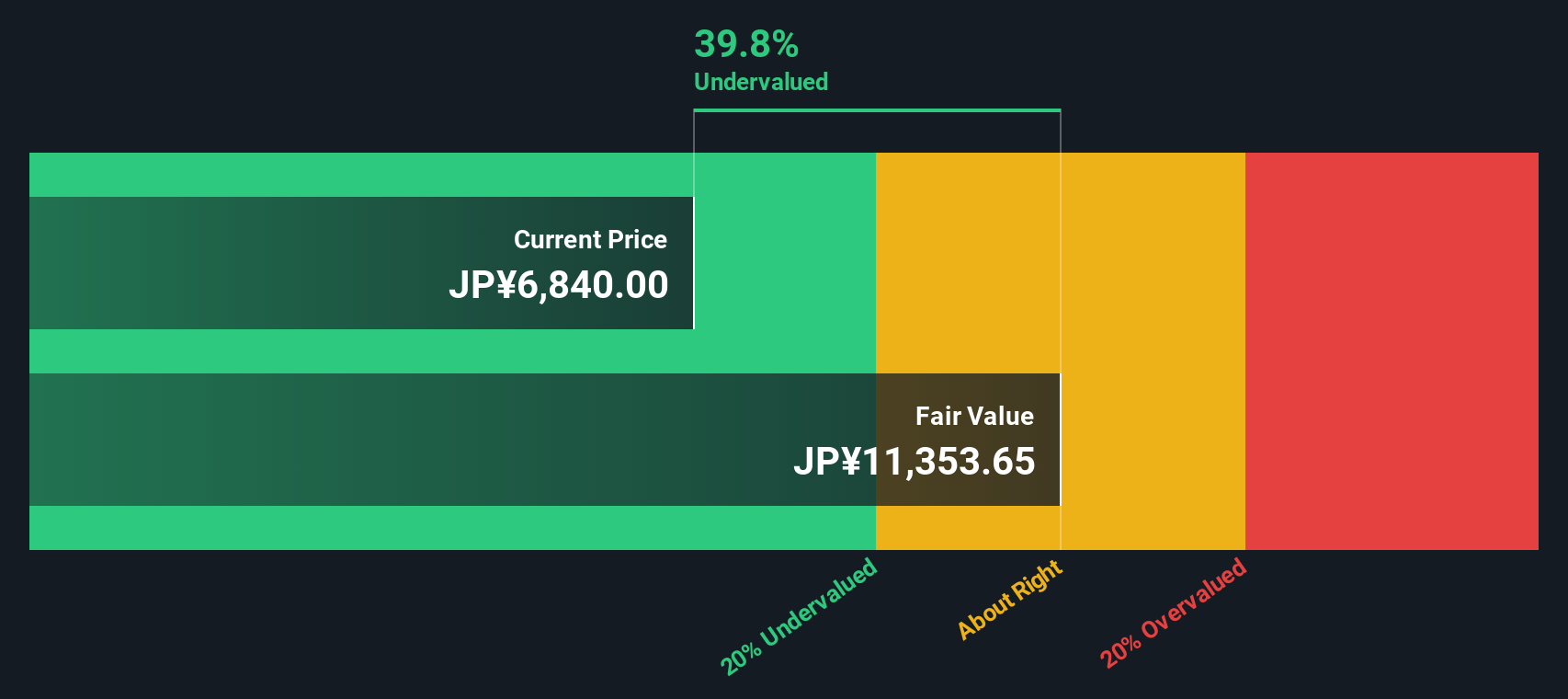

Another View: Discounted Cash Flow Tells a Different Story

While Dai-Dan appears undervalued on earnings multiples, our DCF model suggests there could be even more value left on the table. The shares are trading roughly 41% below what our DCF model estimates as fair value, raising the question whether the market's caution is warranted or an opportunity in disguise.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dai-Dan for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 895 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dai-Dan Narrative

If you want to dig a little deeper or come to your own conclusions, you can quickly shape your personal investment perspective using our simple tools such as Do it your way.

A great starting point for your Dai-Dan research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize your advantage by tracking other exciting opportunities. Simply Wall Street's powerful screeners help you pinpoint stocks that match your unique goals and strategies.

- Jump on emerging financial trends by reviewing these 895 undervalued stocks based on cash flows, which show the potential for significant upside based on strong cash flow fundamentals.

- Unlock steady income potential and stability with these 15 dividend stocks with yields > 3%, featuring companies delivering yields above 3% for investors seeking solid payouts.

- Ride the wave of innovation by scouting these 27 AI penny stocks and spot businesses transforming industries through artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1980

Dai-Dan

Engages in the design, supervision, and construction of electrical, air conditioning, water hygiene, and firefighting facilities works and machinery in Japan.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives