- Japan

- /

- Construction

- /

- TSE:1967

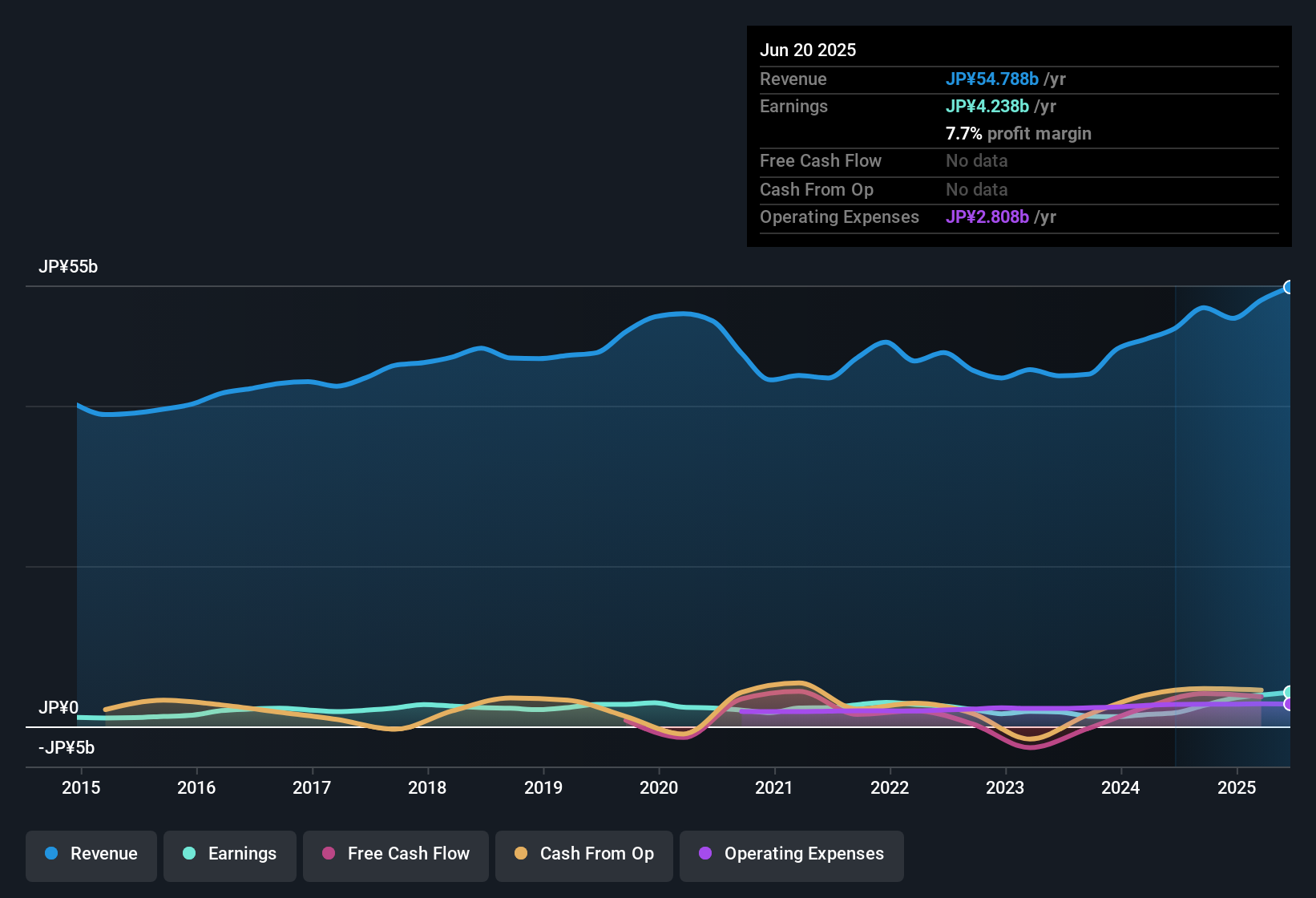

Yamato (TSE:1967) Net Margins Surge to 7.7%, Reinforcing Profit Growth Narrative

Reviewed by Simply Wall St

Yamato (TSE:1967) delivered headline earnings growth of 149.4% over the past year, building on an already impressive 7.5% annual pace over the past five years. The company’s net profit margin rose sharply to 7.7%, up from 3.4% a year ago, with high-quality earnings driving results. Investors may view these numbers favorably given the track record of strong profit growth, a value-oriented P/E ratio of 11.1x compared to an industry average of 12.4x, and a market price of ¥1,899 sitting below the estimated fair value of ¥2,367.94. With no major risks noted, this blend of momentum and value could shape investor sentiment following the results.

See our full analysis for Yamato.Next, we will see how Yamato’s standout performance measures up to the expectations and narratives that shape investor opinion. The real test is whether these results strengthen or challenge the market’s prevailing story.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Jumps Drive Value Appeal

- Yamato’s net profit margin surged to 7.7%, a hefty step up from last year’s 3.4%. This marks substantial improvement in efficiency compared with both the company’s recent history and sector peers.

- Ongoing advances in profitability heavily support the view that operational discipline and high-quality earnings are taking hold more firmly than before. This suggests momentum could persist if management’s strategy continues to deliver.

- Yet, what is surprising given this margin lift is that the market response remains only moderately positive. Investors seem to be waiting for follow-up disclosures or confirmation of new business wins before getting fully on board.

Price Sits Below DCF Fair Value Estimate

- At a current share price of ¥1,899, Yamato trades at a discount to its DCF fair value estimate of ¥2,367.94, and its P/E ratio of 11.1x is lower than the industry average of 12.4x.

- Bulls typically argue that an attractive valuation like this reflects unrealized upside, with a discounted price and elevated profitability combining to form a supportive backdrop for a potential re-rating.

- Still, some critics highlight that being undervalued alone may not trigger immediate share price gains. Especially if the sector, while stable, is not offering major re-rating catalysts and investors remain in a “wait-and-see” mode.

Earnings Growth Momentum Stands Out

- Profit growth has averaged 7.5% annually over five years, culminating in a remarkable 149.4% jump this past year. This adds weight to momentum and revenue durability as central investment themes.

- What is notable is that, while market sentiment is generally positive, activity on both the street and in analyst circles appears cautious rather than exuberant. This hints that some may not be convinced this growth rate is fully sustainable over the next cycle.

- It creates a tension where confirmed performance and visible quality have yet to drive full market buy-in, with many investors closely tracking for tangible business improvements or new contracts to help resolve the “wait-and-see” narrative.

Momentum like this often raises questions about what is behind the scenes. See what the community is saying about Yamato in our full narrative analysis.

See what the community is saying about YamatoNext Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Yamato's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Yamato’s record earnings jump, investors remain cautious as the sustainability of such high growth rates into future cycles is unproven.

If you’re looking for more consistent performers, discover steady winners through stable growth stocks screener (2083 results) chosen for their reliable growth across different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1967

Yamato

Designs, constructs, and manages architecture, civil engineering, air conditioning, sanitation, refrigeration, water supply, sewerage, water treatment, and hot bathing projects.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives