A Look at Shiga Bank (TSE:8366) Valuation as Board Reviews Stock Split and Shareholder Program Changes

Reviewed by Simply Wall St

Shiga Bank (TSE:8366) has announced a Board Meeting on November 14, 2025, that will review plans for a stock split, partial amendments to the Articles of Incorporation, and updates to its shareholder benefit program. These moves could impact investor dynamics and trading activity.

See our latest analysis for Shiga Bank.

Shiga Bank’s share price has cooled a bit in recent weeks after a strong climb earlier this year. Its year-to-date share price return of 54.45% and a one-year total shareholder return of 76.55% suggest momentum is still firmly in its favor, fueled by improving fundamentals and investor interest around the upcoming Board Meeting decisions.

If you’re looking to discover what other fast-moving opportunities the market offers, now is a great time to broaden your perspective and explore fast growing stocks with high insider ownership

But after such rapid gains and solid fundamentals, the key question for investors remains: Is Shiga Bank undervalued with more upside ahead, or has the market already priced in its future growth potential?

Price-to-Earnings of 13.1x: Is it justified?

Shiga Bank is trading at a price-to-earnings (P/E) ratio of 13.1x, just below the Japanese market average and in line with peer companies. This level prompts a closer look. Does it signal a bargain, or reflect high expectations?

The price-to-earnings ratio measures what investors are willing to pay today for a yen of current earnings. For banks, it is a widely followed indicator of perceived growth opportunities and risk in future profit streams. Shiga Bank’s 13.1x P/E shows that its valuation is benchmarked closely to the sector and market norm for Japanese banks.

Compared to its peer group, Shiga Bank is priced attractively with a P/E slightly under the peer average of 13.4x, but stands out as more expensive than the Japanese banking industry average of 10.3x. When measured against our estimated fair P/E of 17.1x, the current multiple could leave some room for re-rating if growth delivers as expected.

Explore the SWS fair ratio for Shiga Bank

Result: Price-to-Earnings of 13.1x (ABOUT RIGHT)

However, slowing share momentum and the risk of lower-than-expected earnings growth could challenge Shiga Bank’s current optimism regarding its valuation.

Find out about the key risks to this Shiga Bank narrative.

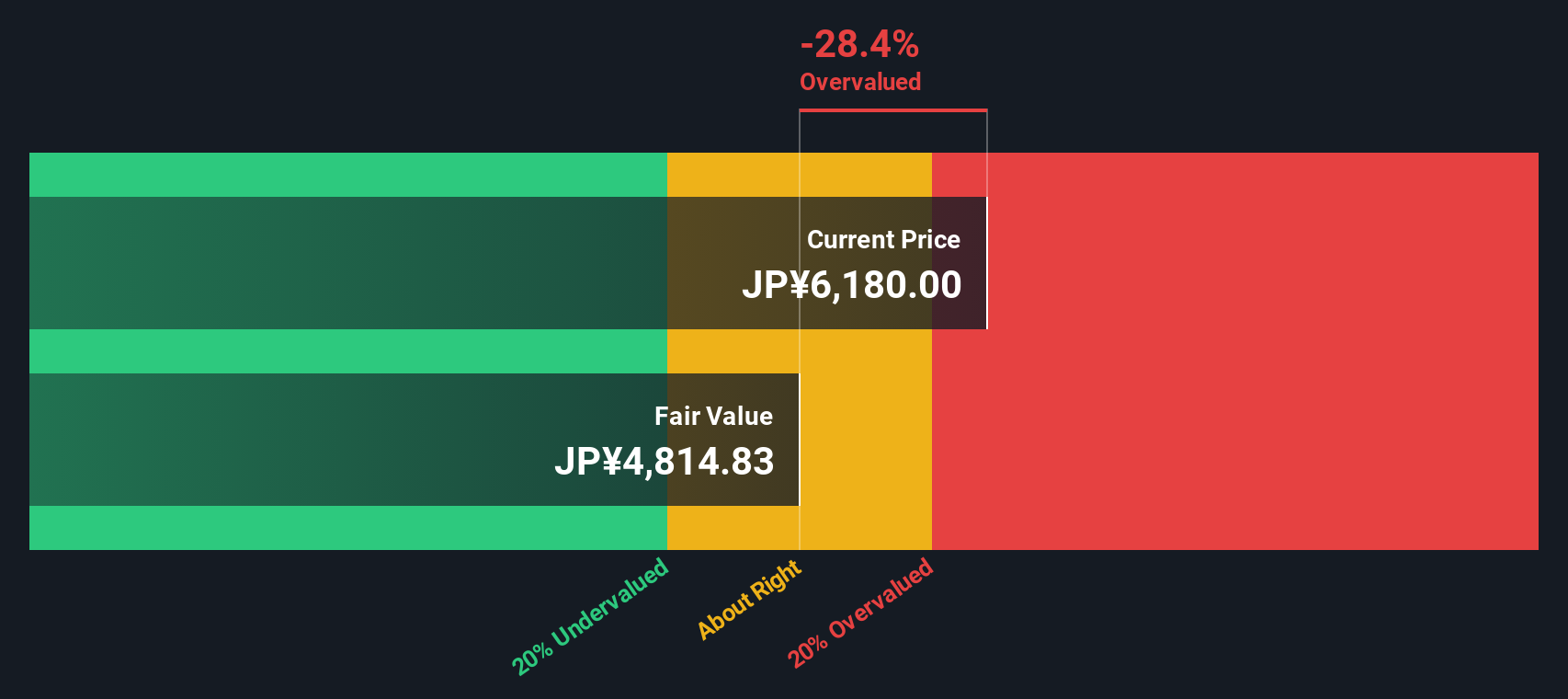

Another View: SWS DCF Model Challenges the Valuation

While the price-to-earnings approach suggests Shiga Bank is priced about right, our SWS DCF model provides a more cautious outlook. According to this method, the shares trade above fair value, estimated at ¥4,810.6. Could the market be too optimistic about future growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Shiga Bank for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 895 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Shiga Bank Narrative

If you want to dig deeper or create your own perspective on Shiga Bank, you can build a custom narrative in just a few minutes: Do it your way

A great starting point for your Shiga Bank research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more great investment ideas?

Give yourself an edge. Serious investors are using the Simply Wall Street Screener to spot tomorrow’s winners early. Don’t get left behind by tomorrow’s success stories.

- Boost your income strategy and hunt down leading opportunities among these 15 dividend stocks with yields > 3% offering solid yields above 3%.

- Ride the wave of tech innovation by uncovering breakthrough companies among these 27 AI penny stocks at the front lines of artificial intelligence.

- Capitalize on underpriced potential by tracking these 895 undervalued stocks based on cash flows fueled by strong cash flow and overlooked value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8366

Shiga Bank

Provides various banking products and services primarily in Japan.

High growth potential with solid track record and pays a dividend.

Market Insights

Community Narratives