- Japan

- /

- Construction

- /

- TSE:1893

How Investors Are Reacting To Penta-Ocean Construction (TSE:1893) Share Buyback and Dividend Increase

Reviewed by Sasha Jovanovic

- Penta-Ocean Construction Co., Ltd. recently announced a share repurchase program of up to 4,500,000 shares for ¥5,000 million, alongside an increase in both interim and full-year dividend guidance to ¥17.00 per share for the fiscal year ending March 31, 2026.

- These shareholder-focused initiatives were complemented by new earnings guidance and details on recent financing activity, highlighting the company’s efforts to bolster both capital efficiency and investor returns.

- We’ll explore how the combination of the buyback and higher dividend signals Penta-Ocean Construction’s commitment to enhancing shareholder value.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

What Is Penta-Ocean Construction's Investment Narrative?

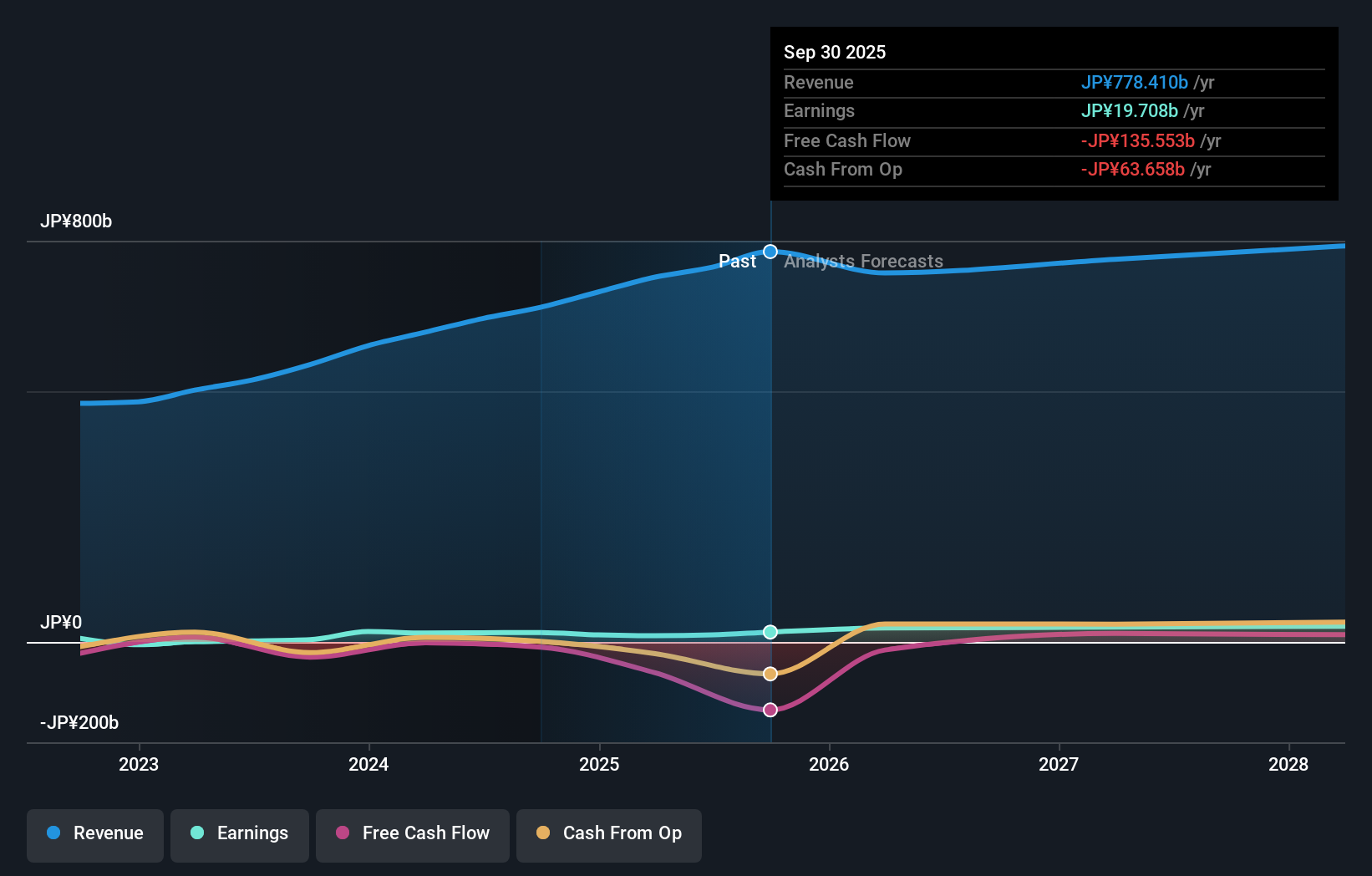

To be a shareholder in Penta-Ocean Construction today, you’d need to believe in the company's potential to convert its strong project pipeline into long-term earnings growth, despite the sector’s competitive pressures and recent volatility. The latest suite of announcements, especially the new share buyback, larger dividend, and refreshed earnings guidance, clearly position management as focused on boosting capital returns and appealing to shareholders. In the short-term, these actions could serve as positive catalysts for sentiment, possibly offsetting previous concerns about Penta-Ocean’s premium valuation, modest return on equity, and slower-than-market revenue growth outlook. However, risks around high non-cash earnings quality, stretched P/E multiples, and limited revenue growth remain relevant, particularly given tighter financial covenants tied to recent debt financing. For now, the news is material as it puts shareholder rewards and capital efficiency front and center, but how much this shifts the underlying risk profile warrants careful watching. Contrast this with lingering quality concerns tied to non-cash earnings, an area investors should watch closely.

Penta-Ocean Construction's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Penta-Ocean Construction - why the stock might be worth as much as ¥521!

Build Your Own Penta-Ocean Construction Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Penta-Ocean Construction research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Penta-Ocean Construction research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Penta-Ocean Construction's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1893

Penta-Ocean Construction

Engages in the civil engineering and building construction activities in Japan, Southeast Asia, and internationally.

Average dividend payer with slight risk.

Market Insights

Community Narratives