- Japan

- /

- Construction

- /

- TSE:1963

Does JGC Holdings' Raised Earnings Guidance Alter the Bull Case for TSE:1963?

Reviewed by Sasha Jovanovic

- On November 11, 2025, JGC Holdings Corporation raised its full-year earnings guidance for fiscal 2026, citing higher anticipated net sales of ¥770.0 billion, operating profit of ¥28.0 billion, and earnings per share of ¥115.83, up from previous forecasts.

- This revision was mainly driven by increased recognized revenue and improved profitability in domestic and international engineering projects, as well as an updated foreign exchange assumption for the second half of the fiscal year.

- Now, we'll assess how JGC Holdings' stronger engineering project execution and raised earnings guidance influence its investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

JGC Holdings Investment Narrative Recap

To stand behind JGC Holdings as a shareholder, you need to believe that its turnaround in engineering project execution can bring sustained growth and margin improvement, despite the company’s historical challenges with cost overruns and exposure to the volatile LNG sector. The recent raised earnings guidance signals improved project delivery and higher anticipated profitability, addressing the crucial short-term catalyst of operational execution quality, but the risk of large-project setbacks remains highly relevant even amid favorable headlines.

Of all recent announcements, the February 2025 management shake-up stands out, given its close connection to the updated guidance. Executive-level changes followed major project underperformance and were intended to strengthen oversight. The timing of improved forecasts suggests a potential link between renewed management focus and steadier operations, though the catalyst for reduced risk lies squarely in ongoing project delivery discipline.

But in contrast to the upgraded outlook, investors should also be aware of persistent risks in large project execution such as…

Read the full narrative on JGC Holdings (it's free!)

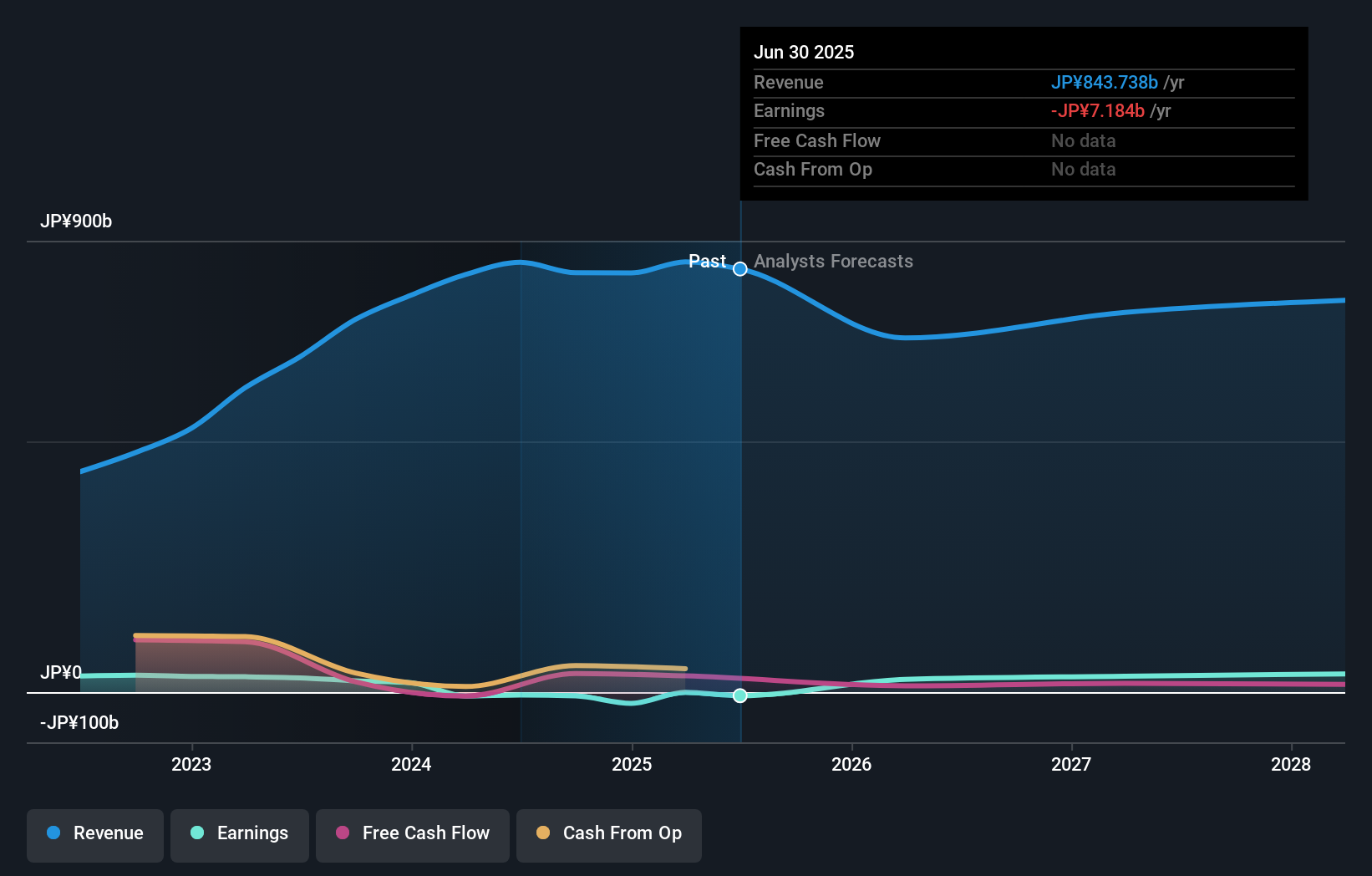

JGC Holdings is projected to achieve ¥763.0 billion in revenue and ¥35.9 billion in earnings by 2028. This reflects a forecast annual revenue decline of 3.3% and a ¥43.1 billion increase in earnings from the current level of ¥-7.2 billion.

Uncover how JGC Holdings' forecasts yield a ¥1350 fair value, a 28% downside to its current price.

Exploring Other Perspectives

The Simply Wall St Community submitted a single fair value estimate of ¥2,031 for JGC Holdings, leaving no range for comparison. While this points to consensus among private investors, execution risk in large EPC projects remains a prominent factor shaping the company's near-term performance.

Explore another fair value estimate on JGC Holdings - why the stock might be worth as much as 9% more than the current price!

Build Your Own JGC Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JGC Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free JGC Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JGC Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1963

JGC Holdings

Provides engineering, procurement, and construction services.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives