- Japan

- /

- Construction

- /

- TSE:1965

Sanki Engineering And 2 Other Undiscovered Gems In Japan With Strong Fundamentals

Reviewed by Simply Wall St

Japan's stock markets have recently gained significant traction, with the Nikkei 225 Index rising by 5.6% and the broader TOPIX Index up by 3.7%, buoyed by dovish commentary from the Bank of Japan and optimism surrounding China's new stimulus measures. This positive market sentiment provides a fertile ground for identifying small-cap stocks with strong fundamentals that may be overlooked. In this context, discovering stocks like Sanki Engineering can offer promising opportunities for investors seeking robust financial health and growth potential in an evolving economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NCD | 11.89% | 8.95% | 25.43% | ★★★★★★ |

| Intelligent Wave | NA | 6.92% | 15.18% | ★★★★★★ |

| Nitto Fuji Flour MillingLtd | 0.80% | 6.26% | 4.41% | ★★★★★★ |

| Otec | 9.81% | 2.32% | -1.39% | ★★★★★★ |

| Uoriki | NA | 3.90% | 6.15% | ★★★★★★ |

| Maezawa Kasei Industries | 0.81% | 2.01% | 18.42% | ★★★★★★ |

| HeadwatersLtd | NA | 19.26% | 23.89% | ★★★★★★ |

| Imuraya Group | 26.21% | 2.37% | 32.09% | ★★★★★☆ |

| Nippon Sharyo | 61.34% | -1.68% | -17.07% | ★★★★☆☆ |

| FDK | 89.57% | -0.88% | 25.34% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Sanki Engineering (TSE:1961)

Simply Wall St Value Rating: ★★★★★★

Overview: Sanki Engineering Co., Ltd. offers a range of social infrastructure services both in Japan and internationally, with a market cap of ¥128 billion.

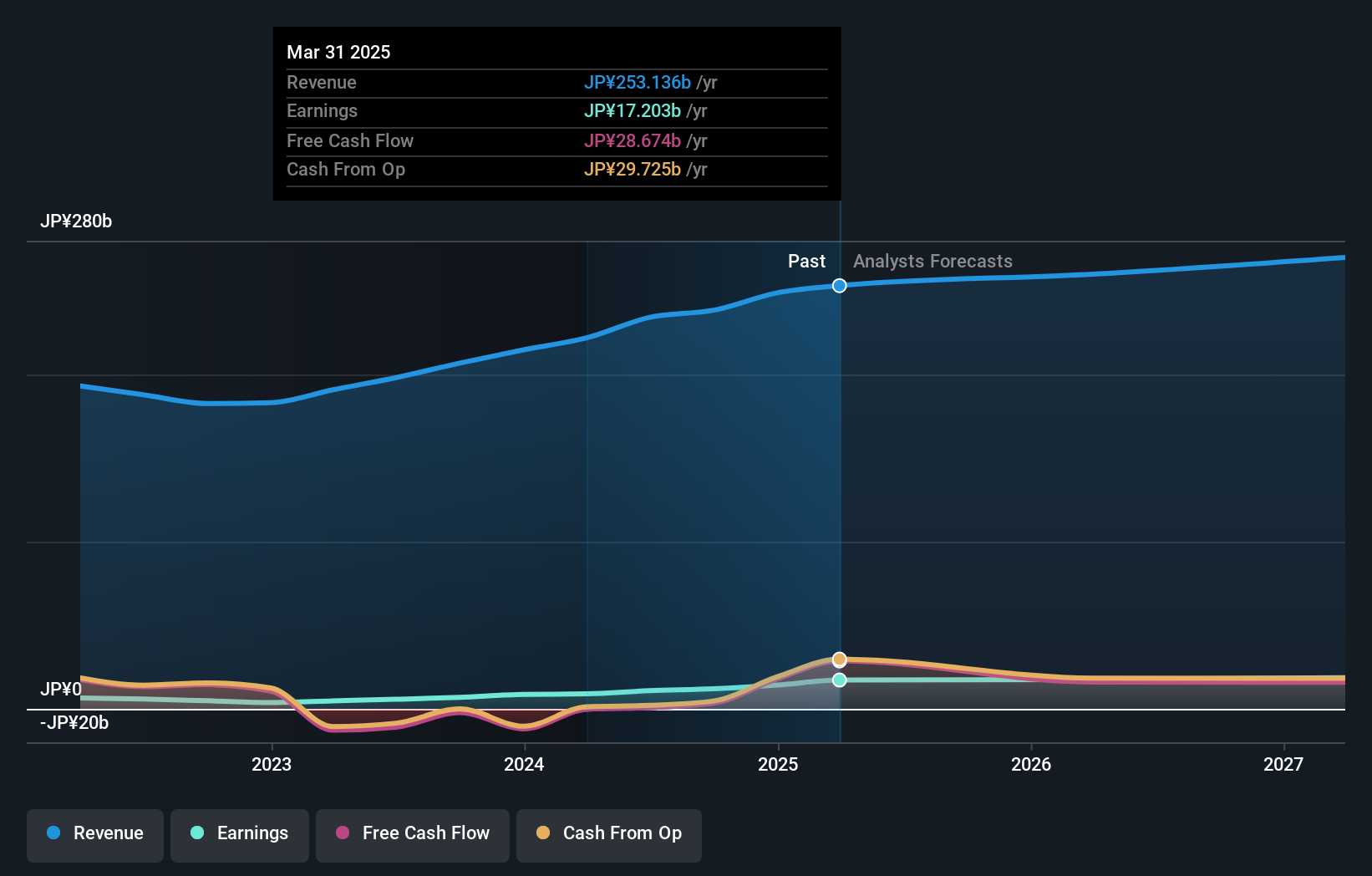

Operations: Sanki Engineering generates revenue primarily from its Building Equipment Business, contributing ¥188.59 billion, followed by the Environmental Systems Business at ¥27.60 billion and the Machine System Business at ¥11.20 billion. The Real Estate Business adds a smaller portion with ¥2.50 billion in revenue.

Sanki Engineering, a relatively small player in Japan's market, has shown impressive growth with earnings surging by 73.9% last year, outpacing the construction industry's 26.6%. The company is trading at nearly 40% below its estimated fair value and maintains a robust financial position with more cash than total debt. Recently, Sanki repurchased 118,000 shares for ¥262.59 million as part of a broader buyback plan to enhance shareholder returns and capital efficiency.

- Click here to discover the nuances of Sanki Engineering with our detailed analytical health report.

Understand Sanki Engineering's track record by examining our Past report.

Techno Ryowa (TSE:1965)

Simply Wall St Value Rating: ★★★★★☆

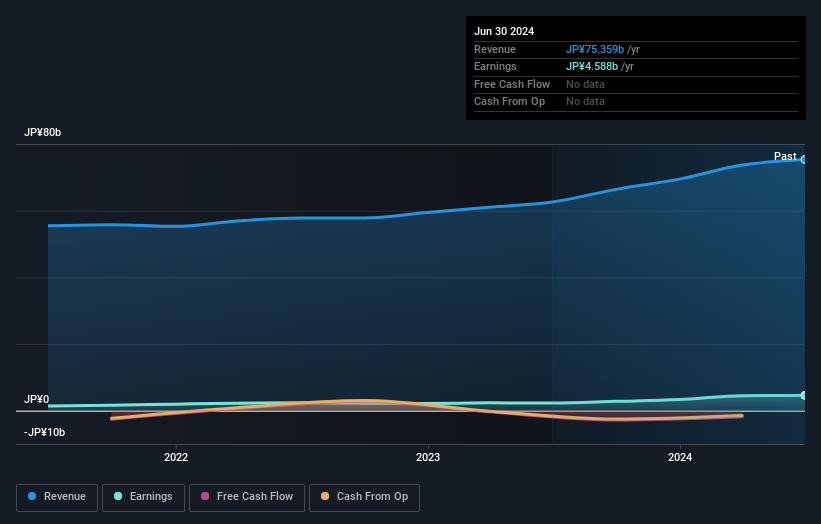

Overview: Techno Ryowa Ltd. specializes in the design, construction, and maintenance of environmental control systems primarily in Japan, with a market cap of ¥43.78 billion.

Operations: Techno Ryowa Ltd. generates its revenue primarily from the Air Conditioning Hygiene Equipment Construction Business, contributing ¥47.04 billion, followed by General Building Equipment Work at ¥24.41 billion. The Electrical Equipment Construction Business and Cooling and Heating Equipment Sales Segment contribute ¥2.64 billion and ¥1.16 billion, respectively.

Techno Ryowa, a notable player in Japan's construction sector, has seen its earnings surge by 99% over the past year, outpacing the industry's 26.6% growth. The company boasts a solid debt-to-equity ratio improvement from 2.7% to 1.8% over five years and maintains high-quality earnings while being added to the S&P Global BMI Index recently. Despite volatile share prices, its price-to-earnings ratio of 9.5x suggests it remains undervalued compared to the market average of 13.5x.

- Delve into the full analysis health report here for a deeper understanding of Techno Ryowa.

Evaluate Techno Ryowa's historical performance by accessing our past performance report.

MODEC (TSE:6269)

Simply Wall St Value Rating: ★★★★☆☆

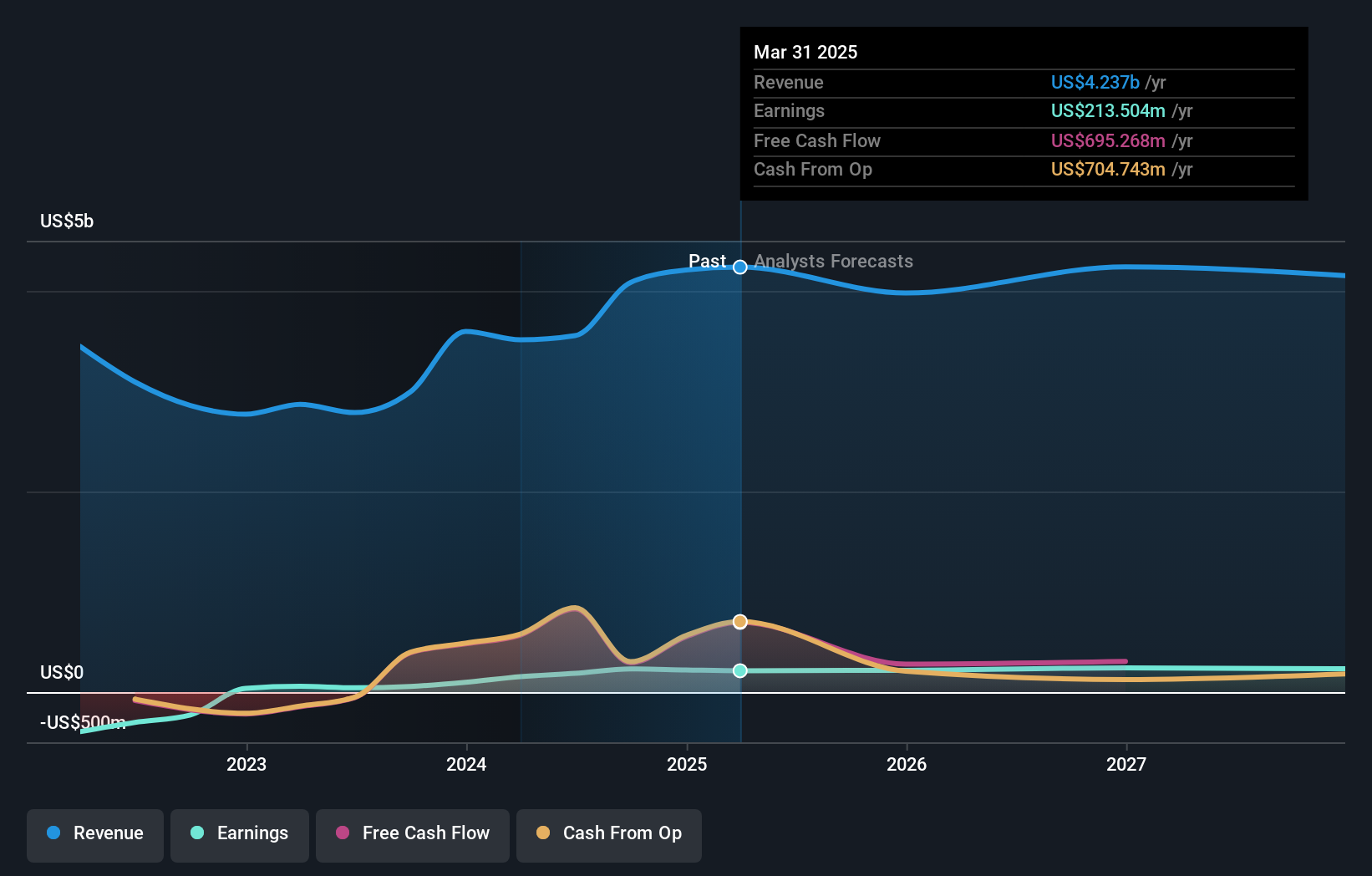

Overview: MODEC, Inc. is a general contractor specializing in the engineering, procurement, construction, and installation of floating production systems globally with a market cap of ¥236.68 billion.

Operations: MODEC generates revenue primarily through engineering, procurement, construction, and installation services for floating production systems. The company reported a gross profit margin of 15.3%, highlighting its efficiency in managing costs relative to sales.

MODEC, a notable player in Japan's energy services sector, has seen its earnings grow by 375.8% over the past year, outpacing the industry average of 27.4%. The company recently increased its interim dividend to ¥30 per share and raised earnings guidance for 2024, forecasting revenue of US$4.3 million and operating profit of US$290,000. Despite a rising debt-to-equity ratio from 19.2% to 47.8%, MODEC maintains more cash than total debt and trades at a favorable P/E ratio of 7.9x compared to the market's 13.5x.

- Get an in-depth perspective on MODEC's performance by reading our health report here.

Review our historical performance report to gain insights into MODEC's's past performance.

Next Steps

- Investigate our full lineup of 741 Japanese Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Techno Ryowa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1965

Techno Ryowa

Engages in the design, construction, and maintenance of environmental control systems primarily in Japan.

Solid track record with excellent balance sheet.