Keiyo Bank (TSE:8544) Valuation in Focus After Dividend Hike and New Share Repurchase Program

Reviewed by Simply Wall St

Keiyo Bank (TSE:8544) just revealed two moves that tend to get investors’ attention, announcing a share repurchase program along with a higher dividend outlook for the year. Both steps point to increased shareholder returns.

See our latest analysis for Keiyo Bank.

Keiyo Bank’s announcement of boosted dividends and a share repurchase comes as its share price has gained strong momentum, with a 30-day share price return of 13.1% and the total shareholder return soaring 90% over the past year. The combination of shareholder-friendly moves and robust longer-term gains suggests confidence is building for both near-term profits and the bank’s broader growth story.

If you’re interested in broadening your investing horizons beyond financials, this is a great time to discover fast growing stocks with high insider ownership

With shares already soaring and management signaling confidence through new buybacks and higher payouts, the question now is whether Keiyo Bank is still undervalued or if the market has fully priced in its growth story.

Price-to-Earnings of 12.8x: Is it justified?

Keiyo Bank trades at a price-to-earnings (P/E) ratio of 12.8 times, above both its Japanese banking peers and industry averages, despite recent share price momentum.

The price-to-earnings ratio reflects what investors are willing to pay today for a company’s current and future earnings. It is commonly used in banking to compare stocks within the sector. A higher P/E could point to expectations of stronger growth, but it also risks pricing in optimism too quickly if not backed by consistent earnings expansion.

Looking at the competitive landscape, Keiyo Bank’s 12.8x P/E ratio stands out as more expensive compared to the peer average of 10.2x and the Japanese Banks industry at 10.6x. This indicates investors are currently placing a premium on Keiyo Bank’s shares relative to its rivals. Without a clear indication through earnings outperformance or a fair ratio benchmark, this premium may be hard to justify if growth stalls.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 12.8x (OVERVALUED)

However, potential risks include a slowdown in earnings or shifts in market sentiment. Either of these could quickly reduce the premium on Keiyo Bank’s shares.

Find out about the key risks to this Keiyo Bank narrative.

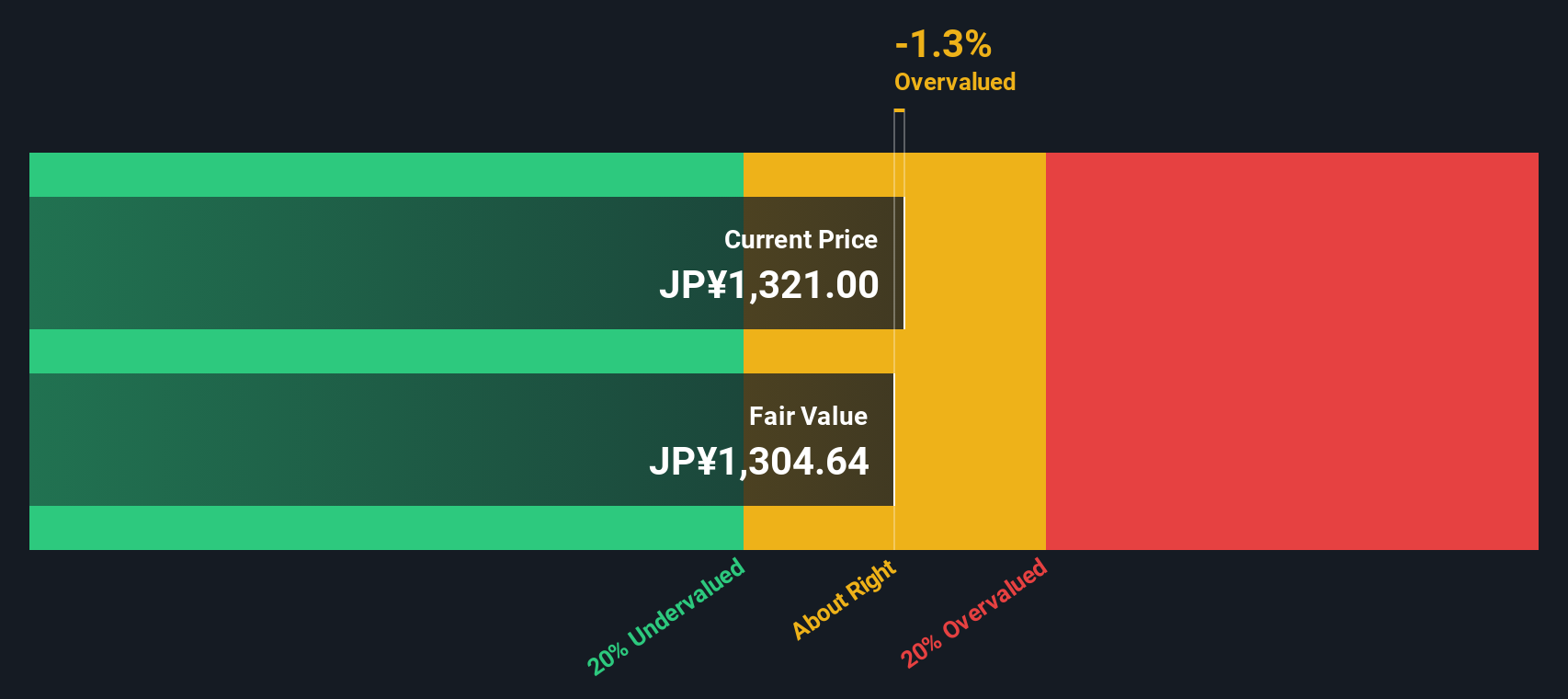

Another View: DCF Suggests Shares Are Slightly Overvalued

Looking beyond price-to-earnings ratios, our SWS DCF model estimates Keiyo Bank’s fair value at ¥1,399, just below the current market price of ¥1,443. This suggests shares might be a touch overvalued. Could market optimism be getting ahead of fundamentals, or is there another story emerging?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Keiyo Bank for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Keiyo Bank Narrative

If you have a different perspective or enjoy digging into the numbers yourself, you can build your own view of Keiyo Bank’s story in just a few minutes. Do it your way

A great starting point for your Keiyo Bank research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more smart investment opportunities?

Don’t limit your strategy to a single stock when there are fresh opportunities waiting. Turn the odds in your favor by finding high-potential ideas using these handpicked screeners:

- Boost income with reliable payouts. Lock in attractive yields through these 17 dividend stocks with yields > 3% before these stocks get snapped up by others.

- Capture upside with undervalued gems. Act now and spot opportunity among these 918 undervalued stocks based on cash flows before the market catches on.

- Ride industry transformation. Seize early exposure to revolutionary technology by checking out these 30 healthcare AI stocks pushing boundaries in medical AI and innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keiyo Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8544

Keiyo Bank

Offers various banking products and services to individual, corporate, and business customers in Japan.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives