- Japan

- /

- Construction

- /

- TSE:1882

Undiscovered Gems In Japan To Watch This August 2024

Reviewed by Simply Wall St

As global markets react to mixed economic data and shifting investor sentiment, Japan's stock market has experienced notable declines, with the Nikkei 225 Index falling 4.7% and the broader TOPIX Index down by 6.0%. Amid this volatility, discerning investors might find opportunities in lesser-known small-cap stocks that exhibit strong fundamentals and growth potential. In this context, identifying stocks with solid financial health, innovative business models, and resilience against economic fluctuations can be particularly rewarding. Let's explore three such undiscovered gems in Japan that merit attention this August 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ryoyu Systems | NA | 1.08% | 8.08% | ★★★★★★ |

| Totech | 16.84% | 4.67% | 9.18% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | -0.08% | 12.04% | ★★★★★★ |

| Ad-Sol Nissin | NA | 1.94% | 6.44% | ★★★★★★ |

| Imuraya Group | 17.62% | 1.55% | 27.83% | ★★★★★★ |

| AJIS | 0.69% | 0.07% | -12.44% | ★★★★★☆ |

| Marusan Securities | 5.33% | 1.01% | 10.00% | ★★★★★☆ |

| Kappa Create | 73.80% | -1.08% | -8.46% | ★★★★★☆ |

| Toyo Kanetsu K.K | 45.07% | 2.00% | 11.94% | ★★★★☆☆ |

| FDK | 89.57% | -0.88% | 25.34% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Toa Road (TSE:1882)

Simply Wall St Value Rating: ★★★★★★

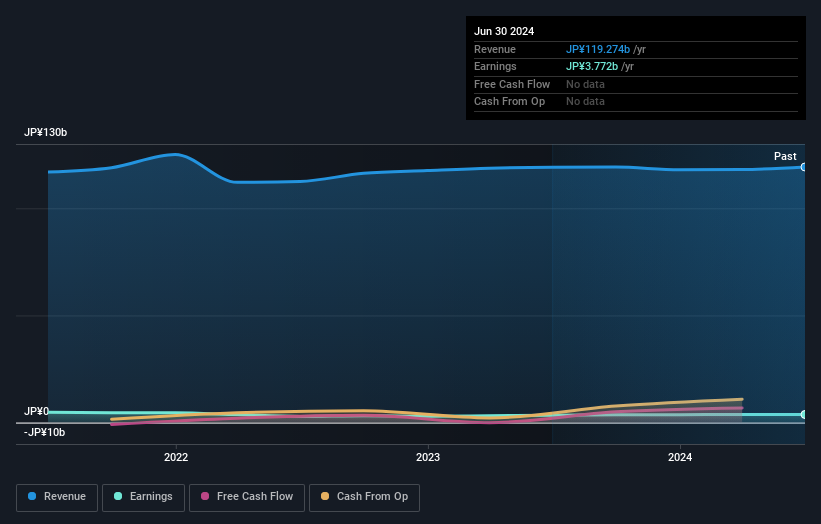

Overview: Toa Road Corporation operates in the civil engineering sector in Japan and has a market capitalization of ¥55.80 billion.

Operations: The company generates revenue from its civil engineering projects in Japan. The primary cost components include materials, labor, and overhead expenses.

Toa Road, a small-cap construction company, has shown promising financial health with its debt to equity ratio declining from 19.5% to 2.7% over the past five years and earnings growing at an annual rate of 12.7%. Despite this, its recent earnings growth of 20% lagged behind the industry average of 23.4%. The company recently repurchased 1 million shares for ¥1,175 million to enhance capital efficiency and shareholder value.

Nitto Fuji Flour MillingLtd (TSE:2003)

Simply Wall St Value Rating: ★★★★★★

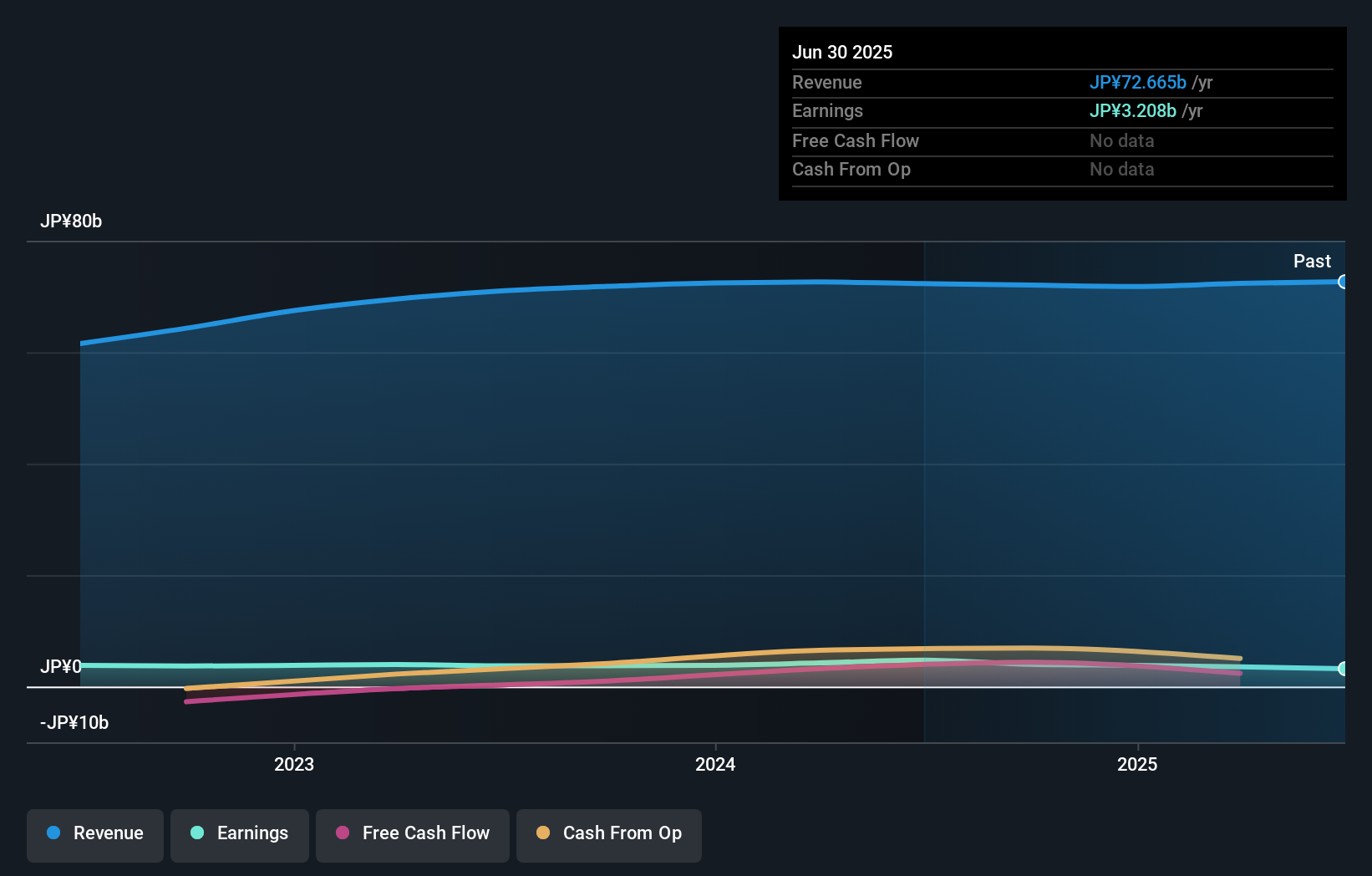

Overview: Nitto Fuji Flour Milling Co., Ltd. manufactures and sells flour products in Japan and has a market cap of ¥62.37 billion.

Operations: Nitto Fuji Flour Milling Co., Ltd. generates revenue primarily from the sale of flour products in Japan. The company has a market cap of ¥62.37 billion.

Nitto Fuji Flour Milling Ltd. has demonstrated solid financial health, with earnings growing at 4.4% annually over the past five years and a debt-to-equity ratio dropping from 2.9% to 0.8%. Their gross profit margin stands strong at 27%, and they are trading at a notable discount, around 39% below estimated fair value. Recent news indicates upcoming Q1 results on July 31, which could provide further insights into their performance trajectory in the food industry.

Takara (TSE:7921)

Simply Wall St Value Rating: ★★★★★★

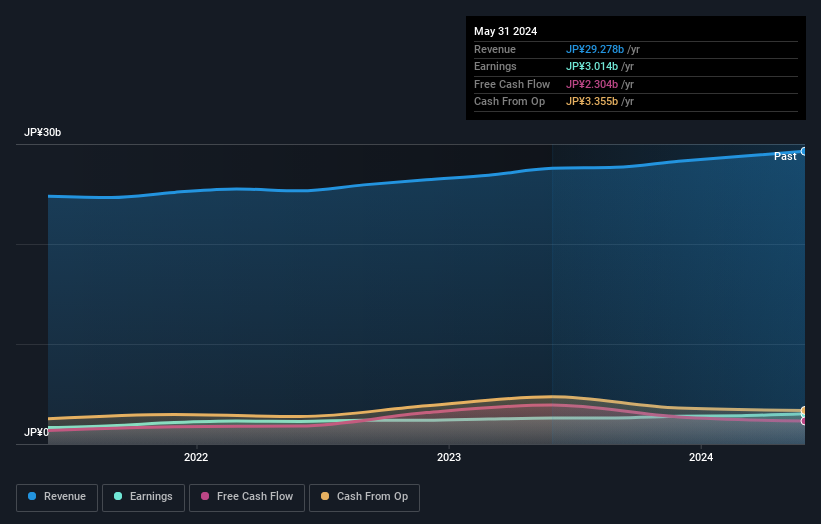

Overview: Takara & Company Ltd. produces, consults, prints, and translates disclosure and IR-related materials in Japan and internationally with a market cap of ¥37.08 billion.

Operations: Takara & Company Ltd. generates revenue primarily from its Disclosure Related Business, which brought in ¥21.07 billion, and its Interpretation and Translation Business, contributing ¥9.51 billion.

Takara & Company Ltd. has shown promising performance, with earnings growing by 16.2% over the past year, outpacing the Commercial Services industry’s 7.8%. The company repurchased shares in 2024, indicating confidence in its future prospects. Takara's debt to equity ratio has impressively reduced from 4.8 to 0.4 over five years, highlighting strong financial management. Recent news includes a dividend increase to JPY 40 per share and projected net sales of JPY 30 billion for fiscal year ending May 2025.

- Click to explore a detailed breakdown of our findings in Takara's health report.

Evaluate Takara's historical performance by accessing our past performance report.

Key Takeaways

- Click through to start exploring the rest of the 708 Japanese Undiscovered Gems With Strong Fundamentals now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toa Road might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1882

Flawless balance sheet established dividend payer.