- Japan

- /

- Metals and Mining

- /

- TSE:5445

Aichi Electric And 2 More Undiscovered Gems In Japan

Reviewed by Simply Wall St

Japan’s stock markets have shown modest gains recently, with the Nikkei 225 Index rising 0.8% and the broader TOPIX Index up 0.2%, amid a backdrop of economic stability and monetary policy adjustments by the Bank of Japan. This environment has created opportunities for discerning investors to identify undervalued stocks that may offer significant growth potential. In this article, we will explore three such undiscovered gems in Japan, starting with Aichi Electric, that stand out due to their strong fundamentals and promising outlooks despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NCD | 11.89% | 8.95% | 25.43% | ★★★★★★ |

| Ryoyu Systems | NA | 1.08% | 8.08% | ★★★★★★ |

| Poppins | 39.80% | 8.36% | -7.40% | ★★★★★★ |

| Ohashi Technica | NA | 1.57% | -20.55% | ★★★★★★ |

| Ad-Sol Nissin | NA | 4.02% | 7.90% | ★★★★★★ |

| HeadwatersLtd | NA | 19.26% | 23.89% | ★★★★★★ |

| NPR-Riken | 15.31% | 10.00% | 44.55% | ★★★★★☆ |

| MIRARTH HOLDINGSInc | 266.33% | 3.00% | -2.40% | ★★★★☆☆ |

| Toyo Kanetsu K.K | 47.92% | 2.34% | 15.44% | ★★★★☆☆ |

| FDK | 89.57% | -0.88% | 25.34% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Aichi Electric (NSE:6623)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aichi Electric Co., Ltd., along with its subsidiaries, manufactures and sells electric power products both in Japan and internationally, with a market cap of ¥39.96 billion.

Operations: Aichi Electric generates revenue primarily from the sale of electric power products in both domestic and international markets. The company has a market cap of ¥39.96 billion.

Aichi Electric, a notable player in the electrical industry, has seen its debt-to-equity ratio rise from 12.4% to 21.8% over five years while maintaining more cash than total debt. Despite earnings growing at an impressive 18.7% annually, recent growth of 5% lagged behind the industry's 20.2%. Trading at a significant discount to its estimated fair value, Aichi boasts high-quality earnings and positive free cash flow, making it an intriguing prospect for investors looking for undervalued opportunities in Japan's market.

- Click here and access our complete health analysis report to understand the dynamics of Aichi Electric.

Understand Aichi Electric's track record by examining our Past report.

Tokyo Tekko (TSE:5445)

Simply Wall St Value Rating: ★★★★★★

Overview: Tokyo Tekko Co., Ltd. specializes in manufacturing and selling steel products for the construction industry in Japan, with a market cap of ¥46.38 billion.

Operations: The steel business segment of Tokyo Tekko Co., Ltd. generates ¥80.89 billion in revenue, while other segments contribute ¥4.89 million.

