Assessing Senshu Ikeda Holdings (TSE:8714) Valuation Following Strategic Move Into M&A Advisory and Investment Management

Reviewed by Simply Wall St

Senshu Ikeda Holdings (TSE:8714) has unveiled plans to launch two new subsidiaries focused on M&A advisory and investment management following its recent board meeting. This move is intended to strengthen regional business continuity and economic resilience.

See our latest analysis for Senshu Ikeda Holdings.

Senshu Ikeda Holdings has garnered market attention with its latest steps to expand in M&A advisory and investment management, adding to a year marked by remarkable momentum. The stock’s 67.93% share price return since the start of the year has supported a striking 101.57% total shareholder return over twelve months. This indicates that investors have taken a keen interest in the group’s growth prospects and regional strategy.

If you’re interested in finding other companies benefiting from strong leadership and dynamic growth, now is a great opportunity to discover fast growing stocks with high insider ownership

After such robust share price growth, investors may be wondering whether Senshu Ikeda Holdings still offers an attractive entry point. Alternatively, they may question if the company’s promising future has already been fully reflected in its valuation.

Price-to-Earnings of 14x: Is it justified?

Senshu Ikeda Holdings trades at a price-to-earnings (P/E) ratio of 14x, slightly above the peer average of 13.9x. This suggests the market is assigning a premium to the stock versus its direct rivals.

The price-to-earnings ratio represents how much investors are willing to pay for each yen of current earnings. For banking institutions like Senshu Ikeda Holdings, the P/E multiple can provide insight into market expectations for future profit stability and growth, particularly in a sector known for its cyclical earnings.

While investors are paying a modest premium to the peer group, this could be connected to the company's above-industry earnings growth rates over the past year as well as improvements in key profitability metrics. On the other hand, compared to the broader JP market, the P/E ratio is actually below average, which may indicate a balanced market view between optimism for the bank’s growth and sector-specific caution.

Compared to the rest of the JP Banks industry, where the average P/E sits at 11.5x, Senshu Ikeda Holdings still stands out as relatively expensive. This higher valuation underscores elevated expectations but may come under scrutiny if growth slows or sector dynamics shift.

See what the numbers say about this price — find out in our valuation breakdown.

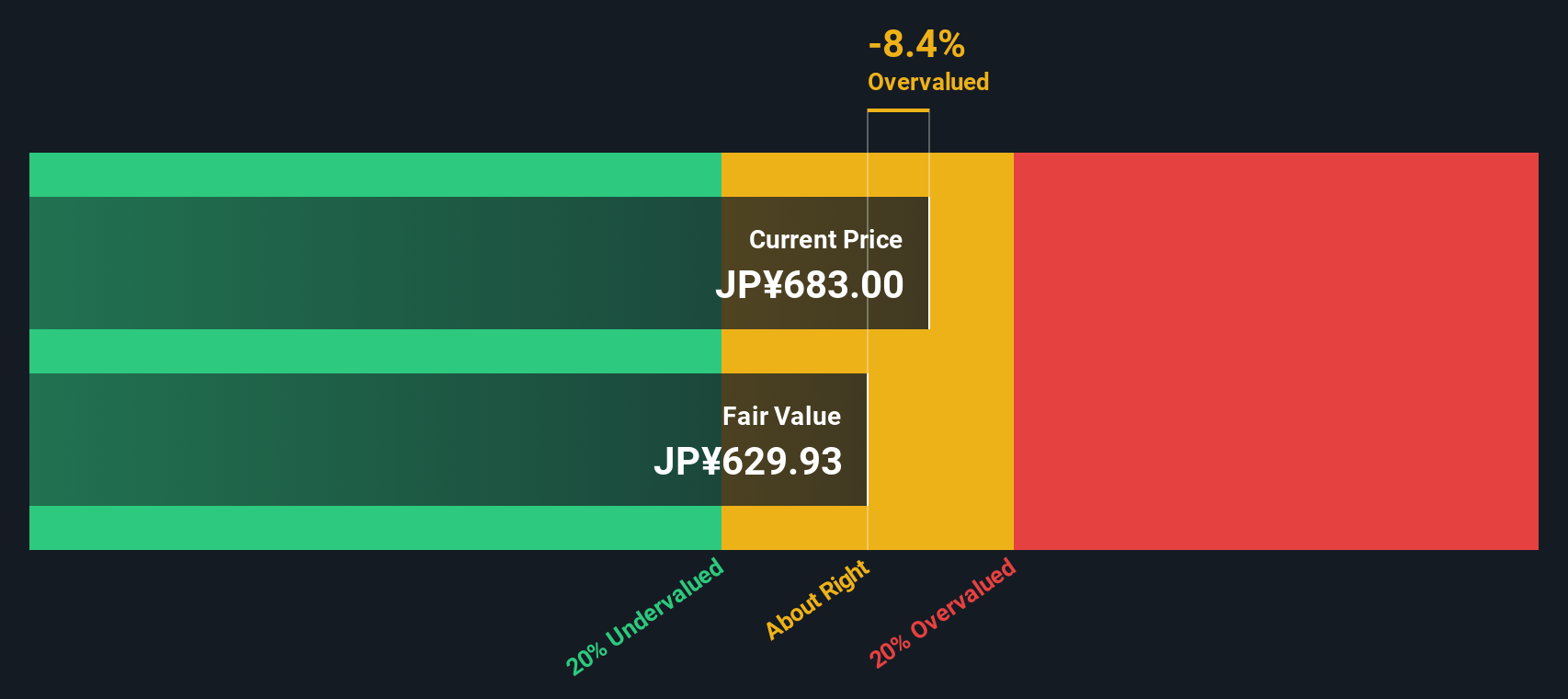

Result: Price-to-Earnings of 14x (OVERVALUED)

However, risks such as a slowdown in regional economic growth or shifts in sector profitability could quickly challenge the current optimism toward Senshu Ikeda Holdings.

Find out about the key risks to this Senshu Ikeda Holdings narrative.

Another View: What Does the SWS DCF Model Suggest?

While the current price-to-earnings ratio suggests Senshu Ikeda Holdings may be overvalued compared to its peers, the SWS DCF model offers a different perspective. According to our DCF assessment, the stock is trading above its estimated fair value, which implies it could be priced somewhat higher than fundamentals support. Does this signal an opportunity being missed or a risk that should be noted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Senshu Ikeda Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Senshu Ikeda Holdings Narrative

If you have a different perspective or want to look deeper into the numbers, it’s quick and easy to develop your own view in just a few minutes. Do it your way

A great starting point for your Senshu Ikeda Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Supercharge your portfolio by tapping into fresh opportunities across exciting sectors, handpicked to help you stay a step ahead of the crowd. Smart investors move fast, so make sure you’re not missing out!

- Capture the upside of high-potential small caps by reviewing these 3588 penny stocks with strong financials that combine growth stories with robust financial strength.

- Boost your passive income with these 22 dividend stocks with yields > 3% offering yields greater than 3 percent, ideal for compounding your returns and building wealth steadily.

- Stay on the cutting edge by tapping into these 27 AI penny stocks transforming industries with artificial intelligence breakthroughs and disruptive technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8714

Senshu Ikeda Holdings

Provides banking products and services to small and medium-sized enterprises, and individuals in Japan.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives