A Look at Nanto Bank’s (TSE:8367) Valuation as Key Board Meeting Approaches

Reviewed by Simply Wall St

Nanto Bank (TSE:8367) has scheduled a board meeting to discuss major topics such as a potential share split, changes to its articles of incorporation, and updates to its shareholder benefit program. These agenda items can influence how investors perceive the bank’s value and structure.

See our latest analysis for Nanto Bank.

Nanto Bank’s share price has surged this year, building strong momentum with a 65% year-to-date gain and an impressive 1-year total shareholder return of nearly 80%. Recent price moves suggest investors are optimistic, possibly anticipating more changes following the upcoming board decisions.

If the buzz around Nanto Bank has you rethinking your next move, this could be the perfect chance to discover fast growing stocks with high insider ownership.

But with the stock already delivering outsized gains this year, investors now face the central question: is there still meaningful upside to be captured, or has the market already priced in Nanto Bank’s future growth prospects?

Price-to-Earnings of 11.5x: Is it justified?

At ¥5,320 per share, Nanto Bank trades at a price-to-earnings (P/E) ratio of 11.5x, making it look pricier than both its direct peers and the wider JP Banks industry.

The P/E ratio compares a company's share price to its per-share earnings, serving as a fast way to gauge market expectations for growth and profitability. For banks, this metric often reflects market confidence in earnings stability and sector prospects.

Despite a strong five-year record of profit growth, investors are assigning Nanto Bank a steeper premium than peers. This possibly signals optimism about future performance. However, with the sector averaging a lower P/E, the market may be overestimating near-term earnings or pricing in anticipated wins from recent momentum or board-level shakeups.

Relative to the JP Banks industry, which holds a P/E average of 10.8x, Nanto Bank stands out as more expensive. It also tops the overall peer average of 10.9x. Unless the company delivers on further growth, this could mean limited room for upside if expectations are not met.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 11.5x (OVERVALUED)

However, slower earnings growth or an unexpected change in board policy could quickly dampen the bullish sentiment around Nanto Bank's stock.

Find out about the key risks to this Nanto Bank narrative.

Another View: Is Nanto Bank Undervalued?

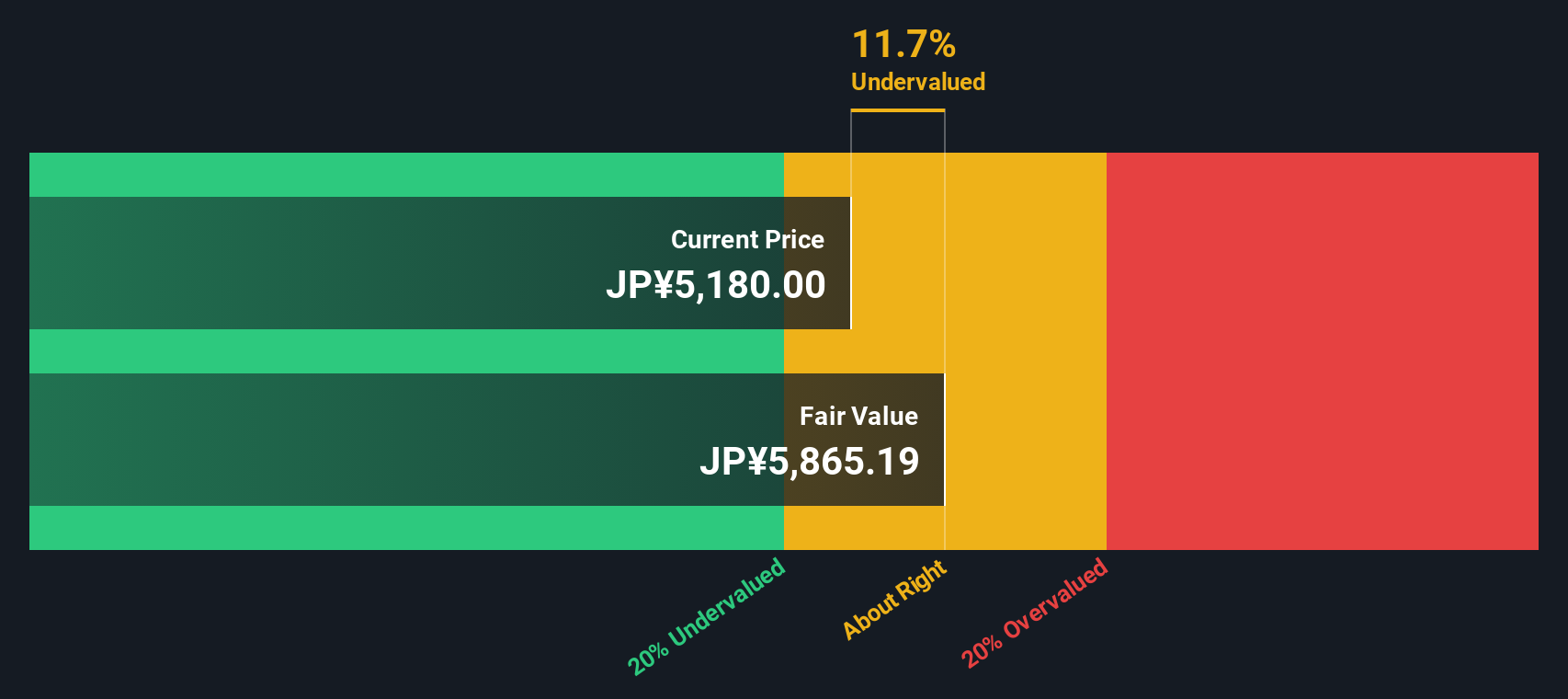

Looking at a different approach, the SWS DCF model estimates Nanto Bank's fair value at ¥5,978 per share. This means the stock is currently trading about 11% below that level, which suggests the market may be undervaluing its longer-term cash flow potential. Could this be a sign that investors are missing out?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nanto Bank for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nanto Bank Narrative

If these results have you thinking differently or if you would rather dive into the details yourself, building a personal view of Nanto Bank takes just a few minutes. Do it your way.

A great starting point for your Nanto Bank research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take action now to stay ahead of the curve. If you want to uncover overlooked gems or target lucrative new trends, try these handpicked opportunities before everyone else does:

- Uncover reliable income with yields above 3% by reviewing these 16 dividend stocks with yields > 3%, which stand out for strong dividend performance and steady payouts.

- Tap into the ongoing AI boom by checking out these 26 AI penny stocks, driving innovation across automation, analytics, and intelligent systems.

- Capitalize on market inefficiencies and growth potential by reviewing these 928 undervalued stocks based on cash flows, which may be priced below their true worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanto Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8367

Nanto Bank

Provides banking, securities, leasing, and credit guarantee services in Japan.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives