A Look at Seven Bank (TSE:8410) Valuation Following New Earnings, Guidance, and Dividend Updates

Reviewed by Simply Wall St

Seven Bank (TSE:8410) shared its half-year results, issued new financial guidance for the upcoming year, and reaffirmed its dividend. These disclosures are shaping current expectations for the bank’s ongoing performance.

See our latest analysis for Seven Bank.

Seven Bank’s latest results and outlook have come amid a year of shifting sentiment, with shares last closing at ¥287.3. While recent announcements around steady earnings and an affirmed dividend may reassure some investors, the 1-year total shareholder return stands at -11.2%, indicating a cautious market mood overall. Still, when looking further back, the picture improves. A 3-year total return of 22.4% and a 5-year total return of 52.5% highlight that longer-term investors have been rewarded, though momentum has clearly faded in the past year.

If Seven Bank’s recent moves have you rethinking your investment options, it might be worth exploring fast growing stocks with high insider ownership to see what else is gaining traction now.

Given its modest discount to analyst targets and mixed performance over recent years, investors may be wondering whether Seven Bank is now trading below its true value or if the market already factors in its growth prospects.

Price-to-Earnings of 19.5x: Is it justified?

Compared to the last close at ¥287.3, Seven Bank's price-to-earnings ratio of 19.5x puts it well above both its industry peers and the level suggested by several valuation benchmarks. This implies the market expects stronger performance or is paying a premium for perceived stability.

The price-to-earnings (P/E) ratio reflects how much investors are willing to pay for each yen of the company’s earnings. It often serves as a quick gauge of valuation relative to profitability. For banks, this metric is especially important because it links directly to their core business of generating consistent profits through interest and fee income.

However, with Seven Bank’s P/E at 19.5x versus the JP Banks industry average of just 10.3x, it stands out as significantly more expensive. The market appears to have priced in premium expectations. Yet the estimated "fair" P/E, suggested by certain regression-based models, is only 12.6x, a level that underscores just how much higher current valuations are relative to historic or statistical norms.

Explore the SWS fair ratio for Seven Bank

Result: Price-to-Earnings of 19.5x (OVERVALUED)

However, slower revenue growth or a further dip in market sentiment could easily pressure valuations and challenge the current outlook for Seven Bank.

Find out about the key risks to this Seven Bank narrative.

Another View: What Does the DCF Model Say?

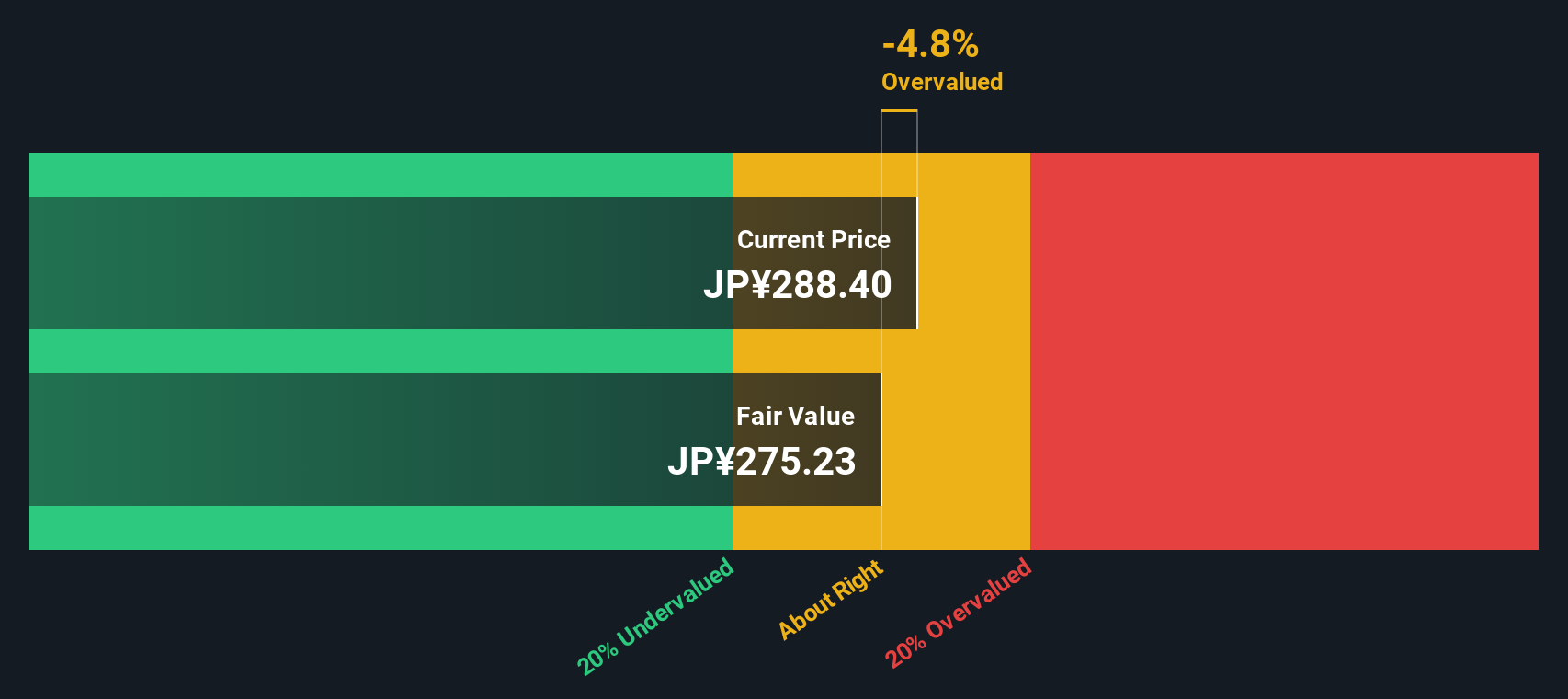

While Seven Bank trades at a premium based on its price-to-earnings ratio, our SWS DCF model tells a different story. Using future cash flow forecasts, the model suggests shares are trading around 4.5% above their fair value, which indicates they might be overvalued by this approach. Should investors weigh this more closely?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Seven Bank for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Seven Bank Narrative

If you have your own take on Seven Bank’s story or want to dig deeper into the data, it only takes a few minutes to build your own perspective. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Seven Bank.

Looking for More Investment Opportunities?

Don’t limit yourself. Smart investors know there’s always another opportunity with huge upside just around the corner. Use these proven ideas to keep your portfolio a step ahead of the crowd.

- Uncover income potential with these 18 dividend stocks with yields > 3%, offering high yields and stable cash flows for consistent returns.

- Tap into rapid financial innovation through these 27 AI penny stocks and see which companies are reshaping entire industries with artificial intelligence.

- Catch the wave of market mispricings by checking out these 901 undervalued stocks based on cash flows, where strong fundamentals meet attractive valuations today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8410

Seven Bank

Provides various banking products and services to individual and corporate customers in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives