Resona Holdings (TSE:8308): Valuation Insights Following Strong Results, Dividend Hike, and Share Buyback

Reviewed by Simply Wall St

Resona Holdings (TSE:8308) just delivered its half-year update, and there is plenty for investors to unpack. The bank reported an increase in both net interest income and net income, as well as a new share buyback and a higher dividend.

See our latest analysis for Resona Holdings.

Resona Holdings has seen its momentum accelerating this year, and the market has responded enthusiastically to a string of recent positives, including robust half-year earnings, a larger dividend, and a new share buyback. The stock’s share price return year-to-date is an impressive 35.5%, with a 1-year total shareholder return of 32.3% and a remarkable 375% over five years. Longer-term holders have benefited from both price appreciation and dividends.

If this kind of upward trajectory has you curious about what else might be gaining steam, broaden your search and discover fast growing stocks with high insider ownership

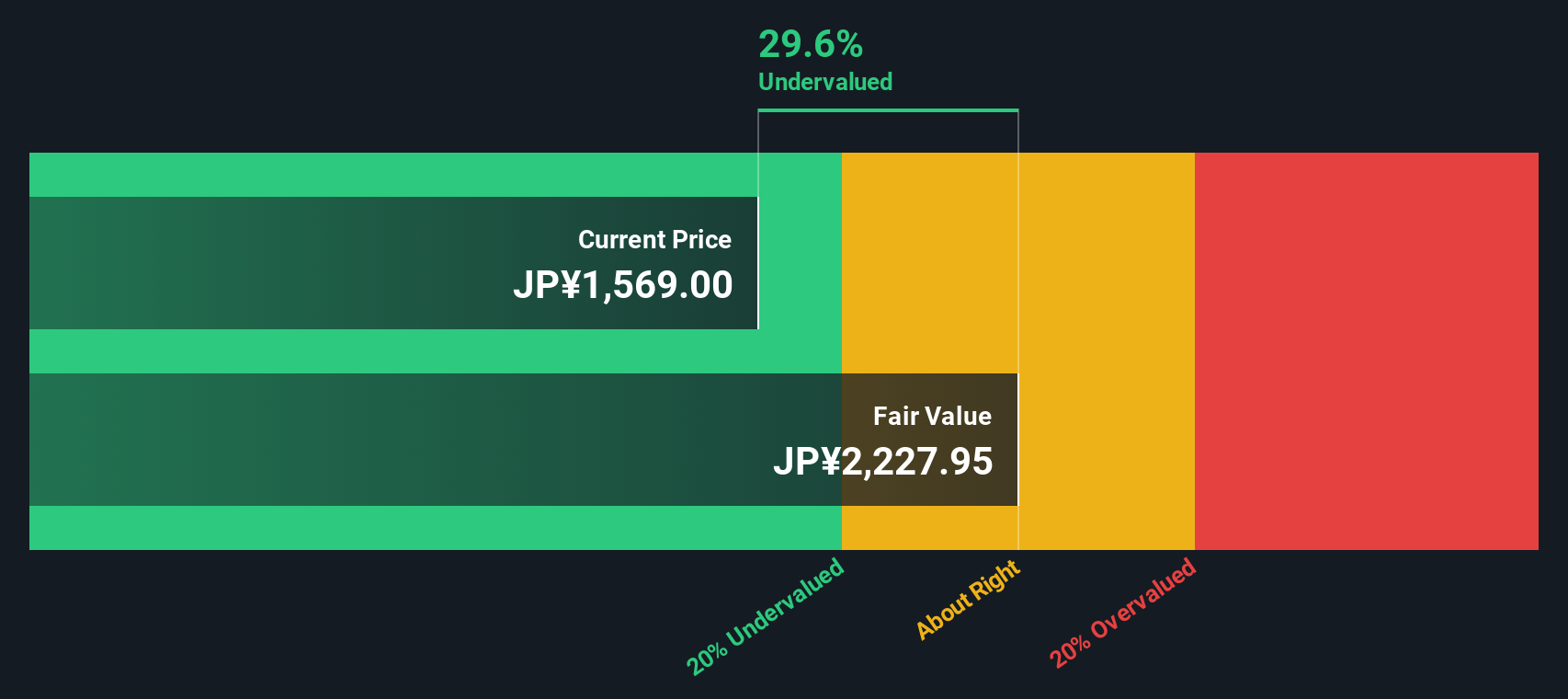

With shares soaring on the back of strong results and shareholder rewards, the question now is whether Resona Holdings is undervalued and still represents a buying opportunity, or if the market has already priced in further growth.

Most Popular Narrative: 8% Overvalued

The most popular narrative places Resona Holdings’ fair value somewhat below its last close of ¥1,550, suggesting that strong recent gains may already be incorporated. This view draws on a combination of consensus forecasts, risk assessments, and assumptions about future profitability that form the basis for the latest price target.

*Efforts to enhance fee income, including strong performance in assets under management and settlement-related income, are supporting revenue growth and diversification. The strategic reduction of policy stock holdings and the expected increase in net gains from stocks may contribute to future earnings and improve capital utilization.*

What drives this valuation higher than the current price? Bold profit margin expansion, creative capital deployment, and a revenue mix shift are just the beginning. Behind the headline fair value, surprising quantitative forecasts swirl. Discover which future financial levers and expectations push this narrative, and just how much the earnings mix could change.

Result: Fair Value of ¥1,439 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as rising operating expenses and unpredictable interest rate impacts could challenge the current optimistic outlook for Resona Holdings.

Find out about the key risks to this Resona Holdings narrative.

Another View: Discounted Cash Flow Perspective

While the analyst consensus currently calls Resona Holdings overvalued, our SWS DCF model reaches a strikingly different conclusion. According to this approach, Resona Holdings is trading about 30.5% below its fair value. This suggests a substantial undervaluation from a long-term cash flow perspective. Could the market be underestimating future cash generation, or are there risks not fully captured here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Resona Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 856 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Resona Holdings Narrative

Keep in mind, if these views don’t align with your own or you’d rather dive into the numbers yourself, it only takes a few minutes to craft your own narrative: Do it your way.

A great starting point for your Resona Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Tap into unique stock picks that others overlook and set yourself up for smarter investment decisions right now.

- Uncover high-yielding options by checking out these 15 dividend stocks with yields > 3%, and get ahead with stocks offering consistent income potential and solid growth prospects.

- Propel your portfolio with these 25 AI penny stocks, spotlighting companies harnessing artificial intelligence breakthroughs for tomorrow’s competitive edge.

- Supercharge your strategy by sizing up these 856 undervalued stocks based on cash flows and spot quality businesses trading well below their intrinsic worth before the market catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8308

Resona Holdings

Through its subsidiaries, engages in the provision retail and commercial banking products and services in Japan and internationally.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives