- Japan

- /

- Construction

- /

- TSE:1948

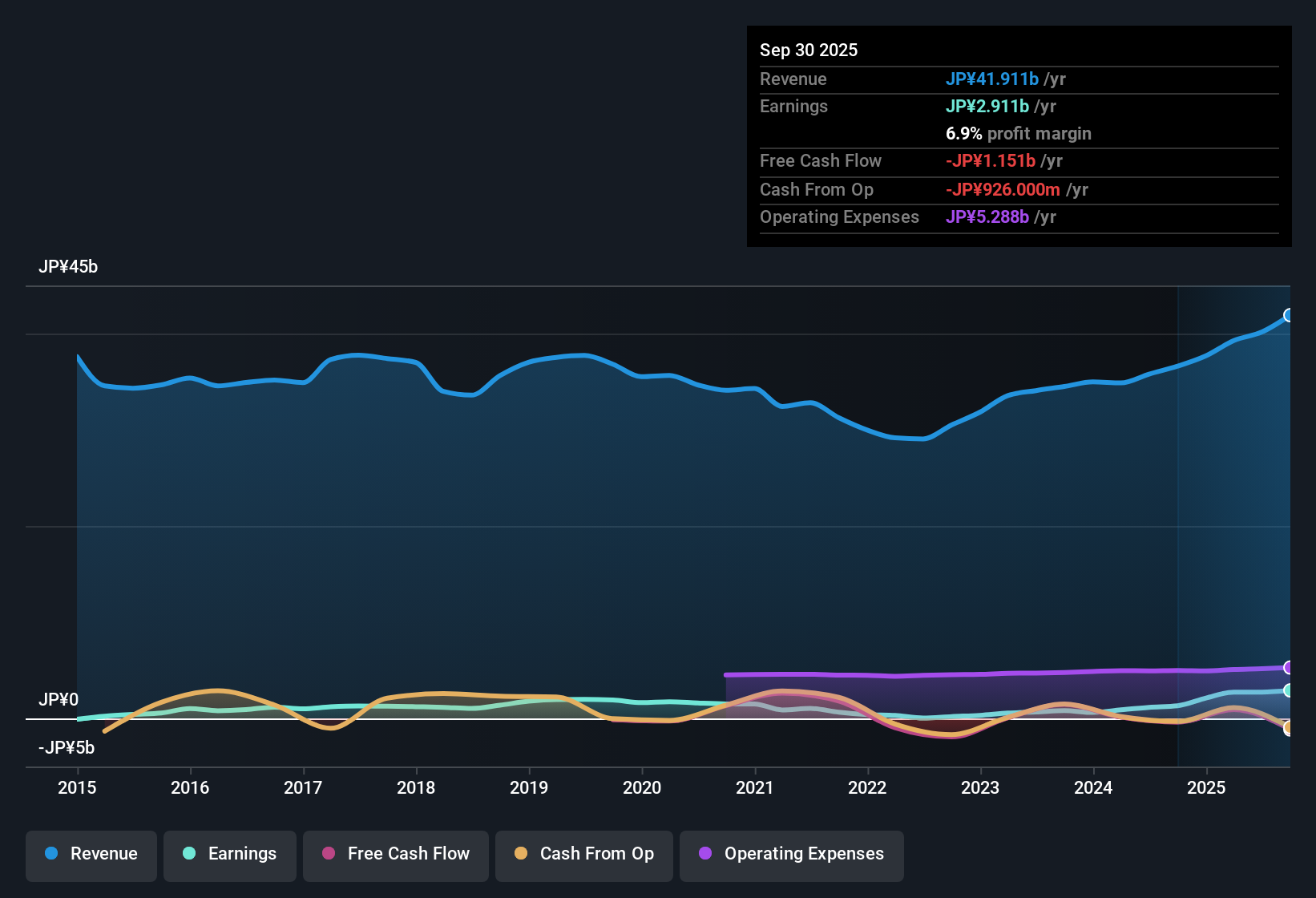

Kodensha (TSE:1948) Earnings Surge 122%, Profit Margin Expansion Reinforces Bullish Narratives

Reviewed by Simply Wall St

Kodensha (TSE:1948) delivered striking earnings growth of 121.9% over the past year, surging past its five-year average increase of 28.5% per year. Net profit margin rose to 6.9% from last year’s 3.6%, and the company’s EPS valuation at a Price-to-Earnings Ratio of 8.3x is well below the peer and industry averages at 10.1x and 12.3x respectively, signaling attractive value for investors. With robust profit growth and expanding margins on display, the recent results make a compelling case for Kodensha’s operational strength and market appeal, even as investors watch for continued dividend sustainability.

See our full analysis for Kodensha.The next step is to put these headline numbers side-by-side with the prevailing market narratives to see which stories stand up, and which ones get put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Climbs to 6.9%

- Kodensha’s net profit margin now stands at 6.9%, a meaningful expansion from last year’s 3.6% and a new high-water mark for recent years.

- What is notable is that prevailing analysis highlights this margin growth as a key anchor for investor confidence. Stronger margins, when combined with the current pace of profit growth, often encourage positive sentiment among market participants.

- This margin expansion is seen as an indicator that core operations are benefiting from better cost control or mix, which helps validate investor optimism.

- Market watchers note that this trend could be a catalyst for continued rerating of Kodensha’s shares if it proves durable.

Dividend Sustainability Flagged as Watch Item

- The only risk noted in the data is a minor flag regarding dividend sustainability, which could indicate some caution for income-focused investors even as overall profitability improves.

- Critics highlight that strong earnings growth may not always translate into reliable dividends, especially if profit gains are earmarked for reinvestment or if volatility in construction cash flows returns.

- This single risk item tempers some of the “all-clear” tone of headline financials and prompts closer attention on payout policies.

- In construction, sector volatility and project-based income can introduce swings in cash flows that potentially impact dividend cover. Cautious investors will be watching this closely in future filings.

P/E Ratio Trades Below Industry at 8.3x

- Kodensha’s Price-to-Earnings Ratio is 8.3x, sitting attractively below the Japanese construction industry average of 12.3x and peers at 10.1x.

- What stands out to investors is that this valuation gap, anchored by genuine operational strength, makes the stock appear undervalued relative to the sector’s recent momentum and could spark fresh interest from value-focused funds.

- With recent profit growth and expanding margins, observers regard the current P/E discount as especially notable given Kodensha’s robust earnings profile.

- However, some point out that market appreciation could adjust this discount quickly if momentum continues or dividend risks diminish.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Kodensha's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Kodensha boasts impressive earnings growth and margin expansion, lingering concerns around its dividend sustainability may give pause to income-oriented investors seeking stable payouts.

If consistent dividends matter most to you, explore these 2000 dividend stocks with yields > 3% to find companies with attractive yields and stronger track records of sustainable income.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kodensha might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1948

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives