A Look at Kiyo Bank (TSE:8370) Valuation Following Its Latest Dividend Hike

Reviewed by Simply Wall St

Kiyo Bank (TSE:8370) is drawing investor attention after raising its second-quarter dividend to ¥58 per share, compared to ¥45 last year. Dividend payments are scheduled to begin on December 5, 2025.

See our latest analysis for Kiyo Bank.

That higher payout appears to have caught the market’s attention, with Kiyo Bank’s share price still sitting strong at ¥2,858 after a robust year-to-date climb of 30.5%. Impressively, investors have seen a 45.6% total shareholder return over the past twelve months and triple-digit gains over three and five years. This points to momentum that still feels alive.

If you’re keeping an eye out for rising stories with serious staying power, now’s a great moment to expand your horizons and discover fast growing stocks with high insider ownership

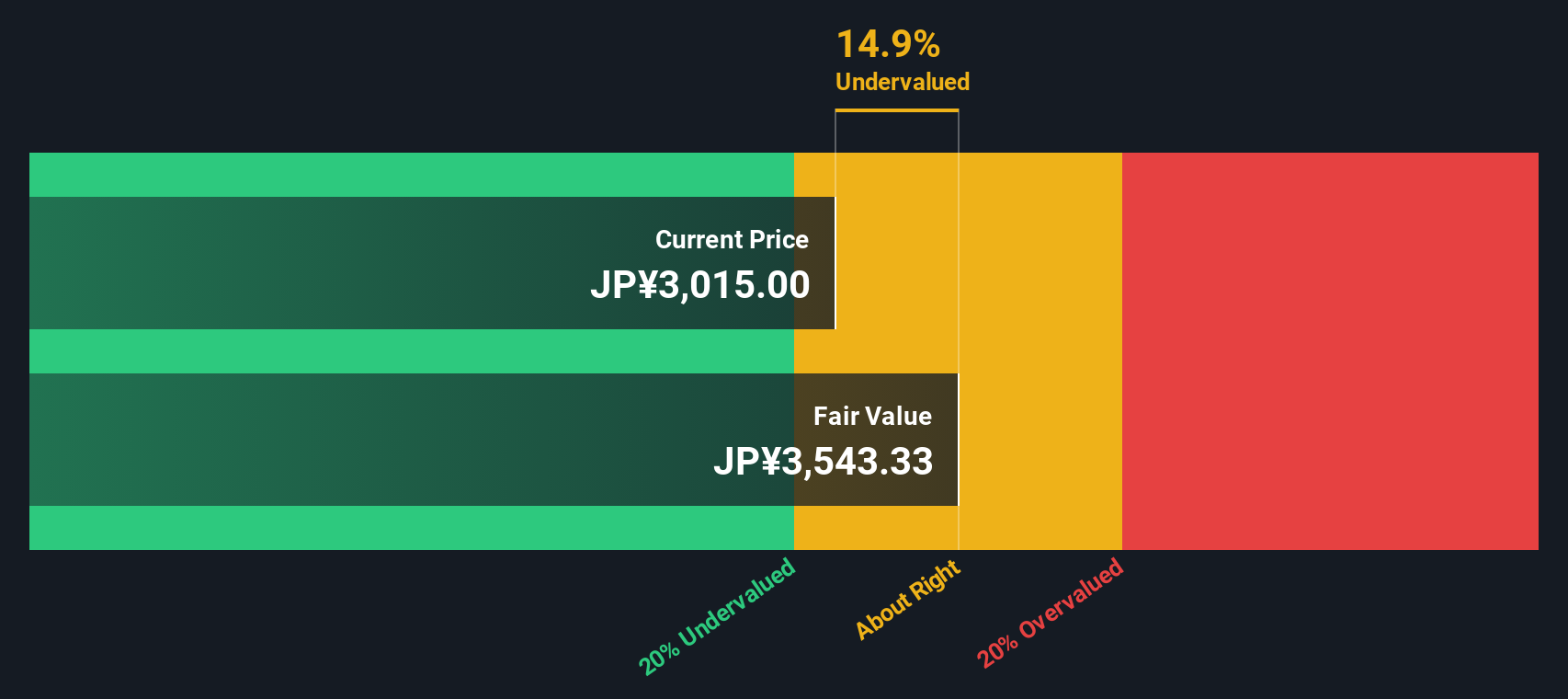

But with the share price at multi-year highs and payout growth making headlines, is Kiyo Bank still undervalued? Or has the market already priced in all of its future upside for investors?

Price-to-Earnings of 9.7x: Is it justified?

Kiyo Bank’s current price-to-earnings (P/E) ratio stands at 9.7x, placing it below the industry and peer averages. With the last close at ¥2,858, this suggests the market is valuing Kiyo Bank’s earnings at a discount to its peers within the Japanese banking sector.

The price-to-earnings ratio tells investors how much they are paying for each yen of the bank’s earnings. For the banking industry, where growth is often steady but not explosive, a lower P/E can signal a stock is undervalued or that the market doubts its growth prospects.

Compared to the Japanese banks industry average of 10.3x and a peer average of 12.1x, Kiyo Bank’s multiple points to a relative undervaluation. This means investors are currently paying less for each unit of earnings than they would for similar banks. This could create an appealing entry point if the company’s profitability endures.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 9.7x (UNDERVALUED)

However, if slower revenue or net income growth is reported in the future, this could challenge the case for continued outperformance as seen in recent years.

Find out about the key risks to this Kiyo Bank narrative.

Another View: What Does the SWS DCF Model Suggest?

The SWS DCF model takes a different approach and estimates Kiyo Bank’s fair value at ¥3,862.94. This puts the current price at roughly 26% below this benchmark. While the market may be cautious, DCF suggests understated potential and challenges the notion that upside is already priced in. Which view will prove right?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kiyo Bank for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 898 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kiyo Bank Narrative

If you want a closer look at the numbers or shape an independent perspective, you’ll find it only takes a few minutes to craft your own view. Do it your way

A great starting point for your Kiyo Bank research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let the next great opportunity slip through your fingers when you can easily find overlooked stocks with growth, income, and technology potential right now.

- Spot high-yield opportunities by checking out these 15 dividend stocks with yields > 3%. These offer strong returns above market averages.

- Uncover the next big breakthroughs in artificial intelligence by reviewing these 27 AI penny stocks that are making waves in innovation.

- Capture value that others might miss with these 898 undervalued stocks based on cash flows, which is based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kiyo Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8370

Kiyo Bank

Provides various banking products and services to individual and corporate customers in Japan.

Established dividend payer and good value.

Market Insights

Community Narratives