- Japan

- /

- Construction

- /

- TSE:1951

Don't Race Out To Buy EXEO Group, Inc. (TSE:1951) Just Because It's Going Ex-Dividend

EXEO Group, Inc. (TSE:1951) stock is about to trade ex-dividend in 3 days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. Thus, you can purchase EXEO Group's shares before the 27th of September in order to receive the dividend, which the company will pay on the 28th of November.

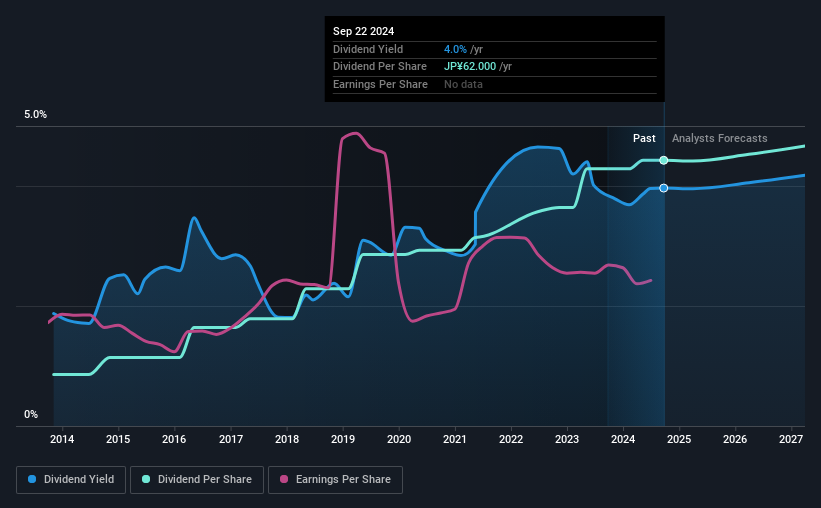

The company's next dividend payment will be JP¥31.00 per share, and in the last 12 months, the company paid a total of JP¥62.00 per share. Based on the last year's worth of payments, EXEO Group has a trailing yield of 4.0% on the current stock price of JP¥1563.50. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! As a result, readers should always check whether EXEO Group has been able to grow its dividends, or if the dividend might be cut.

View our latest analysis for EXEO Group

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. EXEO Group distributed an unsustainably high 124% of its profit as dividends to shareholders last year. Without extenuating circumstances, we'd consider the dividend at risk of a cut. A useful secondary check can be to evaluate whether EXEO Group generated enough free cash flow to afford its dividend. Over the last year it paid out 53% of its free cash flow as dividends, within the usual range for most companies.

It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and EXEO Group fortunately did generate enough cash to fund its dividend. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Very few companies are able to sustainably pay dividends larger than their reported earnings.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If earnings fall far enough, the company could be forced to cut its dividend. With that in mind, we're discomforted by EXEO Group's 13% per annum decline in earnings in the past five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. EXEO Group has delivered an average of 18% per year annual increase in its dividend, based on the past 10 years of dividend payments. That's intriguing, but the combination of growing dividends despite declining earnings can typically only be achieved by paying out a larger percentage of profits. EXEO Group is already paying out 124% of its profits, and with shrinking earnings we think it's unlikely that this dividend will grow quickly in the future.

The Bottom Line

Is EXEO Group worth buying for its dividend? Earnings per share have been in decline, which is not encouraging. What's more, EXEO Group is paying out a majority of its earnings and over half its free cash flow. It's hard to say if the business has the financial resources and time to turn things around without cutting the dividend. It's not an attractive combination from a dividend perspective, and we're inclined to pass on this one for the time being.

With that in mind though, if the poor dividend characteristics of EXEO Group don't faze you, it's worth being mindful of the risks involved with this business. Every company has risks, and we've spotted 1 warning sign for EXEO Group you should know about.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if EXEO Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:1951

EXEO Group

Engages in telecommunications, civil engineering, construction, electric equipment, system solutions, and renewable energy business in Japan.

Excellent balance sheet established dividend payer.