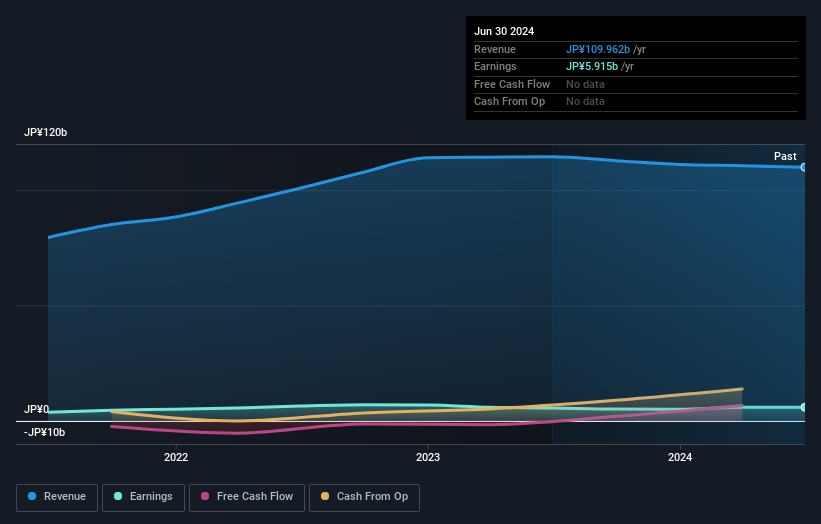

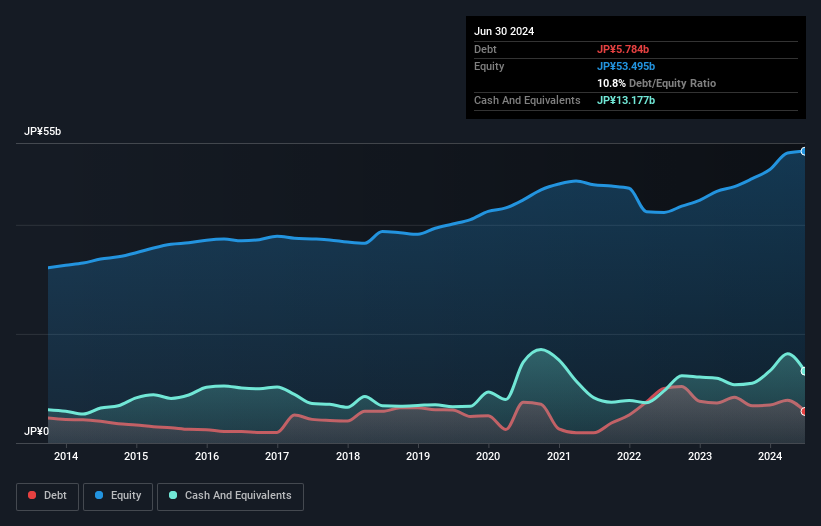

Tokyo Tekko has shown impressive earnings growth of 65.5% over the past year, outpacing the Metals and Mining industry, which saw a -5.7% change. The company's debt to equity ratio improved from 15.1% to 10.8% in five years, indicating better financial health. Recently, Tokyo Tekko repurchased 96,900 shares for ¥499.66 million between May and June 2024, reflecting confidence in its valuation at trading levels significantly below estimated fair value by about 71%.

- Navigate through the intricacies of Tokyo Tekko with our comprehensive health report here.

Examine Tokyo Tekko's past performance report to understand how it has performed in the past.

Ehime Bank (TSE:8541)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Ehime Bank, Ltd. provides banking products and financial services in Japan and has a market cap of ¥43.84 billion.

Operations: Ehime Bank generates revenue primarily from its banking operations (¥43.36 billion) and leasing business (¥3.47 billion).

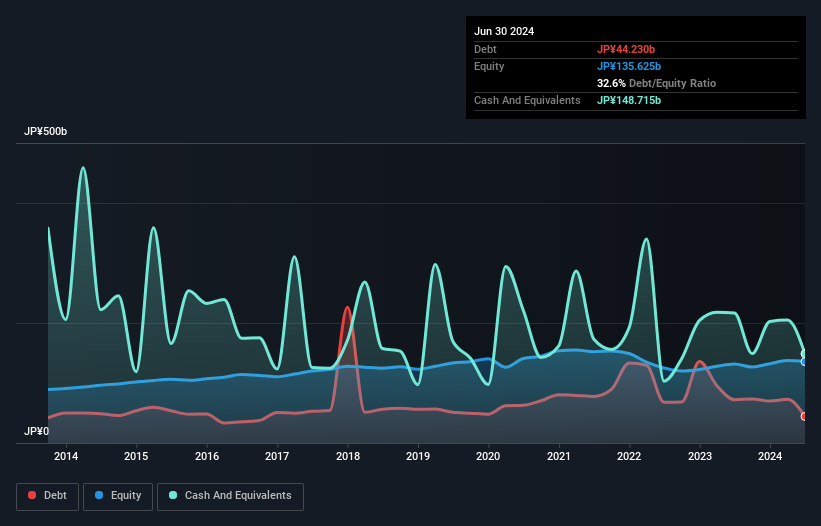

Ehime Bank, with total assets of ¥2,830.2B and equity of ¥135.6B, has deposits amounting to ¥2,615.3B and loans at ¥1,914.5B earning a Net Interest Margin of 1.3%. The bank's bad loans are at an appropriate level (1.9%), but its allowance for bad loans is low (38%). Trading at 54.8% below estimated fair value highlights potential undervaluation while earnings grew by 22.3% last year despite a 2.4% annual decline over five years.

- Click to explore a detailed breakdown of our findings in Ehime Bank's health report.

Review our historical performance report to gain insights into Ehime Bank's's past performance.

Where To Now?

- Unlock our comprehensive list of 756 Japanese Undiscovered Gems With Strong Fundamentals by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokyo Tekko might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5445

Tokyo Tekko

Engages in the manufacture and sale of steel products for the construction industry in Japan.

Flawless balance sheet with solid track record and pays a dividend.