- Japan

- /

- Construction

- /

- TSE:1812

Is Kajima’s Upgraded Profit Outlook and Dividend Raise Shifting the Investment Case for TSE:1812?

Reviewed by Sasha Jovanovic

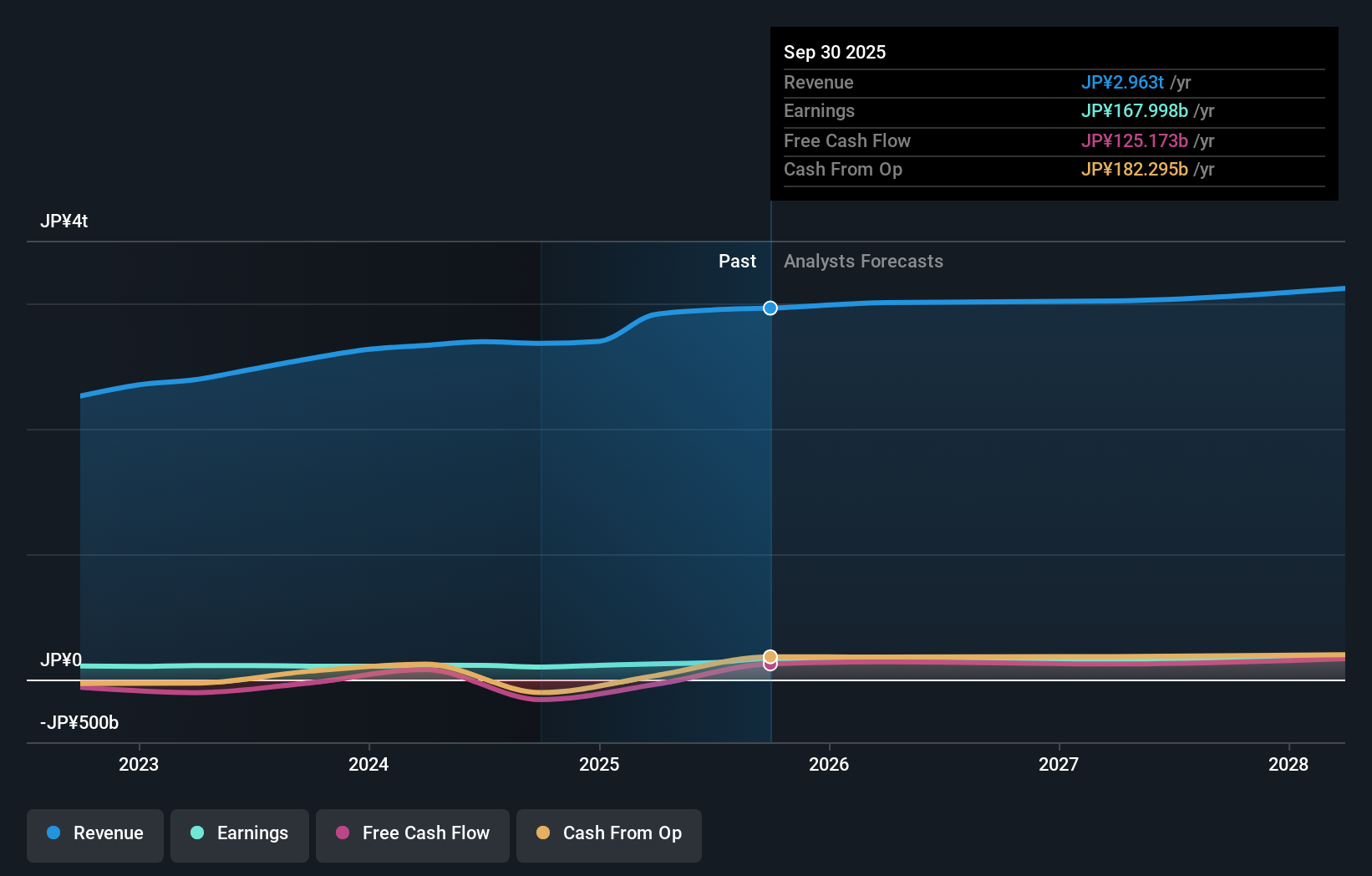

- Kajima Corporation recently raised its consolidated and non-consolidated earnings forecasts for the year ending March 31, 2026, and announced higher dividends for both the interim and full-year periods.

- The guidance revision reflects improved gross profit margins in Japan’s civil engineering and building construction businesses, with strong contributions from domestic subsidiaries and real estate operations.

- We’ll look at how Kajima’s improved forecast and dividend increase could influence the company’s investment narrative going forward.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Kajima's Investment Narrative?

To be a shareholder in Kajima Corporation, you’d want to believe in the strength and sustainability of Japan’s infrastructure and real estate development cycle, especially as the company directly benefits from domestic construction and property trends. The recent upward revision to both earnings and dividends offers a clear signal that Kajima’s Japanese operations and real estate arms are performing better than many expected, hinting at near-term tailwinds for investors looking for income and stable returns. This positive shift may alter what matters most in the short term: prior worries about slow top-line growth are now challenged by higher profit margins and robust subsidiary results. That said, not everything improves; project delays abroad, especially in U.S. and European real estate disposals, highlight an ongoing risk of earnings volatility if market conditions don’t improve or further sales are postponed. The latest news shifts the focus more clearly to domestic outperformance, but the global execution story still matters, and investors can’t ignore it.

Still, ongoing legal and overseas property timing risks may impact near-term certainty. Despite retreating, Kajima's shares might still be trading 22% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on Kajima - why the stock might be worth as much as 28% more than the current price!

Build Your Own Kajima Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kajima research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Kajima research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kajima's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kajima might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1812

Kajima

Engages in civil engineering, building construction, real estate development, architectural and civil design, and other businesses.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives