Did Nishi-Nippon Financial Holdings' (TSE:7189) Dividend Hike Mark a New Phase for Shareholder Returns?

Reviewed by Sasha Jovanovic

- Nishi-Nippon Financial Holdings announced it will increase its second quarter-end cash dividend to ¥45.00 per share and revised its year-end dividend forecast to ¥65.00 per share for the fiscal year ending March 31, 2026, citing improved business performance and a commitment to shareholder returns.

- This significant upward revision underscores the company's aim to return approximately 40% of net income to shareholders while maintaining financial stability and responsiveness to economic conditions.

- We’ll assess how this increased dividend forecast shapes Nishi-Nippon Financial Holdings’ investment narrative, with shareholder returns a central theme.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Nishi-Nippon Financial Holdings' Investment Narrative?

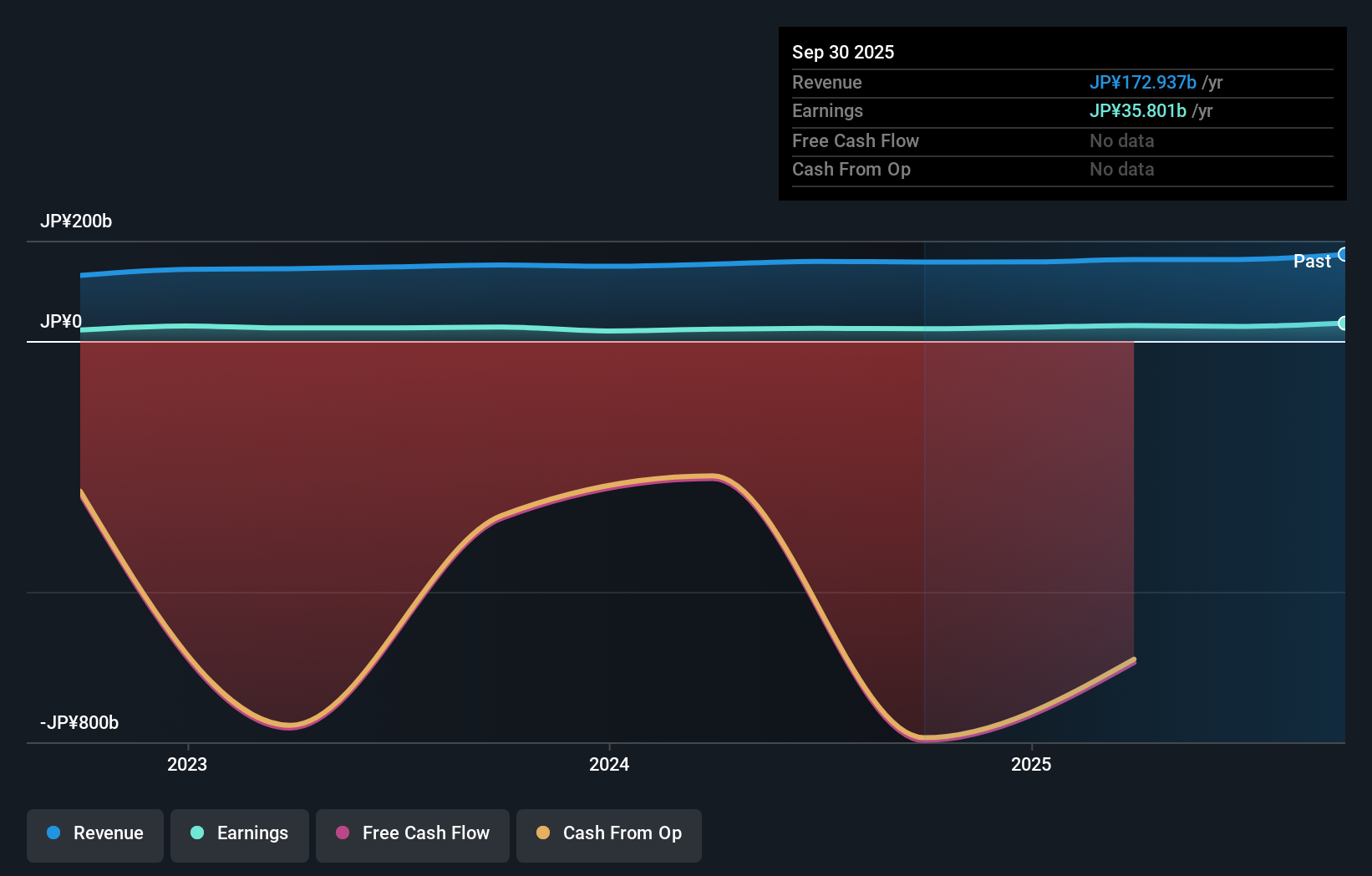

To be a shareholder in Nishi-Nippon Financial Holdings right now, you’d need confidence in both the bank’s improving business performance and its ongoing focus on rewarding shareholders, something underscored by the recent jump in its dividend forecast. The move to boost both the interim and year-end dividends is likely to shape near-term sentiment, reinforcing shareholder returns as a key catalyst. However, this pivot also means that questions about dividend sustainability, given a previously mixed track record, may intensify as payouts rise with profit. Short-term, the big picture is still closely tied to upcoming earnings and market reactions to new dividend guidance. While concerns remain, such as the relatively low allowance for bad loans and limited board independence, the higher dividend signals a willingness to share profits, which could sharpen attention on both immediate opportunities and lingering risks as new financial results emerge. Despite the focus on dividends, the low allowance for bad loans is a risk not to ignore.

Despite retreating, Nishi-Nippon Financial Holdings' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore another fair value estimate on Nishi-Nippon Financial Holdings - why the stock might be worth as much as 30% more than the current price!

Build Your Own Nishi-Nippon Financial Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nishi-Nippon Financial Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nishi-Nippon Financial Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nishi-Nippon Financial Holdings' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nishi-Nippon Financial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7189

Nishi-Nippon Financial Holdings

Through its subsidiaries, provides financial and non-financial products and services in Japan, China, Hong Kong, and Singapore.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives