- Japan

- /

- Construction

- /

- TSE:1417

A Look at MIRAIT ONE (TSE:1417) Valuation Following Its Second-Quarter Dividend Increase

Reviewed by Simply Wall St

MIRAIT ONE (TSE:1417) just announced a dividend increase for the second quarter, raising its payout from JPY 35.00 to JPY 40.00 per share. This move reflects growing confidence in the company’s direction.

See our latest analysis for MIRAIT ONE.

MIRAIT ONE’s decision to boost its dividend comes as momentum in the stock has been building, with a share price return of 8% over the past month and a stellar 52% total shareholder return in the last year. This performance hints at renewed optimism and suggests investors are responding positively to both financial stability and growth prospects.

If you’re keen to see what else is gaining traction this year, now is a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

With shares up sharply and a higher dividend on the table, does MIRAIT ONE still offer hidden value for investors, or has the market already priced in all its future growth potential?

Price-to-Earnings of 14x: Is it justified?

With a price-to-earnings ratio of 14x, MIRAIT ONE trades above both its industry average and its fair price-to-earnings benchmark. This suggests investors pay a premium for its shares compared to similar companies.

The price-to-earnings ratio reflects how much investors are willing to pay for each yen of annual profit. This measure is especially relevant for construction firms, where profit stability is a key consideration. For MIRAIT ONE, this higher multiple points to market optimism about its future earnings, but it may also signal expectations that are already priced in given the company’s recent growth streak.

The company’s 14x price-to-earnings is notably higher than the JP Construction industry’s 11.8x average. This highlights that the stock is not a bargain by this yardstick. When compared to its estimated fair price-to-earnings of 13.4x, the current level appears slightly elevated, indicating that the stock is possibly trading at a premium level the market could recalibrate toward.

Explore the SWS fair ratio for MIRAIT ONE

Result: Price-to-Earnings of 14x (OVERVALUED)

However, risks such as the current premium valuation and a price target below today's share price could pressure future returns if market sentiment shifts.

Find out about the key risks to this MIRAIT ONE narrative.

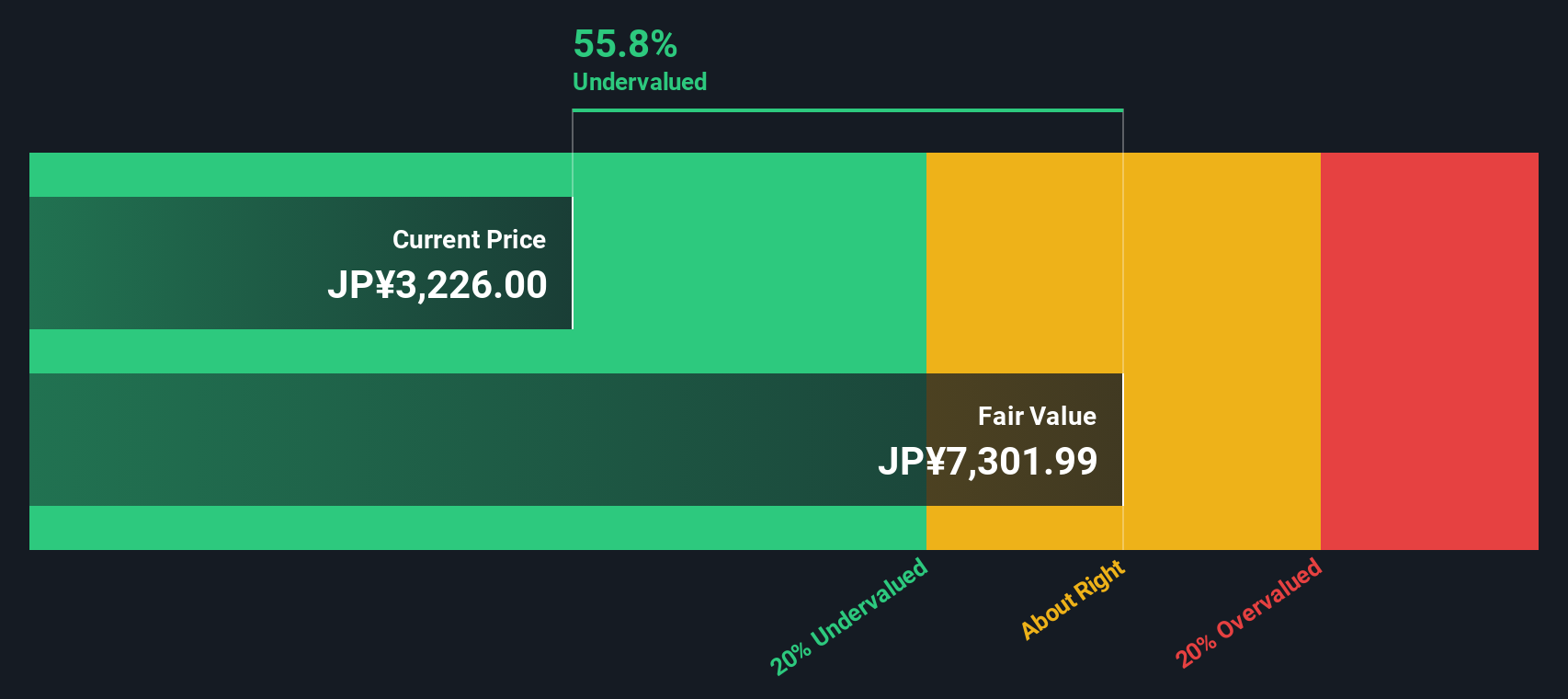

Another View: Discounted Cash Flow Signals Deep Value

On a different note, our DCF model paints a much more optimistic picture for MIRAIT ONE. Although the stock’s premium valuation by earnings multiple may stand out, it is currently trading at a staggering 55.8% discount to its estimated fair value. This wide gap raises the possibility that the market may be overlooking some long-term upside.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MIRAIT ONE for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MIRAIT ONE Narrative

If you think there’s more to the story or want to dig into the numbers yourself, you can build your own view in just a few minutes, so why not Do it your way?

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding MIRAIT ONE.

Looking for More Investment Ideas?

Don’t let opportunities pass you by. Broadening your search can open doors to markets and innovations you may have overlooked. Take action and boost your portfolio’s potential with these compelling options:

- Capture steady income streams when you check out these 15 dividend stocks with yields > 3% and see which yield-focused stocks are offering strong returns right now.

- Tap into the future of computing by targeting these 26 quantum computing stocks at the forefront of quantum technology and high-growth breakthroughs.

- Stay ahead of the digital finance curve and navigate these 81 cryptocurrency and blockchain stocks for access to companies driving blockchain and cryptocurrency innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1417

MIRAIT ONE

Engages in the telecommunications construction, electrical construction, civil engineering work, and architectural and construction businesses in Japan.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives