- China

- /

- Consumer Durables

- /

- SZSE:002981

Undiscovered Gems And 2 Other Small Caps With Promising Potential

Reviewed by Simply Wall St

In a week marked by significant macroeconomic and earnings activity, global markets saw major indices mostly decline, with small-caps showing resilience compared to their larger counterparts. Amidst this backdrop of cautious market sentiment and mixed economic signals, investors are increasingly turning their attention to smaller companies that demonstrate strong fundamentals and potential for growth. Identifying these undiscovered gems requires a keen eye for solid financial health, innovative business models, and the ability to thrive in fluctuating economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Winstek Semiconductor | 11.42% | 9.38% | 24.14% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Fourth Milling | NA | 4.35% | 29.30% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| Can-One Berhad | 88.80% | 9.35% | 23.83% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Shentong Technology Group (SHSE:605228)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shentong Technology Group Co., Ltd is engaged in the development, manufacturing, and sale of automotive parts in China with a market capitalization of approximately CN¥3.81 billion.

Operations: Shentong generates revenue primarily through the sales of auto parts and molds, amounting to approximately CN¥1.55 billion.

Shentong Technology Group, a promising player in its sector, has seen earnings grow by 56.9% over the past year, outpacing the Auto Components industry's 10.1%. Despite this impressive growth, earnings have decreased by an average of 25.2% annually over the last five years. Trading at 58.3% below its estimated fair value suggests potential undervaluation for investors seeking opportunities in smaller companies. The company's financial health appears solid with more cash than total debt and positive free cash flow status, indicating a stable position to cover interest obligations without concern for cash runway issues.

Risuntek (SZSE:002981)

Simply Wall St Value Rating: ★★★★★☆

Overview: Risuntek Inc. is engaged in the research, development, manufacturing, and sales of electroacoustic products and components in China with a market cap of CN¥3.23 billion.

Operations: Risuntek generates revenue from the sale of electroacoustic products and components. The company's financial performance is reflected in its market capitalization of CN¥3.23 billion.

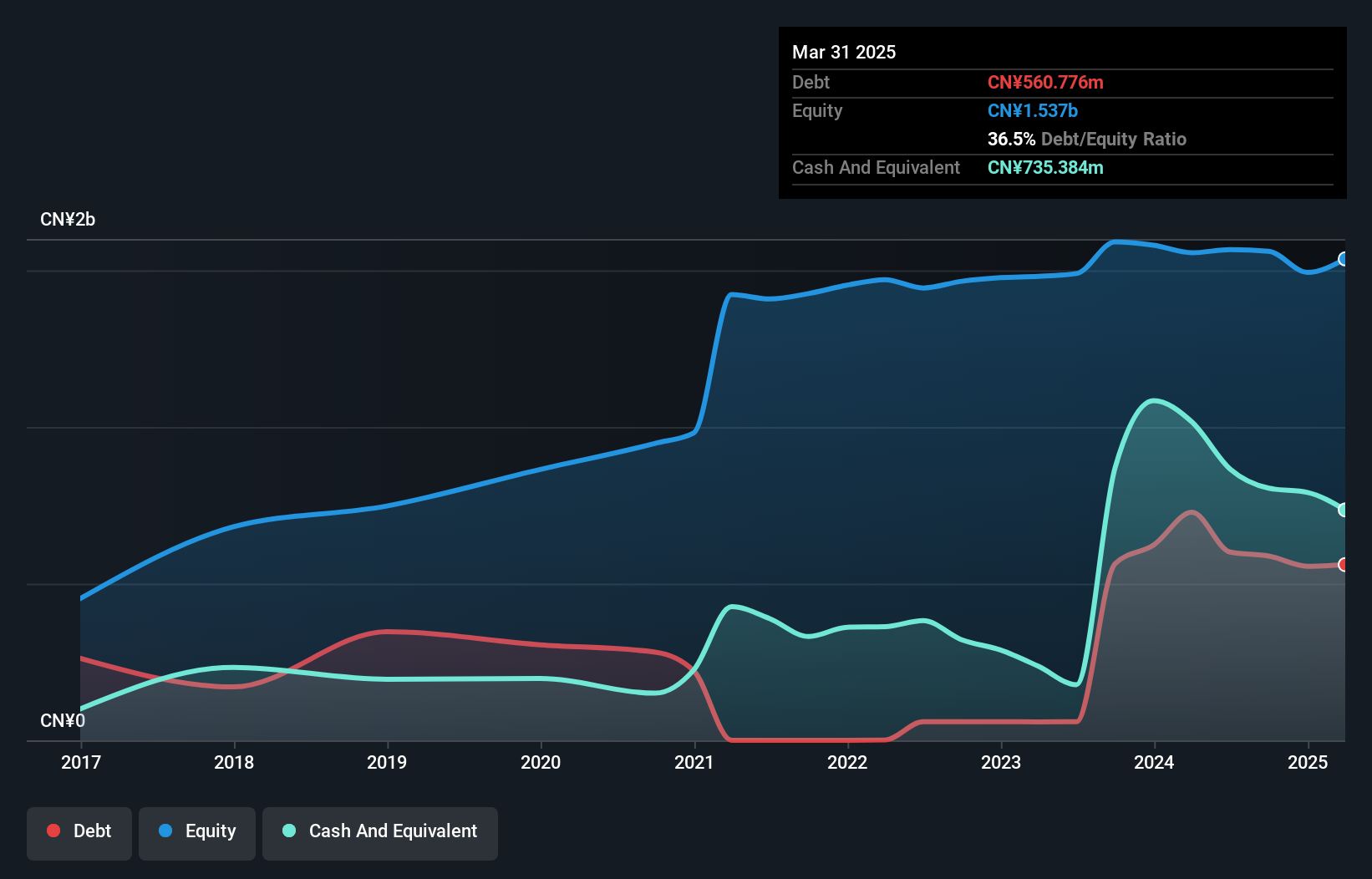

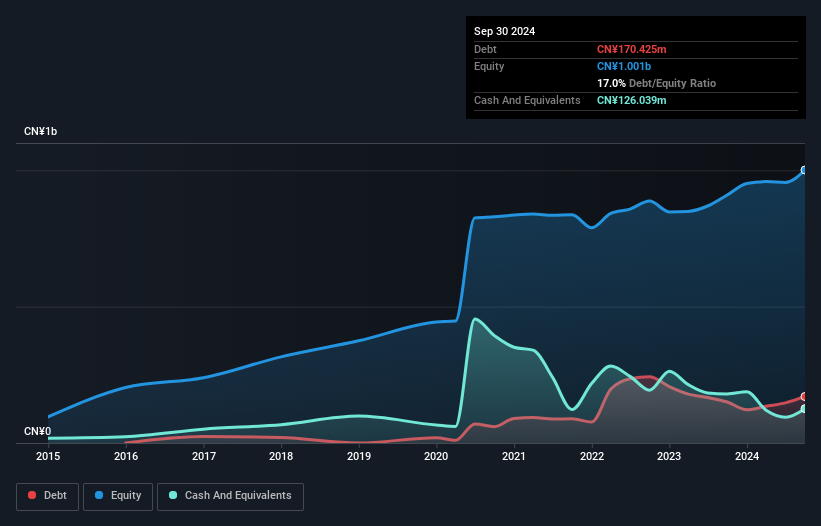

Risuntek, a nimble player in its sector, showcases robust earnings growth of 22.8% over the past year, outpacing its industry peers. The company boasts high-quality earnings and maintains a satisfactory net debt to equity ratio of 4.4%, reflecting prudent financial management despite an increase from 3.4% to 17% over five years. Its price-to-earnings ratio stands at a competitive 27.9x against the broader CN market's 36.4x, suggesting potential value for investors eyeing growth prospects within this space. Recent sales figures reached CNY 1,209 million for nine months ending September, with net income slightly dipping to CNY 75 million from last year’s CNY 76 million, indicating stable operational performance amidst evolving market conditions.

- Take a closer look at Risuntek's potential here in our health report.

Gain insights into Risuntek's past trends and performance with our Past report.

Awa Bank (TSE:8388)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Awa Bank, Ltd. offers a range of banking products and services to individual and corporate clients in Japan, with a market cap of ¥107.82 billion.

Operations: Awa Bank generates its revenue primarily through interest income from loans and advances, along with fees and commissions from various banking services. The net profit margin shows a notable trend at 15% over the recent period, reflecting the bank's efficiency in managing its expenses relative to income.

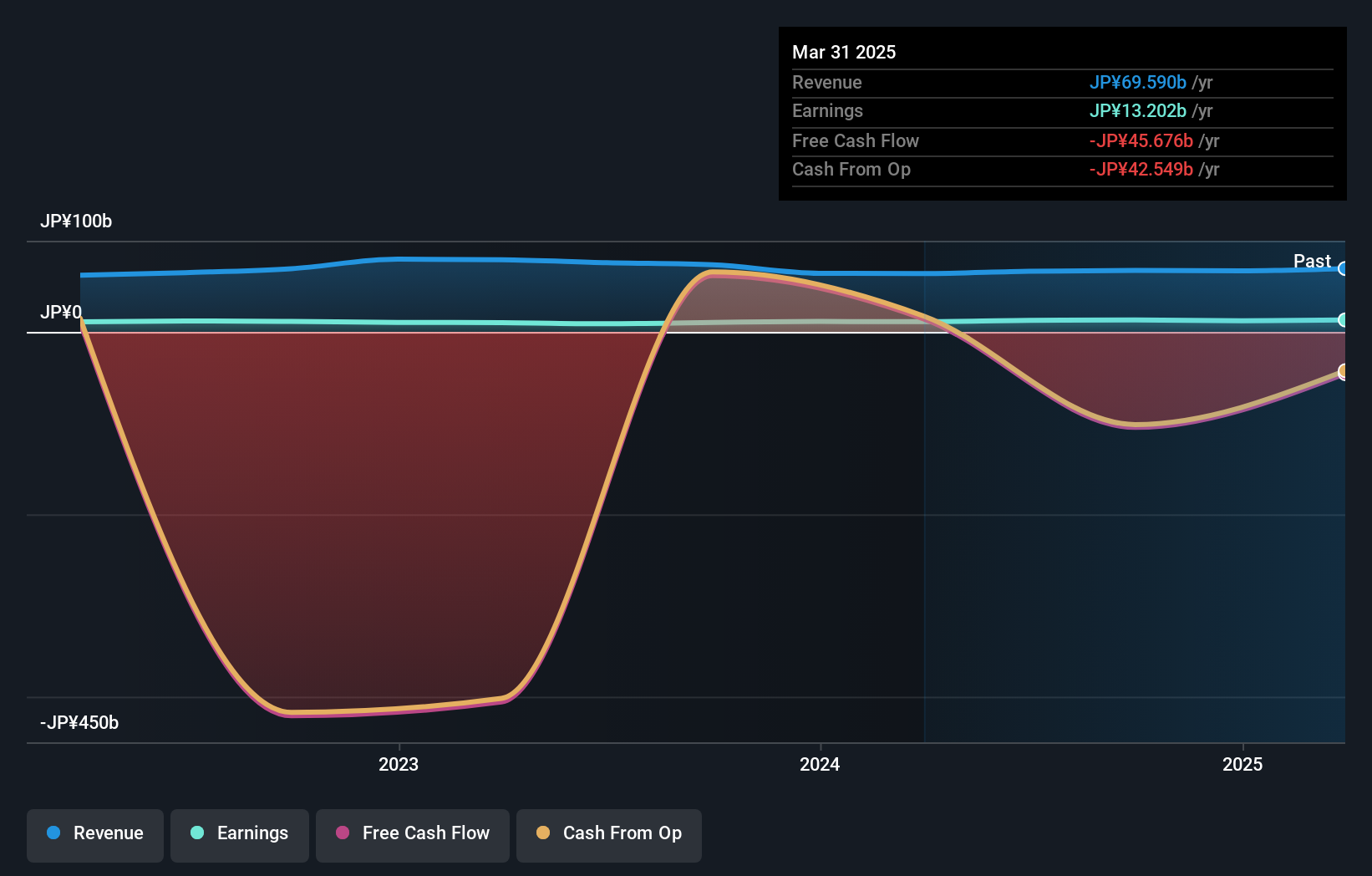

Awa Bank, a smaller player in the financial sector, is trading at 35.3% below its estimated fair value, presenting an intriguing opportunity. With total assets of ¥3,941.8 billion and equity of ¥332.6 billion, it holds a robust position despite having high bad loans at 2%. The bank's earnings surged by 42.6% last year, outpacing the industry average of 19.1%, supported by primarily low-risk funding sources comprising 93% customer deposits. A recent share repurchase program aims to buy back up to 200,000 shares for ¥500 million to enhance shareholder returns and maintain capital flexibility until December 2024.

Seize The Opportunity

- Gain an insight into the universe of 4699 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002981

Risuntek

Researches, develops, manufactures, and sells electroacoustic products and components in China.

Solid track record with excellent balance sheet.