A Look at Bank of Nagoya (TSE:8522) Valuation Following Board Meeting on Strategic Shareholding Review

Reviewed by Simply Wall St

Bank of Nagoya (TSE:8522) just announced a board meeting set for November 14, with a focus on revising its reduction targets for strategic shareholdings. Investors often watch these discussions closely, as changes could affect the bank’s capital allocation and future returns.

See our latest analysis for Bank of Nagoya.

That board meeting comes after an impressive run, with Bank of Nagoya’s share price up over 10% in the past month. Momentum is building on the back of an 84% return so far this year. Factoring in dividends, the one-year total shareholder return now sits near 97%, helping to reinforce investor optimism about further changes or capital allocation updates.

If you’re curious where else to look for standout trends, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

With the stock surging nearly 97% over the past year, the real question is whether Bank of Nagoya remains undervalued or if investors have already priced in all the anticipated growth, which could leave little room for upside.

Price-to-Earnings of 11.9x: Is it justified?

Bank of Nagoya currently trades at a price-to-earnings ratio of 11.9x, which is below the overall Japanese market’s 13.7x but above its bank industry peers at 9.4x. This suggests the market may be assigning a premium relative to similar banks, even as broader market valuations remain higher.

A price-to-earnings ratio (P/E) measures how much investors are willing to pay for each yen of earnings. For banks, it reflects market expectations for sustainable profitability and growth going forward.

Despite a reasonable P/E compared to the entire market, the bank appears expensive versus local bank industry averages. Such a premium may imply the market expects further outperformance in profits or stability. However, with no fair ratio calculated, it is unclear whether this premium is fully justified or could mean limited upside if peer valuations revert.

Compared to its sector, Bank of Nagoya’s P/E signals a valuation premium. If the sector's performance or outlook shifts, this premium could be at risk.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 11.9x (OVERVALUED)

However, ongoing shifts in sector performance or unexpected market corrections could quickly challenge the current optimism surrounding Bank of Nagoya’s valuation.

Find out about the key risks to this Bank of Nagoya narrative.

Another View: Discounted Cash Flow Perspective

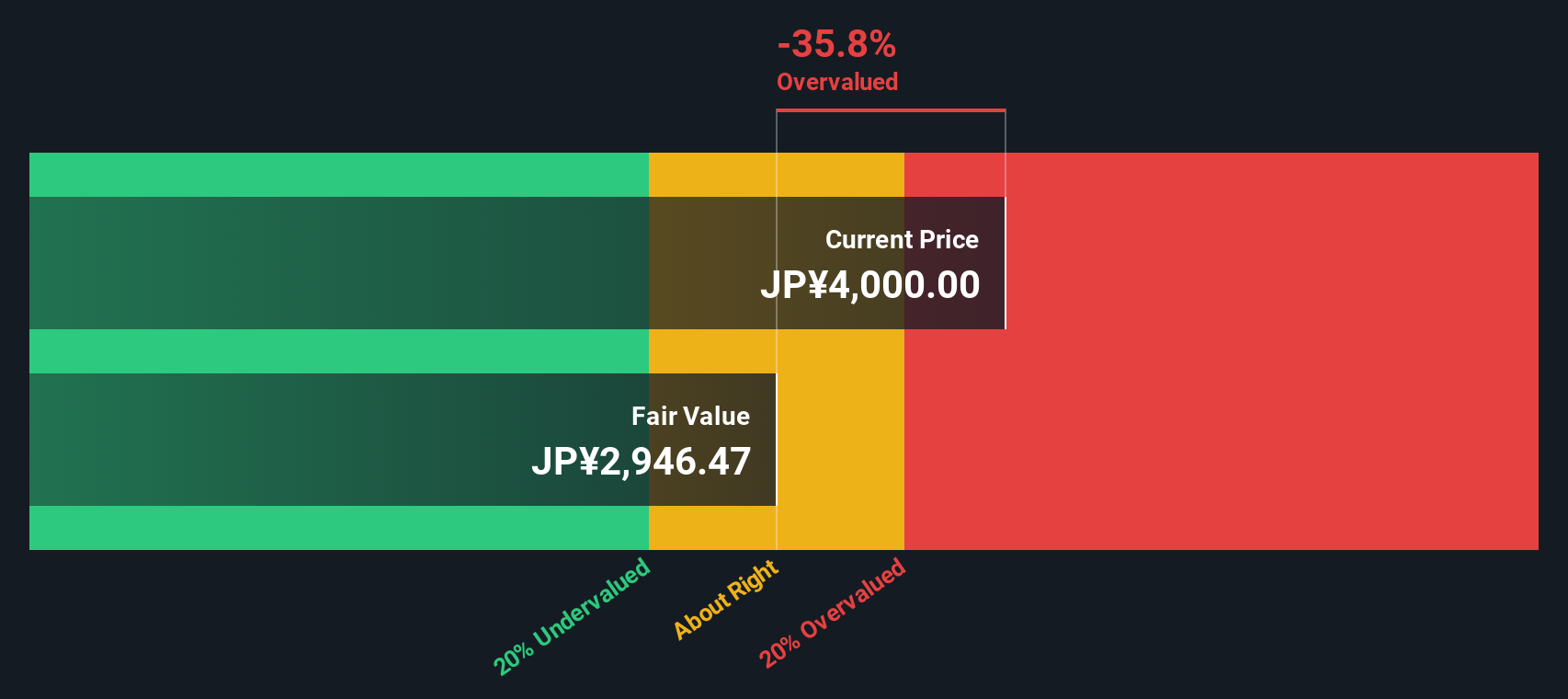

Instead of focusing on earnings multiples, our DCF model estimates Bank of Nagoya’s fair value at ¥2,941.7 per share. Since shares currently trade at ¥3,950, this approach suggests the stock might actually be overvalued. Can the bank’s growth and momentum justify trading so far above DCF fair value?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bank of Nagoya for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 898 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bank of Nagoya Narrative

Keep in mind, if this perspective does not match your own or you prefer to dig deeper independently, you can easily build your own view in just a few minutes with Do it your way.

A great starting point for your Bank of Nagoya research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Opportunities?

Do not let a single stock limit your potential. The Simply Wall Street Screener surfaces bold new opportunities that can accelerate your investment journey.

- Uncover the income powerhouses with consistently high yields through these 15 dividend stocks with yields > 3% to take your portfolio’s cash flow to the next level.

- Tap into game-changing innovations by finding exciting companies advancing artificial intelligence with these 27 AI penny stocks and position yourself for what’s next.

- Maximize your value strategy by seeking underappreciated stocks using these 898 undervalued stocks based on cash flows that might be flying under everyone else’s radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Nagoya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8522

Bank of Nagoya

Provides various banking, financial leasing, and credit card services in Japan.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives