- Japan

- /

- Construction

- /

- TSE:1826

Sata Construction (TSE:1826) Margin Jump Challenges Bearish Narrative Despite High Valuation

Reviewed by Simply Wall St

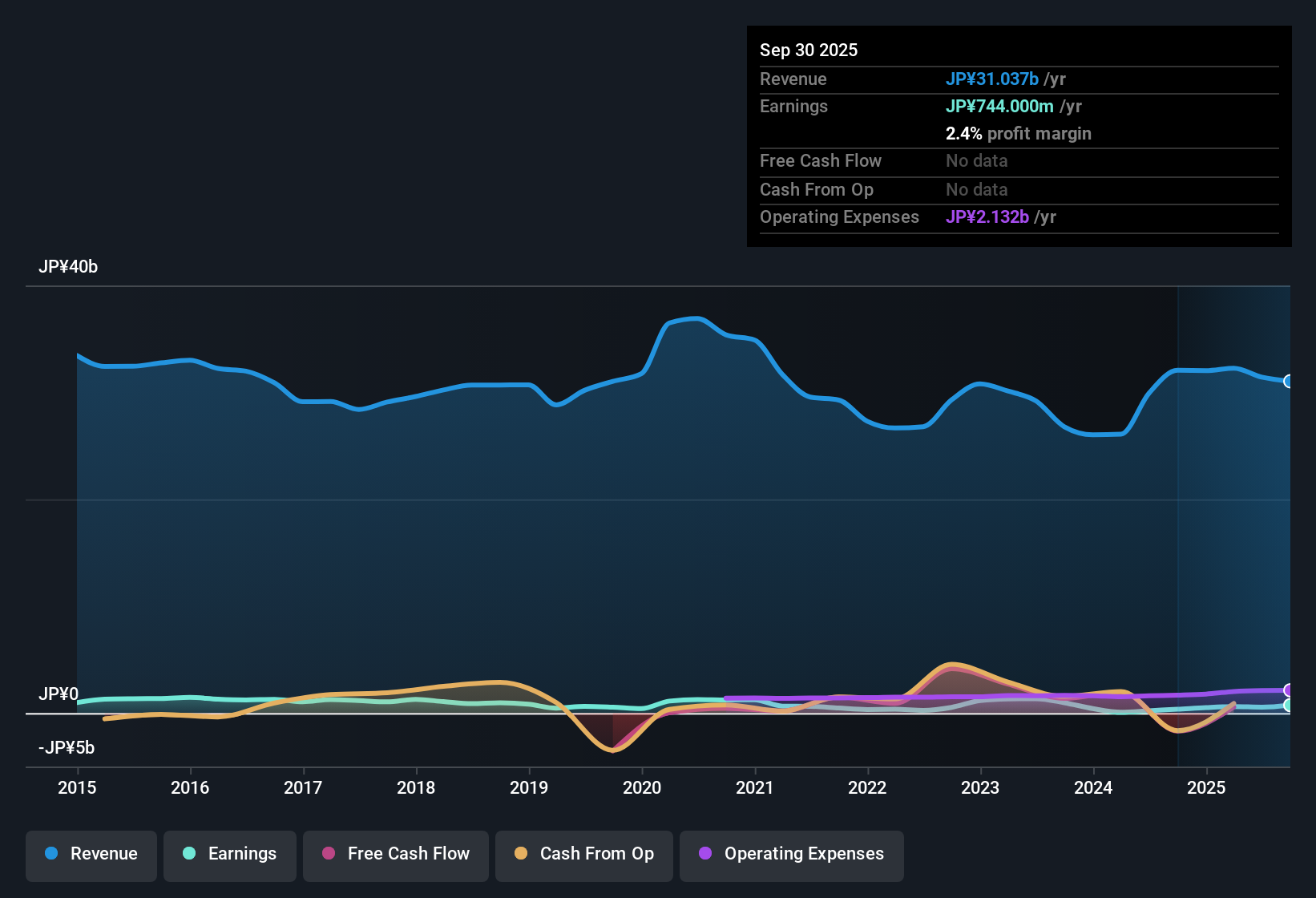

Sata Construction (TSE:1826) reported a net profit margin of 1.8%, up from 0.7% last year, with EPS growth of 152.3% over the past year. This contrasts with a 5-year annual decline of 12.5%. Its share price closed at ¥1,140, well above the estimated fair value of ¥803.24. The stock currently trades at a P/E of 31.1x, commanding a sharp premium over both industry and peer averages. While profitability has improved and earnings quality is described as high, investors remain mindful of risks related to dividend sustainability and the outlook for future growth.

See our full analysis for Sata Construction.The next section examines how these numbers compare to expectations and how they challenge or reinforce the dominant market narratives.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Expansion Contrasts Long-Term Decline

- Net profit margin improved to 1.8% compared to 0.7% last year, even as the 5-year average earnings growth remains negative at -12.5% per year.

- What is surprising is that, despite the latest turnaround in profitability, the prevailing market view highlights that Sata Construction’s longer-term pattern of declining earnings continues to temper enthusiasm.

- Recent uplift may suggest better operational execution, but the durability of this margin is still questioned based on the multi-year trend.

- This creates tension for investors weighing a single good year against a longer record of shrinking profits.

Premium Price Far Exceeds Sector Norms

- Sata trades at a P/E ratio of 31.1x, well above both the Japanese construction industry average of 12.4x and the peer average of 10.4x, indicating an outsized valuation premium.

- The prevailing market view argues these elevated multiples are hard to justify without new catalysts or sector leadership.

- Investors who pay up for quality must weigh the relatively high price against a history of negative annual growth, making the premium difficult to defend in the absence of stronger forward indicators.

- The gap to the DCF fair value (¥803.24) adds to concerns that the share price may not be sustainable if positive momentum fades.

Dividend Risks Cloud Outlook

- Major risks highlighted in the disclosures focus on the sustainability of current dividend payments and uncertainty around ongoing profit growth.

- Prevailing analysis notes that while higher margins and a solid year are positives, questions remain about whether this can support stable or growing dividends going forward.

- If profit growth returns to the longer declining trajectory, shareholder payouts could come under pressure, undermining optimism sparked by recent results.

- Some investors may hope for continued sector support, but the lack of confirmed growth levers leaves the dividend exposed to downside if performance stalls.

See our latest analysis for Sata Construction.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Sata Construction's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Sata Construction’s high valuation and uncertain earnings trajectory make it difficult to justify paying a premium without clearer signs of sustainable growth.

If you want to focus on companies that look undervalued compared to their fundamentals, check out these 840 undervalued stocks based on cash flows to see which stocks offer more compelling value today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1826

Sata Construction

Engages in the contracting and investigation, planning and designing, and supervision of civil engineering and other construction works in Japan.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives